RENSSELAER, N.Y. — NYISO presented the Business Issues Committee the final market design for pricing carbon emissions into its wholesale electricity markets on Thursday, the same day the New York State Assembly passed a bill that will put many of Gov. Andrew Cuomo’s environmental targets into statute.

The Climate Leadership and Community Protection Act (A8429) will require 70% of the state’s electricity be generated by renewable resources by 2030, nearly quadruple its offshore wind energy goal to 9 GW by 2035 and require the economy to be carbon-neutral by 2040. The law also doubles the distributed solar generation goal to 6 GW by 2025 and targets deploying 3 GW of energy storage by 2030. (See New York Boosts Zero-carbon, Renewable Goals.)

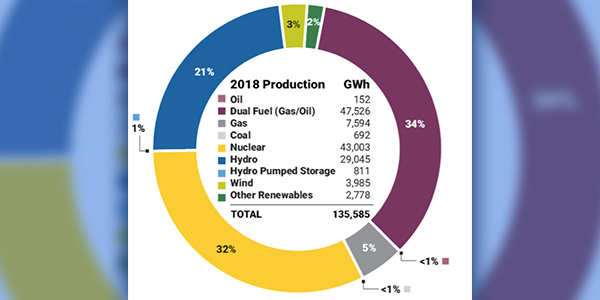

| NYISO

Stakeholders were divided on whether the bill — expected to be signed into law by Cuomo — necessitates increased skepticism on carbon pricing or urgency on the effort.

“It will take time to digest the new information, but having carbon pricing helps reach these goals, said Rana Mukerji, NYISO senior vice president for market structures. “If [load-serving entities] are required to buy renewables, the procurement prices will reflect the benefit renewables derive from having carbon priced into the energy market.”

Representing the Independent Power Producers of New York, Matt Schwall said, “IPPNY continues to be very supportive. … Carbon pricing is now more important than ever. There’s been a lot of time spent developing the idea, and this will help us reach the targets.”

Luthin Associates’ Aaron Breidenbaugh, representing Consumer Power Advocates, an unincorporated group of nonprofit institutional customers, said he was “skeptical” of how consumers could benefit from carbon pricing under the new law.

Couch White attorney Kevin Lang, speaking for New York City, said he shared Breidenbaugh’s concerns: “Carbon pricing isn’t going to get us incrementally more generation … and I agree that NYISO needs to look at the new law before moving forward.”

Mark Younger of Hudson Energy Economics said, “You can put targets, but that doesn’t mean they’re effective. You can put 7,000 MW of wind in the North Country and meet a target of 7,000 MW of additions, but not get much benefit of zero-carbon megawatt-hours in the state.”

“Action needs to start happening immediately, and we need to be sending price signals that reflect the value, or the damage, of carbon emissions,” said Howard Fromer, director of market policy for PSEG Power New York. “How? The closest thing is the mechanism we’ve come up with here, and carbon pricing is even more important now than it was a year ago.”

Robert Pike, NYISO director for market design and product management, said, “We’re here today just to recognize the culmination of the work that’s taken place over a considerable amount of time.”

Mark Reeder, representing the Alliance for Clean Energy New York (ACE NY), said, “A long time ago, we said that a market without a carbon component is inconsistent with our environmental goals. Carbon pricing can help the state reach its goals.”

On Monday, third-party consultant Analysis Group presented to the Installed Capacity/Market Issues Working Group preliminary results of a supplemental analysis examining the impacts of pricing carbon. The study is intended to augment the Brattle Group report process that concluded in December. (See More Details Divulged on New NYISO Carbon Pricing Study.)

Broader Regional Markets Update

Pike presented the monthly Broader Regional Markets report and highlighted item No. 26, noting that the Management Committee in May approved a new external supplemental resource evaluation (SRE) penalty regime.

Approved by the BIC in April, the SRE penalty provisions will boost the ISO’s ability to call on external resources that have sold capacity to New York. Pending FERC approval, the proposal is anticipated to become effective in August.

Pike also highlighted BIC and MC approval last month of revisions to the NYISO-PJM joint operating agreement to address coordination on flowgates similar to the East Towanda-Hillside Tie Line.

Manual Revisions

The BIC approved revisions to several manuals, with most of the changes required by implementation of the Zone J (New York City) reserve region.

Following Board of Directors and stakeholder approval, the ISO in April filed a proposal with FERC to establish the new reserve region. (See NYISO Business Issues Committee Briefs: March 13, 2019.)

Ashley Ferrer, NYISO energy market design specialist, reported that the changes would affect the Ancillary Services, Day-Ahead Scheduling and Transmission & Dispatch Operations manuals.

ISO staff engineer Harris Miller detailed additional revisions unrelated to the Zone J reserve requirements being proposed within the affected manuals.

Ferrer said the proposed New York City reserves would go into effect Wednesday, assuming approval by FERC.

LBMPs, Gas Prices Drop

NYISO locational-based marginal prices averaged $23.10/MWh in May, down about 17.5% from April and about 19.7% from the same month a year ago, Pike said in delivering the monthly operations report. Year-to-date monthly energy prices averaged $37.57/MWh, a 25% decrease from a year ago.

Day-ahead and real-time load-weighted LBMPs came in lower compared to April. Average daily sendout was 373 GWh/day in May, higher than 371 GWh/day in April and lower than 397 GWh/day in the same month a year ago.

Transco Z6 hub natural gas prices averaged $2.27/MMBtu for the month, off slightly from April and down 11% from a year ago.

Distillate prices were down 8.5% year over year and mixed from the previous month, with Jet Kerosene Gulf Coast averaging $14.64/MMBtu, up a penny from April, while Ultra Low Sulfur No. 2 Diesel NY Harbor dropped to $14.54/MMBtu from $14.72/MMBtu in April.

May uplift increased to 13 cents/MWh from -15 cents in April, while total uplift costs, including NYISO’s cost of operations, came in higher than the previous month.

The ISO’s 23 cents/MWh local reliability share in May was up from 20 cents the previous month, while the statewide share climbed to -11 cents/MWh from -35 cents in April.

The Thunderstorm Alert cost was 19 cents/MWh, up from the usual zero to 1 cent.

— Michael Kuser