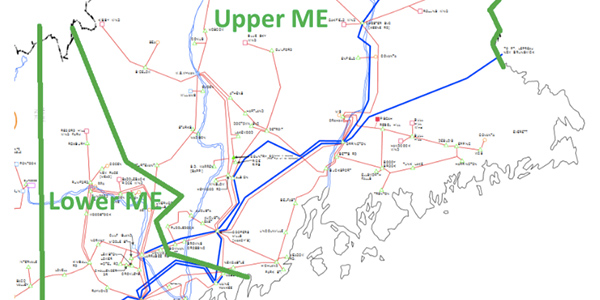

WESTBOROUGH, Mass. — Several projects in Northern and Western Maine have withdrawn from the interconnection queue since the second Maine Resource Integration Study began last September, leaving only 520 MW of incremental generation cluster-eligible. Among the withdrawals was a proposed 248-MW wind farm in Aroostook County.

“The farther north we go, the more upgrades we incur,” Al McBride, the RTO’s director of system planning, told the Planning Advisory Committee on Wednesday.

The study’s goal is to identify potential transmission infrastructure that could be needed to interconnect queued generation in Maine, and to quantify generation that could interconnect with new transmission pursuant to the network capability interconnection standard (NCIS) and the capacity capability interconnection standard (CCIS).

The PAC also heard a presentation on the evaluation of time-sensitive projects identified in the Boston 2028 Needs Assessment study.

The study was recently updated to reflect the draft Capacity, Energy, Loads and Transmission (CELT) 2019 load forecast. The retirement of Mystic 8 and 9 may delay or inhibit the ability to re-energize the 345-kV cables in the Boston area and to restore area load as a part of the system restoration plan.

The RTO will perform an operational study on the impact of the Mystic retirements on system restoration plans and will communicate any resulting needs in an addendum to the study.

RTO Seeks Comments on RFP Template

Director of Transmission Planning Brent Oberlin presented the draft competitive transmission request for proposal (RFP) template for stakeholder review.

The RTO plans to issue its first RFP for a competitively developed transmission solution under ISO-NE Planning Advisory Committee Briefs: April 25, 2019.)

“We are following what’s going on in PJM,” Oberlin said. “There’s been some discussion of whether or not they’re moving to a template structure to evaluate various risks to exposure to cost increases, etc., how cost containment will affect that. So, we’ve been on the phone with PJM every week making sure we understand where they’re going.”

The New England Power Pool Transmission Committee is discussing modifications to Section I and Attachment K of the Tariff along with the addition of a selected qualified transmission sponsor agreement (SQTPSA).

The NEPOOL Reliability Committee is discussing related modifications to sections I and III.12.6 of the Tariff, as well as modifications to Planning Procedure 4, which governs cost review of regulated transmission solutions eligible for regional cost support.

Comments on the draft RFP materials should be submitted to pacmatters@iso-ne.com by July 10.

Net Load Reduced in Upper Maine 2029 Needs Assessment

The RTO has reduced the net load in its 2029 Maine Needs Assessment as a result of the draft 2019 CELT forecast, Alex Rost, manager of transmission planning, told the PAC.

Rost said the net load was reduced because of changes in load, energy efficiency and solar PV since the 2017 CELT.

Resources to be included in a needs assessment are those clearing a Forward Capacity Auction, or that have been selected in, and are contractually bound by, a state-sponsored request for proposals, or are otherwise obligated by contract.

Two new projects that received capacity supply obligations in FCA 13 have been added to the 2029 cases, he said. The 632-MW combined cycle Killingly Energy Center in Connecticut is far from the study area and therefore modeled offline, while the 123-MW Three Corners Solar project connecting into the Albion Road 115-kV substation in Maine is modeled at about 32 MW, or 26% of nameplate.

In addition, four generators have been set as out-of-service in the 2029 cases, Rost said. One generator in New Hampshire, the 48-MW Schiller 4, is fully delisted for the second consecutive FCA.

As described in the Transmission Planning Technical Guide, if a resource has delisted in the two most recent FCAs, the RTO will consider the resource unavailable for dispatch when performing a Needs Assessment. If a resource does not operate for three calendar years in a row, the resource is deemed to be retired.

One stakeholder asked if the RTO was proposing to define a new interface. No, Rost said.

“The interfaces that exist on the system are there based on varied system conditions, many of which may not necessarily be captured in what we study and set up for a Needs Assessment, especially when you consider the probabilistic methodology that we use for setting up generator dispatches when studying peak load,” Rost said.

The 15-MW Indeck-Energy Alexandria generator in New Hampshire had a qualified capacity value of 0 MW for FCA 13, while two generators in Maine have submitted retirement delist bids for FCA 14: the Yarmouth 1 and 2 units of 50 MW each.

Maine line impedances and ratings, and 345/115-kV transformer voltage schedules, have been updated with the addition of a new large industrial load at the Belfast 115-kV station.

The Upper Maine 2029 Needs Assessment will consider sensitivity scenarios adding the New England Clean Energy Connect (NECEC) project (modeled at 1,090 MW), as well as the Three Rivers Solar Power projects (modeled at 26 MW).

While NECEC does not yet have an approved contract with the Massachusetts Department of Public Utilities, the RTO recognizes that the project may have a contract prior to, or soon after, the completion of the Needs Assessment, Rost said.

Update on Tx Projects and Asset Conditions

Eva Mailhot, assistant engineer for transmission planning, presented an update on Regional System Plan transmission projects and asset condition projects that showed no major cost estimate changes and no new projects since the March 2019 update.

Four upgrades on the project list have been placed in service since March: three around Boston and one in Southeast Massachusetts/Rhode Island. In addition, one project was canceled in that period, the $7.3 million Newcastle Substation upgrades project in Maine.

The new in-service projects are:

- Project 1518 ($14.5 million) resolved thermal overloads by upgrading Kingston Station in Greater Boston, creating a second normally closed 115-kV bus tie and reconfiguring the 345-kV switchyard.

- Project 1741 ($3.3 million) resolved thermal overloads by rebuilding the 2.5-mile Middleborough Gas and Electric (MGED) portion of the E1 line from Bridgewater to Middleborough.

- Project 1352 ($19.4 million) resolved thermal overloads in Greater Boston by adding a second Mystic 345/115-kV autotransformer and Mystic bus reconfiguration.

- Project 1357 ($1.5 million) provided reconfiguration needed to resolve short circuit concerns by opening lines 329-510/511 and 250-516/517 in Greater Boston at Mystic and Chatham respectively, and operating K Street as a normally closed station.

Summer Locational Reserve Needs Reduced

RTO staffer Fei Zeng presented on locational reserve needs for 2019-2023.

The study showed no need to maintain summer reserves in Greater Southwest Connecticut through 2023 thanks to the additions of new gas-fired generation since 2018 and transmission upgrades expected in 2021. The retirement of Bridgeport Harbor 3 in 2021 is expected to have little impact.

Greater Connecticut’s summer reserve needs were eliminated by the 2018 start-up of CPV Towantic, the assumed addition of Bridgeport Harbor Unit 5 and Greater Hartford/Central Connecticut transmission upgrades.

For Northeast Massachusetts/Boston, reserve needs are expected to be in the range of 50 to 400 MW for summer 2020 but will be eliminated by the Greater Boston transmission upgrades.

The study used historical operational data used for developing forward reserve market requirements and the 2019 CELT for future loads and behind-the-meter PV forecast.

Forward Capacity Market results are used for resource additions and retirements. Transmission limits were consistent with those assumed for installed capacity requirement-related simulations to be conducted in 2019.

— Michael Kuser