By Michael Kuser

RENSSELAER, N.Y. — If you’ve ever seen a circus performer riding two horses around the ring, one foot on each, you have a good idea of the balancing act Analysis Group’s Sue Tierney had to execute in detailing the preliminary results of her firm’s carbon pricing study for NYISO.

Tierney’s performance came just days after the New York legislature passed the Climate Leadership and Community Protection Act (A8429), a development that could further complicate NYISO’s carbon pricing effort as it moves to a conclusion. (See “New Energy Law Could Affect CO2 Market Design,” NYISO Business Issues Committee Briefs: June 20, 2019.)

“We are looking at the carbon proposal as proposed by NYISO last December, although we are now revising our work to take into account the implications of shifting public policies in New York,” Tierney told NYISO’s Installed Capacity/Market Issues Working Group (ICAP/MIWG) on June 24.

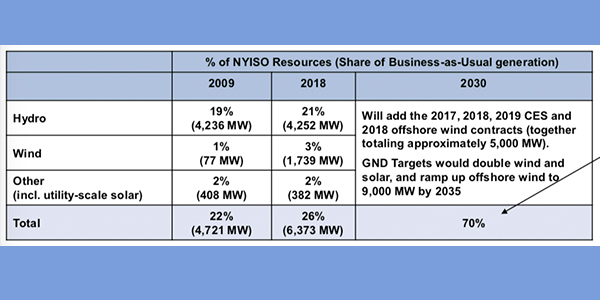

The third-party study examining the impacts of pricing carbon into NYISO’s wholesale electricity markets is intended to augment the Brattle Group report process that concluded in December, and is underway just as the new bill makes statutory many of Gov. Andrew Cuomo’s environmental targets, such as requiring 70% of the state’s electricity to be generated by renewable resources by 2030.

“We are not going to advocate for one particular action or another, though our point of view may be obvious from our analysis,” Tierney said. The final results are expected to be previewed with stakeholders ahead of the ISO posting the technical report and a separate summary for policy makers.

The new law would nearly quadruple the state’s offshore wind energy goal to 9 GW by 2035 and target making the electric system carbon-neutral by 2040. The bill also doubles distributed solar generation to 6 GW by 2025 and targets deploying 3 GW of energy storage by 2030.

After presenting information about changes in NOx emissions that could be anticipated with a carbon price in the NYISO energy market, Tierney said such outcomes are important, “even with the peaker rule in New York City,” referring to the state Department of Environmental Conservation’s proposal to revise its Clean Air Act regulations. The changes to lower allowable NOx emissions from simple cycle and regenerative combustion turbines during the ozone season would go into effect May 1, 2023, with generator compliance plans due by March 2, 2020. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

In contrast, the new climate bill will take effect once it’s signed by Cuomo, expected soon. The bill will assign the responsibility of adopting and enumerating the new standards to the DEC; establish an environmental justice advisory group; and create a 22-member “New York state climate action council” that “shall consult with the climate justice working group … the Department of State Utility Intervention Unit and the federally designated electric bulk system operator.”

Price Signals

“The 70% renewables target in the new bill is consistent with what the governor has been saying about the electric sector since January,” Tierney said. “There’s going to be more demand for electricity because of these goals now established in the act.”

The power sector will play a key role, given the intent to convert transportation and building heating and cooling end uses to electricity, she said.

Adding that the bill will also include deeper energy efficiency measures, Tierney said the other forms of “beneficial electricity use” promoted in the statute would create pressure to increase electricity supply and demand.

“This is the yin and yang of more electricity use and better efficiency,” Tierney said. “If you go meet all these renewables goals and growing demand with long-term contracts for [renewable energy credits], it would mean an increasingly large — and potentially unsustainable — share of the NYISO market under out-of-market, [policy-driven] contracts. By contrast, a carbon price could lessen the reliance of certain renewables on out-of-market contracts.”

A carbon pricing mechanism could stimulate entry based on wholesale price signals and reduce risks associated with increasing quantities of supply under long-term contracts in FERC-regulated wholesale markets, the presentation said. It noted that by 2030, if all new renewables entered the market with long-term REC contracts, in addition to those already under contract, and if zero-emission credit contracts were extended for the FitzPatrick and Nine Mile Point 2 nuclear plants beyond 2029, roughly 50 to 60% of supply would be under contract.

Howard Fromer, director of market policy for PSEG Power New York, said, “The bill directs a significant portion of the state’s clean energy and energy efficiency dollars to environmentally disadvantaged communities … perhaps reducing the amount available for subsidizing renewable energy resources.”

“The point here is that carbon pricing complement and reduce the role of long-term or out-of-market contracts,” Tierney said. “Having as full a toolkit as possible will benefit policymakers. It could provide greater visibility in energy markets for the value of zero-carbon resources, and possibly even help the upstate nukes beyond 2029, when the ZEC program ends. I have no idea whether the nuke owners would act in response, but a price signal is better than nothing.”

The Brattle study and a separate analysis released in May by the ISO’s Market Monitor, Potomac Economics, both point to power production efficiency improvements, lower emissions (in environmentally disadvantaged communities in particular), public health improvements and reduction in overall use of natural gas, Tierney said.

Public Benefits

Regarding public health benefits and other impacts, “Brattle and the Potomac Economics study could understate some impacts … because of their underlying assumption that all of the renewables needed to meet the prior 50% target by 2030 would show up in any event in the base case at no apparent cost to consumers,” Tierney said.

She added that that level of clean power is not free: “So the question that is still unanswered is whether a carbon price would help reduce the overall cost of entry of renewables?

“A carbon price would affect the dispatch of fossil units, and that will reduce local air emissions, as well as carbon emissions,” Tierney said. “We wouldn’t have protests about power plants if there were no benefit in removing them.”

Mark Reeder, representing the Alliance for Clean Energy New York, said, “There are a number of benefits of carbon pricing that Brattle said will occur but which Brattle said were too hard to quantify, so [they] are set to zero … like the benefits of increasing the likelihood of life extensions of existing hydro, the financial benefit to [the New York Power Authority], etc.”

On the Market Monitoring Unit’s analysis of the impacts of carbon pricing, which for consumer price impacts considered the two scenarios of base case and repowering, Reeder pointed out that the first three years of a carbon charge would cost consumers, but the following seven years would save them money, and he asked why not average the effect.

Erin Hogan, representing the UIU, said it would be better not to average, that “people don’t dismiss three years of pain so easily. If any report should be balanced, this is the one.”