VALLEY FORGE, Pa — PJM’s Merchant Transmission and Offshore Wind Task Force will soon bring potential rule changes for offshore wind development to the Planning Committee for consideration, RTO staff said Thursday.

John Reynolds, of PJM’s resource adequacy department, said stakeholders have so far offered three packages that address how transmission developers for single non-controllable AC lead lines could obtain capacity interconnection rights (CIRs) without committed generation.

The task force formed in February after the PC approved a problem statement and issue charge that would pave the way for existing and future offshore wind projects to develop throughout PJM, where researchers believe the potential is “big.” (See “PC Moves Forward on Offshore Interconnection Rights,” Big Prospects for Offshore Wind in PJM.)

Under existing rules, merchant transmission developers are only eligible to obtain transmission injection and withdrawal rights for DC facilities or controllable AC facilities connected to a control area outside the RTO. And because PJM does not offer CIRs to non-controllable AC lines, it is unable to perform stability or short-circuit analyses, as is typically done when a committed generation source exists.

Two of three packages introduce the concept of transferrable CIRs (xCIRs). In one plan, PJM would base the xCIRs on thermal studies only, while the second would allow requests for xCIRs based on all standard studies using a generic generator model. Both plans would make the rights transferrable to a generator project in the queue one year after the execution of the interconnection study agreement (ISA).

A third plan would modify the generator request to allow delayed submission of its data and use generic modeling instead for the feasibility and impact study. The official data would be due no later than 90 days into the study.

“These three are not the only ones we expect to have,” Reynolds said.

The task force has three more meetings scheduled before it returns to the PC for a first read of any draft language in September.

1st Read of Cost Containment Rules Coming in August

Mark Sims, PJM’s manager of infrastructure coordination, told the PC that staff will present Manual M14F draft language for a first read in August, concluding months of educational updates and coordination with the Independent Market Monitor.

The language will detail PJM’s expanded cost containment process, which will include an updated hybrid fee structure. Sims previously told the PC that PJM’s old tiered approach, approved in 2014, doesn’t account for the increased cost of the new comparison framework that involves an independent consultant’s review and legal and financial analyses. (See “New Fee Structure for Cost Containment Needed,” PJM PC/TEAC Briefs: June 13, 2019.)

Staff will seek endorsement of the language at the September PC and Markets and Reliability Committee meetings.

Unchanged Load Model Selection Endorsed

Stakeholders unanimously endorsed PJM’s load model selection for the 2019 reserve requirement study (RSS) after staff said it remained unchanged from the year before.

Patricio Rocha Garrido, of PJM’s resource adequacy department, said the load model of 2003-2012 remains the best choice for studying the 2023/24 delivery year. Analysis shows minor deviation in megawatt distance between 2018 and 2019, but Rocha Garrido described this as “insignificant enough” to not alter the model.

PJM also recommends switching its peak week to a different period in July so that it occurs in the same month as the “world” peak, but not on the same dates — which historical data suggests is unrealistic. The “world” load models include dates from the neighboring MISO, NYISO, TVA and VACAR regions.

Dominion, FirstEnergy Supplementals

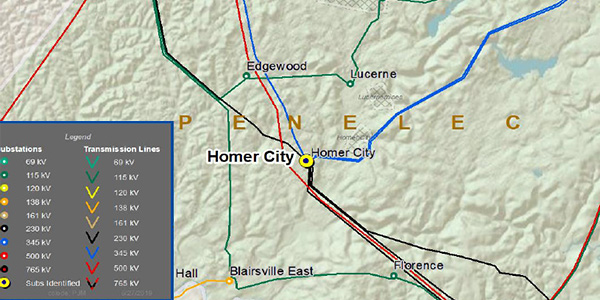

FirstEnergy has identified protection schemes using a certain vintage of relays and communication equipment that have a history of maloperation on its Shawville-Shingletown 230-kV and Elko-Shawville 230-kV lines in the APS/Penelec transmission zone.

The 51-year-old Homer City North 345/230/23-kV transformer in western Pennsylvania faces increased probability of failure because of obsolete parts, leaks, deteriorated control cabinet components, high levels of heating gasses and moisture, and type “U” bushings. Likewise, the 34.5-mile Armstrong-Homer City 345-kV line is deteriorating from woodpecker damage, top and bayonet rot, and weatherization.

Dominion Energy wants to add a new delivery point for Mecklenburg Electric Cooperative in Boydton, Va., to support a new data center campus with a total load in excess of 100 MW. The requested in-service date is April 1, 2020.

The company said its Chickahominy 500/230-kV, 840-MVA transformer has been identified for replacement as part of its ongoing transformer health assessment process. Dominion said it’s the last known Westinghouse shell transformer — built in 1987 — on its system. These transformers are considered suspect because of previous transformer failures that reduced basic insulation level ratings and forced remanufacturing.

– Christen Smith