By Michael Kuser

NYISO’s effort to price carbon into its wholesale markets could help New York achieve its ambitious clean energy goals, but the policy would benefit from a boost in the social cost of carbon (SCC) or additional programs, according to a study released Tuesday.

The study by the nonprofit Resources for the Future (RFF) indicates a $63/ton carbon price could drive clean energy penetration to as high as 64% of the state’s resource mix by 2025, “well on the way” to the 70% requirement for 2030. The SCC is currently estimated at $40/ton.

The target of 70% renewable generation by 2030 implies an increase in the share of non-emitting generation from its current level of approximately 60% (46% not including Indian Point, which is slated to retire in 2021) to roughly 88% in 2030 (for load-serving entities under the jurisdiction of the New York Public Service Commission) and 100% by 2040, according to the study.

“This analysis suggests pricing carbon within New York electricity markets could help to advance the adoption of clean energy, but a higher carbon price, additional companion policies or different policies will likely be necessary to hit the clean energy goals New York state has set for 2030.”

The think tank used its own Engineering, Economic and Environmental Electricity Simulation Tool (E4ST) to model the impact of carbon pricing on emissions and prices in New York and throughout the Eastern Interconnection based on expectations for 2025.

The study, “Benefits and Costs of Power Plant Carbon Emissions Pricing in New York,” was co-authored by RFF’s Daniel Shawhan and incorporates key assumption changes from an earlier version of the analysis presented last September to the Integrating Public Policy Task Force (IPPTF), a joint effort between the ISO and the PSC. (See ‘Negative Leakage’ from NY Carbon Charge, Study Shows.)

The ISO’s Market Issues Working Group (MIWG) took over in January from the task force, which over nearly a year and a half had developed the carbon pricing proposal released last December.

“The most influential change was that we used what I consider to be better projections of the costs of solar and wind technology,” Shawhan told RTO Insider.

“The ones we used before were from the [U.S. Energy Information Administration’s] Annual Energy Outlook, and they’re just simply out of date,” Shawhan said. “So we used better assumptions … the medium cost projections from the National Renewable Energy Laboratory annual technology baseline. The effect of that change was to lower the projected cost of solar and wind, and, as a result, we get considerably more emissions reductions and we get a low projected cost to electricity users, lower than some of our prior projections.”

Clean Energy Legislation

NYISO market participants have been debating how the state’s newly enacted Climate Leadership and Community Protection Act (A8429) and its mandated influx of renewables would affect the effort to price carbon. (See “New Energy Law Could Affect CO2 Market Design,” NYISO Business Issues Committee Briefs: June 20, 2019.)

Along with the 70-by-2030 renewables target, the new law nearly quadruples the state’s offshore wind energy goal to 9 GW by 2035 and requires the economy to be carbon-neutral by 2040. It also doubles the distributed solar generation goal to 6 GW by 2025 and targets deploying 3 GW of energy storage by 2030.

Gov. Andrew Cuomo signed the bill July 18, the same day he announced the state was awarding a combined total of 1,700 MW in offshore wind contracts to Equinor’s Empire Wind project and to Sunrise Wind, a joint venture of Ørsted and Eversource Energy.

In addition, the state Department of Environmental Conservation is revising its Clean Air Act regulations to lower allowable NOx emissions from simple cycle and regenerative combustion turbines during the ozone season, effective May 1, 2023, with generator compliance plans due by March 2, 2020. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

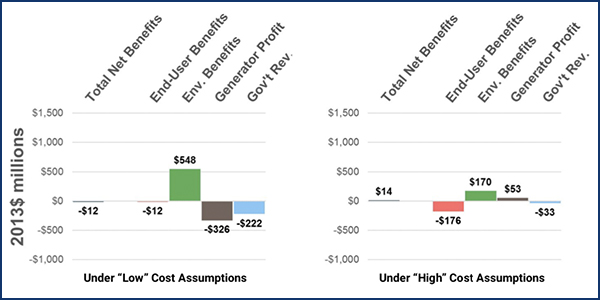

According to the RFF simulation results, New York electricity users in in 2025 would pay the equivalent of between 0.1 and 1.1% of the retail electricity rate for the carbon adder, while the net benefit to society as of that year would be between $108 million and $691 million per year, in 2013 dollars.

The analysis found a carbon adder drives New York renewable energy credit and zero-emission credit prices to zero, incentivizing renewables investment and the maintenance of upstate nuclear generation in the energy markets. It also found the carbon policy increases zonal average wholesale electricity prices in New York by $20 to $24, but with revenue rebated to end users, and other charges reduced, the average cost to end users is 9 cents to $1.21/MWh.

In addition, the study found the Regional Greenhouse Gas Initiative’s Emissions Containment Reserve, due to be introduced in 2021, will provide a mechanism for reducing the emissions cap if the RGGI allowance price falls to the reserve trigger price, resulting in lower total power sector emissions from the RGGI states taken together.