By Amanda Durish Cook

CARMEL, Ind. — MISO has terminated work on a new set of futures scenarios for the 2020 Transmission Expansion Plan (MTEP 20), opting to take the extra year to resolve its lagging renewable growth and retirement projections.

The RTO announced last week that it will recycle its MTEP 19 futures so it can finish MTEP 20 work early to allow time to completely retool the 20-year scenarios for the 2021 cycle. It introduced the idea to stakeholders in June. (See MISO Floats MTEP Time Trade-off.)

At a special workshop Thursday, MISO presented more evidence to back up its claim that a futures overhaul will be both necessary and time-consuming. The RTO said its members’ public announcements and stakeholder feedback indicate that fleet change in the footprint is occurring more rapidly than staff originally thought.

“We’ve seen on the ground [that] in the last three to five years, our members are taking actions that are outpacing even what we bookended. So, our planning is not managing that uncertainty,” MISO Director of System Planning Jesse Moser told stakeholders. “It’s time for a more full-fledged redo.”

Developing futures takes time that the annual MTEP cycles don’t allow, Moser said. “We feel rushed in this current process.”

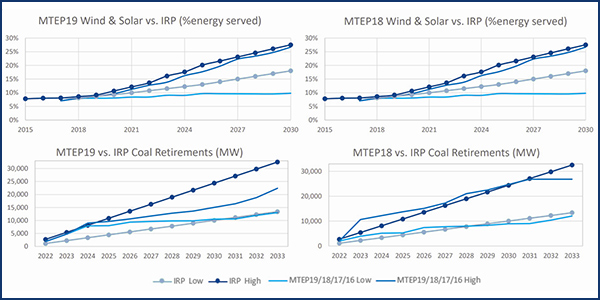

Moser said utilities’ publicly available integrated resource plans alone indicate that the tempo of new wind and solar generation and coal plant retirements are already set to track above MISO’s highest predictions from MTEP 16, 17, 18 and 19.

In contrast with coal dominating in 2005, wind and natural gas generation have overtaken the interconnection queue, with a “huge” recent influx of solar in MISO South, Moser said.

“We’re seeing new resources that will have infrastructure in new locations and will have different operating characteristics. So, change is happening, and it’s happening faster than our scenarios have outlined,” he said.

MISO said the number of man-hours it spends developing futures jumped from about 1,000 hours annually in 2011-2014 to nearly 6,000 hours in 2018.

The Union of Concerned Scientists’ Sam Gomberg asked if MISO is considering ways for members to inform it of confidential retirement and generation plans to inform the futures.

Moser said the RTO is open to working more member communication into the process. He also said it will do more to incorporate state policies, carbon commitments and IRPs.

Clean Grid Alliance’s Natalie McIntire said MISO might consider looking beyond the next 20 years in planning, arguing that its recent transmission projects are not large enough to meet future needs. But consultant Roberto Paliza said the 20-year futures are too far in the future to be accurate, urging 10 or 15 years instead.

MISO is collecting sector opinions through the end of the month on how it should restructure the futures.

Stakeholders Split

Stakeholders offered differing opinions on the decision to reuse the MTEP 19 futures.

Entergy’s Yarrow Etheredge said a majority of MISO transmission owners support the cessation, provided “stakeholders are afforded an opportunity to recommend targeted economic planning studies in MTEP 20.” The Organization of MISO States also expressed support for the decision.

However, MISO’s Environmental sector disagreed, arguing that staff and stakeholders have already put work into the MTEP 20 futures. Invenergy’s Ann Coultas said stakeholders shouldn’t “be forced to choose between accurate MTEP 2020 assumptions and general improvements to the MTEP process.”

Northern Indiana Public Service Co., NextEra Energy and WPPI Energy also said MISO should develop MTEP 20 futures.