By Amanda Durish Cook

MISO and PJM said Tuesday they will propose changes to how they determine flowgate rights in a white paper in November.

The RTOs use an April 1, 2004, “freeze date” to determine firm rights on flowgates based on historical firm flows that occurred before the creation of their seam. That date is used to determine both firm flow entitlements (FFEs) used in market-to-market settlements and firm flow limits (FFLs) used in transmission loading relief (TLR).

Earlier in August, MISO staff said the RTOs were considering filing a freeze date solution that would almost certainly be opposed by nonmarket parties to the congestion management process, leaving a decision up to FERC.

During a Joint and Common Market conference call, however, the RTOs said they hope they will be able to find an agreement with the nonmarket parties — including SPP, the Tennessee Valley Authority, Manitoba Hydro, the Minnkota Power Cooperative and Associated Electric Cooperative Inc. — by November. (See Outside Parties Slow MISO-PJM Freeze Date Thaw.)

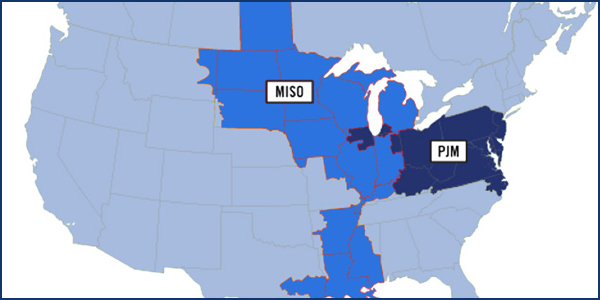

PJM and MISO footprints | MISO, PJM

MISO and PJM’s proposed solution would divide flowgate rights by age, with priority to network resources from 2004 and earlier, followed by: network resources from 2004 or later; transfers between local balancing authorities to make up shortages on a pro rata basis; and RTO load served by RTO dispatch — in that order.

“Of course, the current freeze date process is not suitable for markets right now. … Of course, the solution will increase transfer rights for markets over nonmarket entities. That’s been a big concern for the nonmarket,” Andy Witmeier, of MISO’s seams administration team, said earlier in August. Witmeier said nonmarket neighbors of the RTOs are concerned that their reliability may be impacted by a decrease in non-firm transfer availability. They also fear that an increase in firm limits for post-2004 network resources could lead to more curtailments of non-firm transfers for those outside the two markets.

Witmeier had said MISO and PJM could either file the freeze date changes with changes only to the RTOs’ FFEs, leaving FFLs alone. But MISO staff said they would prefer a full solution that includes FFLs or to file a contested solution and let FERC decide.

The white paper will discuss the solution only as it applies to FFEs. Joe Rushing, of PJM’s interregional market relations team, said Tuesday that the RTOs will continue to discuss with neighboring balancing authorities how FFLs can be updated from the freeze date.

Rushing said the RTOs may consider creating a market mechanism to cut a portion of firm market flows when curtailment of nonmarket flows doesn’t provide enough relief to avoid TLRs. He also said they plan to study individual flowgates to figure out if some might be overtaxed.

He promised more discussion on the issue at the JCM meeting Nov. 19, when the RTOs expect to unveil the white paper.

No MISO Guarantee on PJM Customers’ Revenue Rights

Meanwhile, the RTOs have conceded there is no way for MISO to guarantee PJM’s customer-funded incremental auction revenue rights (IARRs) will result in a corresponding increase in FFEs.

However, the RTOs are promising more accurate estimates of increased flowgate entitlements when an IARR requires a joint coordinated study on the transmission upgrade.

Rushing said the grid operators have received little stakeholder comment on the small potential for financial risks to PJM members.

Both RTOs offer IARRs, which reflect upgrades that increase capability on their transmission facilities. IARR megawatts are awarded for the additional capability created for the life of the upgrade or 30 years, whichever is less, and valued each year based on annual financial transmission rights auction clearing prices. However, PJM’s process provides an additional option that allows a specified IARR to be awarded when a customer agrees to fund transmission upgrades necessary to support the new auction revenue rights request. PJM is also obligated to guarantee at least 80% of IARR megawatts. (See PJM, MISO Plan Study to Coordinate Incremental ARRs.)

MISO has repeatedly said it cannot make guarantees on future FFE allocations to PJM members. PJM staff have said it’s possible they won’t be able to guarantee the 80% share if transmission upgrades affect the MISO system.