By Rich Heidorn Jr.

FERC last week rejected an administrative law judge’s finding that PJM’s transmission study process is unjust and unreasonable for developers seeking to secure incremental auction revenue rights (IARRs) by making upgrades to reduce grid congestion (EL15-79).

The commission reversed ALJ Philip C. Baten’s January 2018 initial decision ordering PJM to reinstate three interconnection queue positions he said were unfairly eliminated when developer TranSource refused to pay for a facility study, the next stage of its interconnection process after the system impact study (SIS). FERC also reversed Baten’s conclusion that PJM should refund TranSource’s SIS application fees. (See FERC Judge Faults PJM, TOs on Transmission Upgrade Process.)

TranSource filed a complaint in June 2015 contending that PJM and transmission owners Public Service Electric and Gas, PPL, Jersey Central Power & Light and Delmarva Power & Light inflated the cost of upgrades necessary to approve three requests for IARRs. (TranSource is not to be confused with Transource Energy, a joint venture of American Electric Power and Great Plains Energy.) (See Transmission Developer: PJM TOs Inflating Upgrade Costs for ARRs.)

The commission affirmed Baten’s decision to reject other remedies TranSource sought, including its claim for $63.6 million in “lost business” opportunities. And it agreed with Baten that it could not determine whether the $1.7 billion in upgrades PJM identified were indeed necessary, noting that the case focused on the impact studies, which are supposed to produce only “good faith” cost estimates.

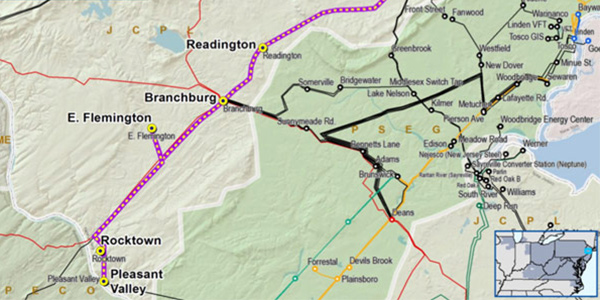

Readington-Roseland Line

TranSource’s upgrade proposals used facility ratings from FERC Form 715 filings made by PJM on behalf of the TOs. Baten said that was a “reasonable” assumption based on “statutory and regulatory provisions” and language in PJM’s Tariff.

PJM testified its cost estimates were based on the line ratings expected at the time that the project being studied would be in service, including planned upgrades. PJM’s estimates also incorporate the host TO’s review of limiting elements based on the methodologies they file under NERC reliability standard FAC-008-3. The methodologies are not public and not the same as those used for Form 715.

A primary conflict was over estimates for upgrading PSE&G’s Readington-Roseland 230-kV line in New Jersey.

PJM’s analysis of transmission upgrade requests under Tariff Attachment EE is done in two steps. The SIS provides developers with an estimate of what their plan will cost with +/- 40% accuracy.

The first component of the SIS is the simultaneous feasibility test, in which PJM tests whether the developer’s IARR request can be accommodated without diminishing the income of the current ARR holders. After that, PJM identifies the facilities that are impacted by the IARRs, and the relevant TOs conduct “desk-side” studies — so called because they do not involve site visits — using the confidential methodology to identify upgrades needed to accommodate the IARRs and their estimated cost.

If the developer chooses to proceed based on the SIS results, PJM conducts an in-depth facilities study that requires a refundable deposit of at least $100,000 and is supposed to provide a more accurate itemization of required upgrades.

A facilities study done for Exelon in late 2014 pegged the cost to repair the Readington-Roseland line at about $14.2 million. Although the towers had been in service for 80 years, “based on visual observation only, tower replacements are not anticipated,” the study said.

But an SIS done for TranSource six months later increased the estimate more than nine times to nearly $126.5 million. When Richard Crouch, a PSE&G electrical engineer, reviewed the project three months later, he called for a complete wreck and rebuild for more than $142.7 million, a $16 million increase.

By 2016, PSE&G engineers had put the line on its list of facilities violating the company’s Form 715 end-of-life criteria.

TranSource contested the SIS for Readington-Roseland and its other requested upgrades, saying it lost financing because of what it called PJM’s “badly inflated” estimates. The RTO eliminated TranSource’s queue positions when it refused to pay for the studies.

Baten ruled that the lack of transparency in PJM’s SIS process made it “unduly discriminatory” to merchant developers by depriving them of business opportunities.

But while the commission directed PJM to add more detail regarding its SIS methodologies and assumptions to its Tariff, it ruled that the RTO’s treatment of TranSource “represent a transparent process that is just and reasonable.” It said the Exelon facilities study cited by TranSource was an interconnection study, not a transmission planning study.

The commission also reversed Baten’s findings that the line rating methodology lacked transparency and that it was reasonable for TranSource to rely on Form 715 ratings in conducting its own evaluation of its upgrade requests.

And it said the judge ignored precedent and the facts in concluding that PJM’s SIS process was unduly discriminatory. Citing Congress’ creation of classes under civil rights statutes, Baten concluded that FERC had “created a class” of merchant developers and established “benefits for the class.” He said that since the IARR program began in 2007, only one project (combining five queue positions) had been awarded IARRs out of 41 Attachment EE queue positions.

FERC said Baten failed to make a finding that PJM treated TranSource differently than other Attachment EE customers or that Attachment EE customers were treated differently than other classes of customers.

“We agree with PJM, the PJM transmission owners and trial staff that the presiding judge’s reliance on the fact that very few Attachment EE requests have resulted in IARRs being awarded is misplaced,” the commission said. It added that he ignored testimony from David Egan, then manager of PJM’s Interconnection Projects Department, that “to make a profit under Attachment EE, a developer must find a ‘sweet spot’ where the transmission upgrades reduce congestion, but enough congestion remains so that the resulting IARRs have value.”

The commission dismissed as moot TranSource’s request to require PJM to add a pre-SIS phase to the Attachment EE process, noting that FERC approved the addition of a feasibility study to the process in April 2018.