By Michael Kuser

RENSSELAER, N.Y. — A NYISO study released last week finds that pricing carbon into the ISO’s wholesale markets will help New York achieve its clean energy goals — the most ambitious in the country.

“Carbon pricing advances the value of New York’s leadership role,” said Sue Tierney of Analysis Group, co-author of the final carbon pricing report. “Assuming New York endorses this idea, NYISO will adopt it and make a filing with FERC.”

Tierney summarized the carbon pricing report to the Installed Capacity and Market Issues Working Group (ICAP/MIWG) after its release was delayed a couple months to perform additional analysis on the impacts of the Climate Leadership and Community Protection Act (CLCPA), as requested by the NYISO Board of Directors. (See NYISO Management Committee Briefs: July 31, 2019.)

Signed into law in July by Gov. Andrew Cuomo, the CLCPA requires 70% of the state’s electricity to be generated by renewable resources by 2030, raises its offshore wind energy goal to 9 GW by 2035 and requires the whole economy to be carbon-neutral by 2040. The law also doubles the distributed solar generation goal to 6 GW by 2025 and targets deploying 3 GW of energy storage by 2030.

A newly created Climate Action Council will implement the measures needed to meet the environmental targets.

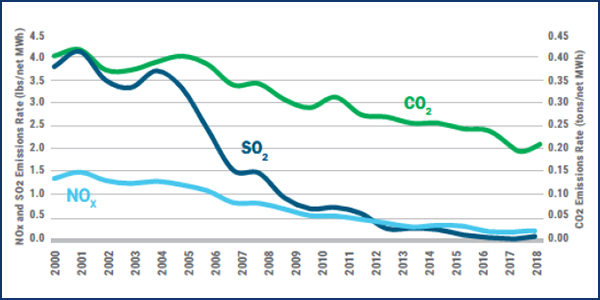

Emission rates for electricity generation in New York (2000–2018) | NYISO

The report’s authors contend that in order for the electric sector to help decarbonize New York’s other economic sectors, which are responsible for 83% of carbon emissions, on the “aggressive” time frames set out in the CLCPA, the “power system will need to adjust to vastly different levels and shapes of electricity demand while simultaneously adding clean energy resources on a scale and pace unseen in recent years in the state (and perhaps not since the mid-20th century).”

The effort will require “every effective means possible” to achieve reductions at the lowest possible cost, the report says.

The report notes that renewable resources covered about 20% of load-serving entities’ demand for electricity in 2018, with 80% coming from hydroelectric plants. The CLCPA will require renewables to cover 70% of LSE demand by 2030.

“A price on carbon in wholesale markets can provide a signpost to low-cost compliance pathways and preserve the fundamental wholesale electricity market structure that encourages operational efficiency and minimizes consumers’ investment risks,” according to the report.

No Heresy

Tierney also discussed the report with NYISO CEO Rich Dewey during a Thursday teleconference with reporters.

“Competitive electric markets are a strong and proven platform from which to leverage innovation, and we look forward to collaborating with the state on the exciting and important work ahead,” Dewey said in a press release ahead of the event.

“You can’t really leave any tools in the toolbox if we are going to achieve these goals,” he said during the conference, the Times Union reported.

But hours before that feel-good event, Tierney faced NYISO stakeholders in what seemed at first to be a session of the Spanish Inquisition, formed to sniff out any sign of unorthodox methodology or belief.

Twenty minutes into her presentation, she was still practically on the first page of a 35-page summary.

“You guys are ridiculous,” Tierney said in jest, to which one of the stakeholders replied that, on the contrary, they were behaving moderately compared to their usual ways.

Couch White attorney Michael Mager, who represents Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers, objected to the process of skipping the stakeholder feedback sessions promised by NYISO and jumping straight to a final report.

Mager also raised concerns about the scope of the study being changed without notice to stakeholders or an opportunity for them to provide feedback on the revised study scope.

Tierney deferred to Rana Mukerji, NYISO’s senior vice president for market structures, who assured Mager and other stakeholders that the ISO still welcomed their feedback and would consider if additional work on the study was necessary. And because the stakeholders did not have time to read the report — as it was issued only that morning — Tierney would be back to answer more questions during the week of Oct. 21, he said.

Assuming enormous public health and ratepayer benefits, there will be out-of-pocket costs that can be attributed to the cost of complying with CLCPA, Tierney said. “The study looks at net benefits of carbon pricing. The implication is that there would be near-term costs for long-term savings and benefits.”

Representing New York City, Couch White attorney Kevin Lang expressed concern about the effect of those near-term cost increases in the city, where the closest renewable energy option is offshore wind, which requires state subsidies, at least for now.

“Initial wholesale costs are going to be higher in New York City, so the state may have to enact other policies to mitigate those effects,” Tierney said.

Mark Younger of Hudson Energy Economics said, “If you don’t act [to implement carbon pricing], there will be other costs associated with that inaction,” referring to various harmful effects of climate change.

Asked how much a carbon charge would help incent new renewable energy projects, Tierney said that financing projects based on renewable energy credits (RECs) and zero-emission credits (ZECs) “is hard to come by, as banks prefer to look at market energy prices,” and that when the market price reflects the social cost of carbon, the market will be more efficient.

Guessing Game

“We don’t know what the Climate Council will do, what the Public Service Commission will do [and/or] what the Department of Environmental Conservation will do in terms of adopting a social cost of carbon,” Tierney said. “We imagined a robust policy toolkit, assuming the kinds of things that already exist, such as long-term REC contracts, performance standards and the like.”

Tierney said it might help for policymakers and stakeholders to look at the study as a cost-effectiveness analysis rather than a benefit/cost analysis, and that pricing carbon is a cost-effective way for the state to meet its environmental goals.

“If the New York wholesale market does not align its price signals with the new law, it will not be efficient,” she said. “This is not a modeling report. We describe the modeling results of others, and we calculate a present market value of some of those results.”

Outlook for zero-carbon electric resources | Analysis Group

The study stuck to the electricity sector, but there’s “going to be a lot of work” for New York to get to 70% renewable energy by 2030, she said.

“One of the features of the current construct is that RECs and ZECs are paid on a load-ratio share,” said David Clarke, director of wholesale market policy for Power Supply Long Island. “So rather than those zones whose carbon emissions would be increased most by nuclear closures paying for the ZECs, there is an implied acknowledgement that keeping nuclear plants open to reduce carbon is a statewide goal with statewide sharing of costs. We are paying a load-ratio share downstate.”

He asked whether the study considered how carbon pricing will change the zonal allocation of ZEC and REC costs.

“Qualitatively but not quantitatively,” Tierney said. “We looked at it in terms of increased risk to consumers and felt that rather than relying on long-term contracts for RECs and ZECs, carbon pricing would reduce risk by shifting it away from consumers. … And carbon pricing also would help consumers avoid the costs of buyer-side mitigation.”