By Amanda Durish Cook

CARMEL, Ind. — MISO is hoping to avoid the need for a sixth straight waiver of its $1,000/MWh offer cap this winter, filing a year ahead of a FERC deadline to double its hard cap.

The RTO on Oct. 1 filed for the third time a proposal to adopt a $1,000/MWh soft cap and a $2,000/MWh hard cap on energy offers — and make corresponding changes to its demand curves (ER20-11).

MISO had until Oct. 1, 2020, to implement a $2,000/MWh hard cap for verified cost-based incremental energy offers after FERC last year said its plan still needed a few tweaks. While the commission accepted much of MISO’s plan to permanently double its hard offer cap, it also required the RTO to pledge to apply the new hard cap to adjusted energy offers from fast-start resources. (See FERC OKs MISO’s Doubled Offer Cap, Orders Alterations.) The new filing is considered a “true-up” filing rather than a compliance filing, the RTO said.

MISO plans to go live with the new offer cap by Dec. 1, having completed “two or three back-and-forths with FERC,” Senior Market Engineer Chuck Hansen said at Thursday’s Market Subcommittee meeting.

Executive Director of Market Operations Shawn McFarlane said he hoped the filing would supplant the need to request a sixth waiver of its $1,000/MWh offer cap this winter. (See MISO Gets 5th Winter Waiver of Offer Cap.)

Hansen said MISO was able finish its offer cap work ahead of deadline because it and market platform vendor General Electric found themselves with more time while they await a FERC order on the RTO’s plan to incorporate energy storage resources into its markets. MISO originally asked for an order on energy storage compliance by July 1 while anticipating “significant” software work thereafter on a storage participation model.

Hansen also said additional staff time was freed up because FERC has yet to issue a final rule for RTOs to craft a participation model for distributed energy resources.

Hansen said MISO will only seek a sixth waiver if FERC rejects the filing. That waiver would closely resemble the last five it filed, he said, with verified energy costs above $1,000/MWh recovered via revenue sufficiency guarantee payments.

MISO’s offer cap plan specifies that all resources, regardless of type, are eligible to submit cost-based energy offers above $1,000/MWh. This time, it added that fast-start resources will not be able to set prices above the $1,000/MWh soft cap or above the $2,000/MWh hard cap without offers first being verified or mitigated by the Independent Market Monitor.

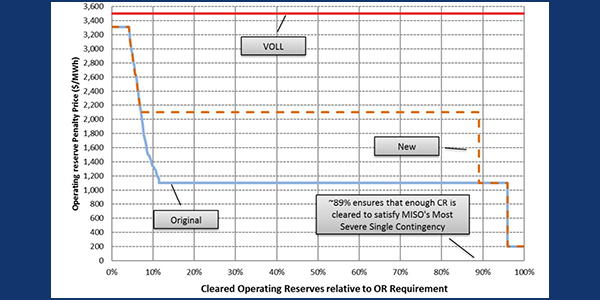

Along with the higher caps, MISO has added a $2,100/MWh prolonged step to its operating reserve demand curve (ORDC) so that resources will receive nearly double the energy price when supply is scarce.

The ORDC will begin at $3,300/MWh, dropping to $2,100/MWh for much of the curve when the RTO clears 8% of its requirement level. At 89%, the level falls to MISO’s original $1,100, remaining there until 96% or more of the requirement is cleared, when the curve flattens at $200.

MISO is planning to maintain its $3,500/MWh cap on the value of lost load (VoLL) over the Monitor’s longstanding criticism that VoLL could be pushed as high as $12,000/MWh to create a more sloped contingency reserve demand curve.

Hansen said MISO still plans to work with stakeholders in the coming months to recast VoLL limits.