By Hudson Sangree

Pacific Gas and Electric’s stock price fell to a record low Monday as a huge wildfire its equipment is suspected of starting last week continued burning mostly uncontrolled in Sonoma County, Calif., amid mass evacuations and power shutoffs to 940,000 customers in Northern and Central California.

PG&E began restoring power Monday to some of its customers as winds died down, but additional public safety power shutoffs (PSPS) are expected Tuesday and Wednesday as another weather system with high winds descends on the utility’s service territory. It would be the third such event in the past week.

By Monday morning, the Kincade Fire, in the hills above Sonoma County wine country, had grown to more than 66,000 acres, with only 5% containment, as thousands of firefighters battled the blaze. It had destroyed nearly 100 structures while threatening 71,000 more, state fire officials said. No deaths have been reported as of press time.

The fire started Wednesday night, possibly beneath a PG&E transmission line. The line had remained energized in keeping with the utility’s PSPS protocol, PG&E said.

“Those transmission lines were not de-energized because forecast weather conditions, particularly wind speeds, did not trigger the PSPS protocol,” PG&E said in a news release. “The wind speeds of concern for transmission lines are higher than those for distribution.”

PG&E filed a report with the California Public Utilities Commission on Thursday detailing the incident beneath a line that transmits electricity from The Geysers, a sprawling geothermal field about 70 miles north of San Francisco.

About 9:20 p.m. PT Wednesday, “PG&E became aware of a transmission-level outage on the Geysers #9 Lakeville 230-kV line, when the line relayed and did not reclose,” the report said. “At approximately [7:30 a.m.] on Oct. 24 … a responding PG&E troubleman patrolling the … line observed that Cal Fire [the California Department of Forestry and Fire Protection] had taped off the area around the base of transmission tower 001/006. On-site Cal Fire personnel brought to the troubleman’s attention what appeared to be a broken jumper on the same tower.”

In a press conference Thursday, PG&E CEO Bill Johnson said, “A jumper is simply a piece of wire that jumps the conductor over the insulator.”

“Filing the [electric incident report] does not tell us where the fire started,” Johnson said. Cal Fire and PG&E are continuing to investigate, he said.

The transmission tower in question was inspected earlier this year as part of PG&E’s Wildfire Safety Inspection Program, the utility said in its statement.

A fire-detection camera reportedly caught the ignition’s fireball on a video posted by the Nevada Seismological Laboratory at the University of Nevada, Reno, which operates fire cameras in California. Footage from a news helicopter showed the tower Friday, according to a Sacramento television station.

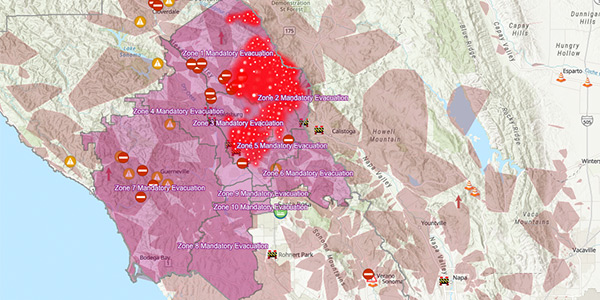

Approximately 180,000 people were ordered to evacuate from Sonoma and Napa counties. The mandatory evacuation orders covered areas heavily damaged by the wine country fires of October 2017, including northern portions of the city of Santa Rosa that were leveled in those firestorms.

Cal Fire investigators blamed PG&E equipment for 21 of the 22 wine country fires, also called the North Bay fires, and determined that a broken PG&E transmission line sparked November’s Camp Fire, the deadliest in state history. That fire burned much of the town of Paradise, killing 86 residents and destroying more than 14,000 homes.

PG&E sought bankruptcy protection in January, citing $30 billion in liability from the 2017/18 fires.

‘Zero Share Price’

After PG&E filed its report with the CPUC last week, a Citigroup analyst warned that PG&E’s stock price could become worthless, according to MarketWatch.

“Shareholders are worried. And should be,” Praful Mehta wrote in a note to clients, the Wall Street publication said. “Kincade increases the probability of a zero share price.”

After PG&E said it would file for bankruptcy in January, its stock price hit a record low of $6.36/share. By Monday morning, a selloff of PG&E stock had dropped the price to $3.62/share. It stood at $3.80/share at the close of trading Monday.

The Wall Street Journal reported Monday that PG&E’s bond prices had also fallen, wiping out hundreds of millions of dollars on paper for its noteholders.

For weeks now, PG&E’s bondholders and shareholders have been engaged in a battle for control of the company in proceedings before Judge Dennis Montali of the U.S. Bankruptcy Court in San Francisco.

The bondholders convinced Montali on Oct. 9 to end PG&E’s period of exclusivity — the time it had to promote its own reorganization plan without interference — and to admit their Chapter 11 reorganization plan as a competitor. (See related story, Attorneys Clash over PG&E Reorg, Blackouts Resume.)

The bondholder plan would wipe out almost all existing equity in the company “because they’re issuing themselves and the victims [of 2017/18 wildfires] about 99.99% of the company,” Mehta told Bloomberg in a videotaped interview. PG&E’s plan could result in stock price of about $20 to $25/share, he said.

Mehta said he thinks it’s far more likely the judge will adopt the bondholders’ plan, which promises to inject more than $29 billion into PG&E in exchange for a controlling interesting in California’s largest utility. Mehta said he gave the bondholder plan about a 75% chance of success, versus a 25% chance for PG&E’s plan.

“So that is the 75% probability of a zero” value share price, Mehta said.