By Rich Heidorn Jr.

Anbaric Development Partners asked FERC on Monday to order PJM to allow developers of offshore transmission “platforms” to obtain injection rights, saying the RTO’s Tariff violates the commission’s open access requirements and is discriminatory.

The transmission developer said it was forced to file its complaint after a stakeholder initiative to consider changing PJM’s rules stalled in September.

PJM’s Tariff allows merchant transmission developers to obtain transmission injection and withdrawal rights for DC facilities or controllable AC facilities connected to a control area outside the RTO. Under a problem statement approved in February, stakeholders considered allowing merchant transmission developers to request injection rights for non-controllable AC transmission offshore. But after six special sessions, stakeholders opted against recommending changes. (See “PJM Recommends Sunsetting Offshore Wind Special Sessions,” PJM PC/TEAC Briefs: Sept. 12, 2019.)

“The nature and scope of fundamental open access rights under the PJM Tariff cannot be left to the whims and commercial interests of stakeholders,” Anbaric said in its complaint. “Put simply, the PJM Tariff does not contemplate the interconnection of transmission platform projects and denies them the opportunity to interconnect to the PJM transmission system and obtain meaningful and material interconnection rights.”

In response to the complaint, PJM spokesman Jeff Shields said the RTO “has been and will continue to engage with members, project developers, and impacted states on the procedures that will enable states to integrate offshore wind into their generation portfolios.”

Bottlenecks

Anbaric and other transmission developers have argued that having individual wind farms build separate radial lines to shore will be more expensive, more environmentally intrusive and less resilient than networked open access facilities that multiple wind farms could use. (See Anbaric Pushes Offshore Grid Plans.)

“What we’ve seen is — and this is true in New York and New England too — if you’re going to scale offshore wind up past the first couple thousand megawatts, radials are going to run into a bottleneck,” Theodore Paradise, Anbaric’s senior vice president for transmission strategy, said in an interview. “There’s not enough interconnection points.”

The company said there are no technical reasons for blocking transmission platform projects, citing transmission built to deliver onshore wind from Texas’ Competitive Renewable Energy Zones and California’s Tehachapi Pass.

Anbaric CEO Ed Krapels said he’d like to see PJM adopt the European model of allowing states to offer solicitations for multiple transmission developers to compete for OSW transmission.

“That’s how the Dutch and the Germans are now getting responses from wind generators that don’t even require long-term contracts,” he said in an interview.

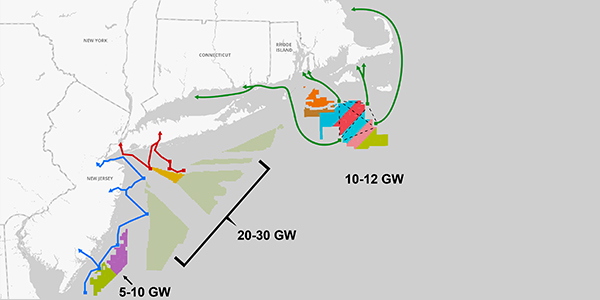

Anbaric — which helped build the 660-MW Neptune HVDC cable linking PJM to Long Island and the 660-MW Hudson project connecting Manhattan to the RTO — envisions a network of transmission “platforms” that could deliver 52 GW or more of offshore wind generation to PJM, NYISO and ISO-NE.

New England’s states are seeking 5,200 MW of OSW by 2035, and New York has ordered 9,000 MW by 2035.

New Jersey has a goal of developing 3,500 MW of OSW by 2030. The state’s Board of Public Utilities in June 2019 selected a 1,100-MW project off the coast of Atlantic City and plans additional solicitations for 1,200 MW in 2020 and 2022. Last week, the BPU held a stakeholder meeting at which officials discussed developing a separate solicitation for offshore transmission.

Maryland has ordered the development of at least 400 MW of offshore wind generation by 2026, at least 800 MW by 2028 and 1,200 MW by 2030.

In Virginia, Dominion Energy plans to develop 2,600 MW of OSW in three 880-MW phases between 2024 and 2026.

Relief Sought

In March 2018, Anbaric submitted interconnection requests for two proposed AC transmission platform projects, each requesting 1,100 MW of injection rights. PJM told the company it would need to partner with a generator to obtain the rights under current rules.

In June 2018, Anbaric submitted an interconnection request for a proposed DC transmission platform project seeking a 1,200-MW injection into Public Service Electric and Gas’ transmission system in North Brunswick, N.J. More than a year later, after completing a feasibility study that assumed the injection, PJM informed Anbaric on Nov. 1 that it would only model the project without injection rights. Anbaric said the project has obtained almost all its required environmental permits.

Anbaric said it was seeking relief like that granted by FERC’s Order 845, which required RTOs to improve the interconnection process and expand the definition of “generating facilities” to include electric storage. (See FERC Order Seeks to Reduce Time, Uncertainty on Interconnections.)

It said the current rules effectively give offshore generation developers a right of first refusal like one that the commission outlawed for incumbent transmission owners in Order 1000.

Anbaric asked FERC to order PJM to revise its Tariff to remove the requirement that all merchant transmission facilities interconnect with another control area and to create a new category of merchant transmission facilities called a “remote generation resource interconnection platform” (ReGRIP).

The company also asked the commission not to order a PJM stakeholder process, saying that could result in delays that would prevent states from issuing solicitations for offshore transmission.

Krapels and Paradise said they are hopeful the commission will respond to the PJM complaint with an order that sets a precedent for other RTOs, saying they have similar concerns in New York and New England.