By Hudson Sangree

Pacific Gas and Electric tried to convince a federal bankruptcy judge on Tuesday to help it escape inverse condemnation — the bane of California’s investor-owned utilities that holds them strictly liable for wildfires ignited by their equipment.

The move may have been a Hail Mary pass, however. PG&E and other IOUs have tried and failed for years to convince judges, lawmakers and state regulators that inverse condemnation isn’t fair because it holds them accountable even if they weren’t negligent.

So far, the IOUs haven’t made much of a dent in the age-old doctrine, which is embedded in the state constitution and applies to regulated monopoly utilities, according to the state appellate courts. The rationale is that because the utilities can exercise eminent domain to seize private property — to create power-line easements, for example — they are liable for damage to private property from their equipment.

The doctrine dates to the mid-1800s when California was trying to rein in the power of the Southern Pacific Railroad.

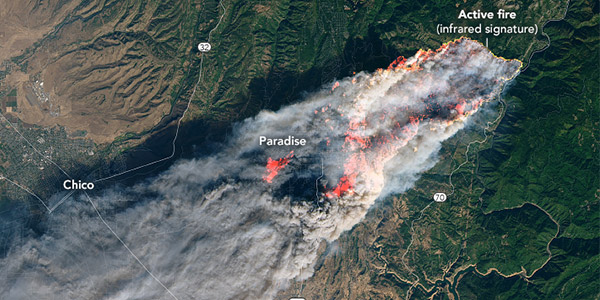

The Camp Fire, ignited by PG&E equipment, killed 85 residents and wiped out the town of Paradise on Nov 8, 2018. | NASA

This time, PG&E decided to try a somewhat different approach with U.S. Bankruptcy Court Judge Dennis Montali, who is overseeing the utility’s immense Chapter 11 reorganization in San Francisco. The company faces billions of dollars in liability for wildfires in 2017 and 2018 started by its equipment, including the Camp Fire, the deadliest and most destructive wildfire in state history.

Despite a number of court rulings to the contrary, PG&E’s attorneys argued Tuesday that inverse condemnation applies only to public entities and that the utility is not a public entity.

The spreading around, or socialization, of the costs of a wildfire works with a municipal utility, such as the Los Angeles Department of Water and Power, because the utility can raise its own rates to cover costs, PG&E lawyer Kevin Orsini told the judge. But PG&E and other IOUs depend on the California Public Utilities Commission to set rates, and regulators will only authorize wildfire-cost recovery if they find an IOU managed its system prudently, Orsini said.

“Inverse was developed and actually works in the context of a true public entity,” the lawyer said.

A senior mobile home community was destroyed by the Camp Fire in Paradise. | © RTO Insider

In their court filings and presentation, attorneys for wildfire victims called PG&E’s effort a blatant attempt at “forum shopping” after repeated failures in other courts and the State Capitol.

“PG&E has spent the past year complaining about the fact that it is subject to inverse condemnation liability under California law and furiously lobbying to change the law,” the victims’ lawyers argued in their brief. “Because its lobbying efforts have not met with success, PG&E now asks this court to do what California’s political branches have been understandably unwilling to do: bail out the utility from having to fully compensate the victims of fires caused by its equipment.”

Montali seemed to dislike PG&E’s suggestion that his judgment should overrule the state courts or the decisions of lawmakers. PG&E tried to convince lawmakers to modify inverse condemnation as recently as this summer without making much headway, he noted. (See Calif. Wildfire Relief Bill Signed After Quick Passage.)

“The California legislature all of three months ago decided not to change the law,” Montali said. “If that isn’t a significant marker, I don’t know what is.”

PG&E also argued that the application of inverse condemnation to IOUs might still be subject to review by the state Supreme Court, and they asked Montali to make findings to pave the way for an appeal.

Montali, however, said he doubted most of the high court justices would substitute their judgment for that of the legislature.

Montali said he would try to quickly issue a written ruling on the matter.