By Michael Brooks

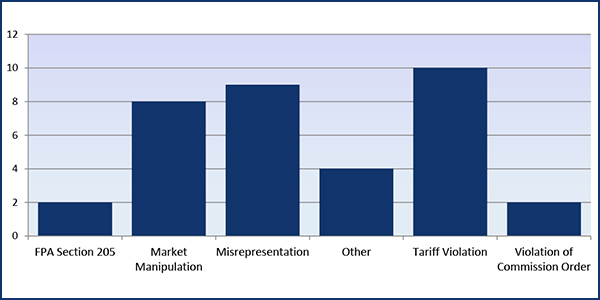

WASHINGTON — FERC’s Office of Enforcement opened 12 new investigations and negotiated two settlement agreements worth $14.4 million in civil penalties and disgorgements in fiscal year 2019, according to its latest annual report released last week.

The number of investigations represented a 50% drop from last year, while the number of settlements was four fewer than FY 2018.

The bulk of penalties and disgorgements this year came in May from Dominion Energy Virginia, which paid $14 million to settle allegations that it had manipulated PJM’s energy market to maximize its receipt of lost opportunity costs (LOCs) between April 2010 and March 2011 (IN19-3).

The RTO pays LOCs to combustion turbine units that clear its day-ahead market but end up not being committed in the real-time market. Enforcement found that Dominion intentionally discounted its incremental energy offers to obtain more day-ahead commitments but increased its start-up values in order to reduce the chance its units would be committed in the real-time market. FERC has dinged multiple PJM members for such a scheme; the RTO tightened its LOC rules in 2015 in order to discourage such behavior. (See PJM Members Committee Briefs: May 2015.)

Enforcement did see a slight increase in self-reports — 149 this year compared to 137 last year — but, as usual, “the vast majority of those self-reports were concluded without further enforcement action because there was no material harm,” it said.

The office’s annual reports always include examples of such self-reports, and it has been steadily adding examples of other activities that did not lead to investigations over the years, saying they “can be helpful to companies seeking to comply with the commission’s regulations and orders.” For example, in 2017, it included cases in which its Division of Analytics and Surveillance contacted market participants about potential violations. (See Investigations up Sharply in FY 2017, FERC Report Shows.)

In this year’s report, the office also included examples of the 16 referrals it received this year from RTO/ISO market monitors. Of those, 11 involved potential market manipulation, seven involved potential tariff violations and four involved misrepresentations prohibited by the commission’s market behavior rules. Three of the monitor referrals were the source of investigations opened this year. Though the report includes summaries of the alleged behavior, it does not reveal the identities of the members flagged by the monitors.

“This report highlights how the commission’s enforcement program has matured, how staff has increased efforts to engage in outreach and provide transparency to industry, and how we’ve improved our ability to detect market anomalies early,” FERC Chair Neil Chatterjee said at the commission’s open meeting Thursday.

In September, Chatterjee announced the commission had shifted several employees out of Enforcement and eliminated its Division of Energy Market Oversight. (See FERC Shuffles Enforcement Staff, Disbands DEMO.)

The move prompted a letter from several U.S. senators that expressed “concern over the apparent erosion of the vital role the Federal Energy Regulatory Commission plays in preventing fraud and manipulation in our nation’s energy and financial markets” (PL10-2-003). The senators — four Democrats and independent Sen. Angus King (Maine) — also noted the commission’s rescission of Notices of Alleged Violations in May. (See FERC Ends Notices of Alleged Violations.)

At the September open meeting, Commissioner Richard Glick said he had no concerns with the division’s elimination, calling it “a simple matter of administrative efficiency.” In his remarks Thursday, Glick said he responded to the senators with three recommendations for legislation to improve the commission’s enforcement work:

- Impose a duty of candor on FERC-jurisdictional financial traders. Glick said the commission had proposed such a requirement in 2015 but dropped it in July when it issued several new rules regarding market-based rate authority data requirements, a move he dissented on. (See “Connected Entity Info Tossed,” FERC Reduces MBRA Data Requirements.)

- Clarify that FERC has the authority to ban recidivist market manipulators. “We see in several cases … that there’s entities and individual traders that engaged in manipulative acts, go to a different employer or form their own trading operation, and go on to continue to do the same thing again,” Glick said.

- Require a vote by the entire commission on whether to terminate an Enforcement proceeding. Currently, the chairman can unilaterally end a probe at their discretion, something Chatterjee did in July in the case of alleged manipulation by Dynegy in MISO’s 2015/16 Planning Resource Auction. (See FERC Clears MISO 2015/16 Auction Results.)