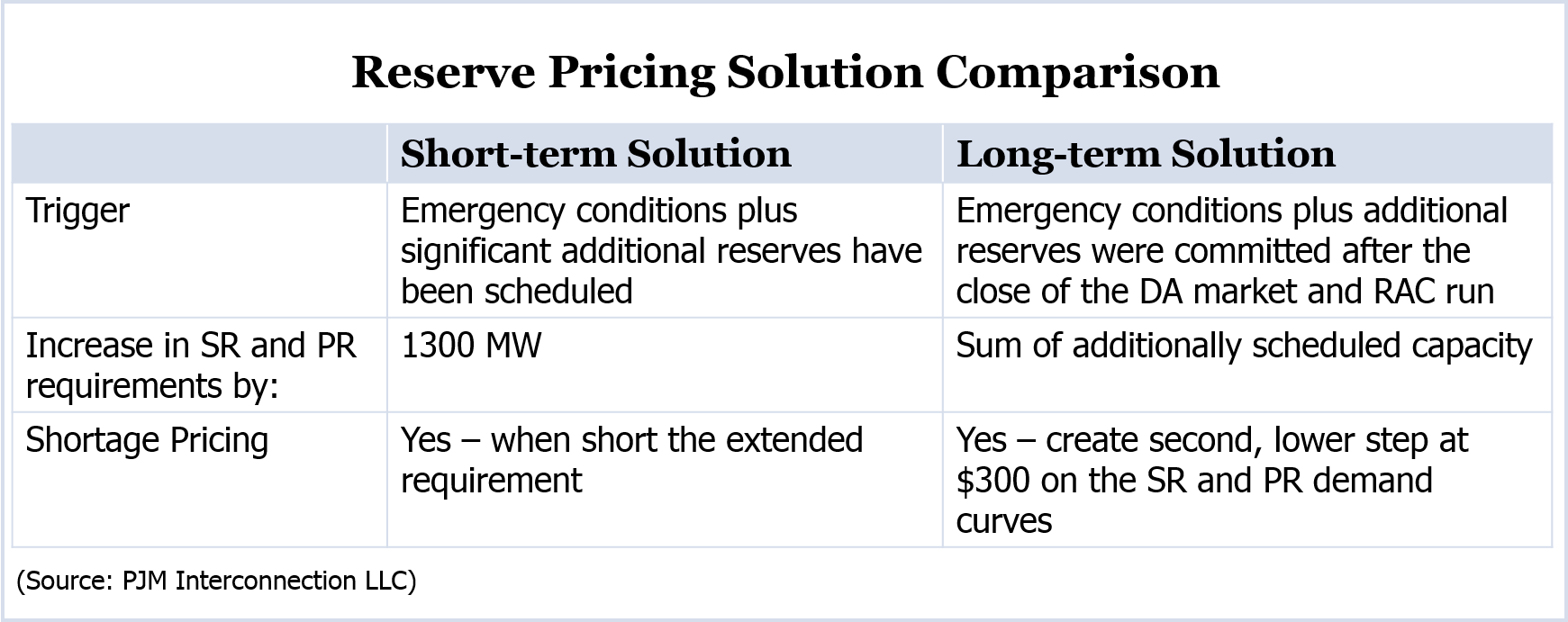

The rules would increase synchronized and primary reserve requirements under emergency conditions (Hot and Cold Weather alerts, Maximum Emergency Generation Alerts) when additional intraday resources are scheduled.

The volume added to reserves would be based on the Eco Max rating of the resources committed as opposed to the static 1,300-MW adder included in the short-term fix, which expired in September. (See PJM Reserve Proposal Gets OK for Trial Run.)

PJM’s proposal won 84% support, and it will be the primary proposal considered by the Markets and Reliability Committee Oct. 30. A proposal from the PJM Industrial Customer Coalition that added a transition mechanism won 61% and will be considered by the MRC if the primary motion fails to win a two-thirds, sector-weighted vote. A proposal from the Independent Market Monitor failed with only 30%.

Separately, 87% of the MIC also approved PJM’s proposal to set limits on interchange during emergency conditions. The limit would be used when operators have made firm resource commitments and anticipated interchange schedules are sufficient to meet projected load for the hour.

Spot imports and hourly non-firm point-to-point transactions submitted after the cap is implemented would be blocked once net interchange reaches the limit. Schedules with firm or network-designated transmission service would not be curtailed.

The change is intended to prevent markets and operations from being whipsawed by large swings in imports.

A competing proposal by the IMM fell short at 23%.

Residential Demand Response

Members approved rules that would allow use of statistical sampling to calculate the performance of residential demand response resources providing synchronized reserves. The sampling would apply to direct load control resources without meters reporting data hourly or in shorter intervals.

The sampling would replace outdated studies such as the Deemed Savings Estimate Report, which is based on data from 2001–2005 from zones in Maryland and New Jersey. Since then, PJM’s footprint has grown to include Kentucky and Chicago, and air conditioners and other appliances have become much more efficient.

Sampling is a way to improve accuracy without the cost of installing one-minute meters on every participating household, PJM said.

If approved by the MRC, the rule would take effect June 1, 2015, with a transition mechanism for resources that cannot meet new requirements for delivery years 2016 through 2018.

Replacement Capacity Transactions

Members approved a problem statement from Citigroup Energy to consider changes to the timing for recording replacement capacity transactions.

Under current rules, Citigroup’s Barry Trayers said, the transactions can’t be submitted to PJM until after the third incremental auction, a rule he called “overkill and overly conservative.”

“I have contracts sitting on the shelf and have a fear about not submitting them at the right time and causing all kinds of havoc,” he said. Trayers explained his concern after the meeting. “If I forget to submit the replacement capacity, I have an obligation to perform which I won’t realize I have because, in my books, I am flat and have no obligations. But in PJM’s eyes I will have separate long and short positions. It is just an accident waiting to happen and can so easily be fixed by just accepting the transactions,” he said.

Trayers said the current rule is intended to ensure the replacement capacity exists. But he said suppliers of replacement capacity must show they have the capacity available before PJM will accept it in an incremental auction.

The change Trayers is seeking is similar to one he successfully pursued earlier this year for auction-specific transactions. (See Stakeholders Look to Expedite Auction-Specific Transactions.)

Trayers said he didn’t seek both changes initially because the first was a “much cleaner argument.”

Subcommittee Rejects Temporary Credit Change for Virtuals

The Credit Subcommittee voted down a proposal to change credit requirements for virtual transactions in January and February 2015, Chief Financial Officer Suzanne Daugherty told the MIC.

Members approved a problem statement last month at the request of Twin Cities Power, which said the change was needed because extreme conditions last winter would otherwise result in much higher reference prices and credit requirements next winter. Credit requirements for increment offers and decrement bids are based on nodal reference prices.

Members approved the problem statement despite opposition from PJM, which said changes could increase members’ exposure to defaults. Problem statements are rarely rejected. (See Members to Consider Changing Credit Rules Despite PJM Opposition.)