By Ted Caddell

Cooler summer weather took a toll on electric-utility earnings in the third quarter. While some companies, such as FirstEnergy, posted increased profits compared to Q3 last year, many noted a drop in operating earnings due to a dip in deliveries to residential, business and commercial customers.

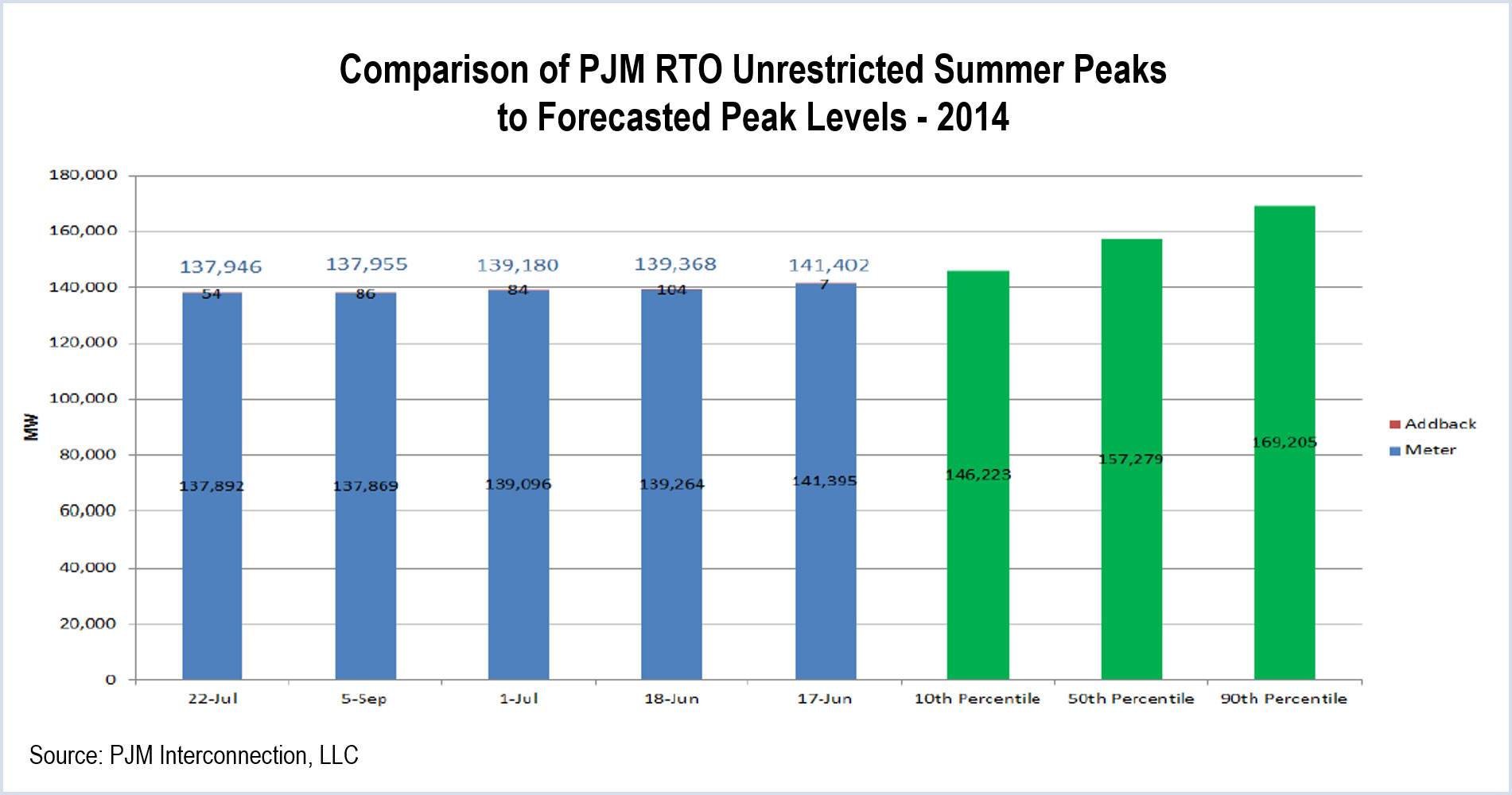

PJM reported last week that Summer 2014 was the mildest in the last 10 years based on the peak day heat index. (See chart.)

FirstEnergy

This time a year ago, the company reported a $254 million charge on a regulatory rider rejected by the Pennsylvania Public Utility Commission. It was also in the midst of reorganizing its business units, having decided to retreat from the competitive retail market to concentrate on generation and regulated businesses such as transmission.

CEO Anthony J. Alexander said the strategy is paying off. “We have continued to build positive momentum in our regulated businesses and limit risk at our competitive operations,” he said in a conference call. He also praised PJM’s Capacity Performance proposal. “This is a positive step and truly recognizing the role of base-load generation with firm fuel, the grid stability and reliability.”

Alexander said that one of its largest generating assets, the 2,400-MW Bruce Mansfield coal plant in Shippingport, Pa., failed to clear the most recent PJM capacity auction. That was one of the reasons the company is holding back on capital improvements to that plant “while we evaluate the strength of competitive markets.”

NRG

“Under these weather circumstances, I think our financial results were as good as could be expected,” CEO David Crane said. “While NRG’s financial performance was constrained in the third quarter by an absence of summer weather events, NRG’s underlying performance across our wholesale and retail operations was quite strong.”

Crane highlighted successes in many areas of NRG’s wide-ranging business model, which includes retail operations, wholesale generation and an increasing amount of renewable energy, especially solar. He said the integration of the assets from its purchases of Edison Mission Energy and Dominion Energy Solutions’ retail operations were on track. He also announced a 440-MW generation contract with Southern California Edison.

The company will continue to build its solar business – especially home solar. “We now believe we have the premier one-stop shop for customers seeking a high-quality solar experience at their homes,” he said. “By the end of this year, we expect to have over 10,000 installations, which is about 70 MW. By the end of 2015, we expect to grow that amount by three times, with an objective of a total of 35,000 to 40,000 installations, or roughly 280 MW.”

Duke

Earnings from its regulated utilities, which make up about 90% of its business, were nearly unchanged from a year ago despite a slight increase in the number of customers throughout its territories. “These results were impacted by milder than normal weather,” CEO Lynn Good said.

She said the company continues to invest in gas-fired generation, pointing to a proposed 1,640-MW plant in Citrus County, Fla., and uprates of 220 MW at an existing plant in Hines County, Fla. The company is eyeing the purchase of a Calpine facility in Florida and plans to add 320 MW to its Suwanee plant.

A major cost is on the horizon, however. Duke also announced last week that it estimates the cost of complying with North Carolina’s coal-ash law would be as much as $3.4 billion. Hundreds of tons of coal ash spilled from a Duke site on the Dan River in February, spurring a legislative effort to force the company to clean up all of its 32 coal-ash basins.

PSEG

“PSEG performed well in the third quarter despite the impact on demand for electricity due to less favorable weather conditions,” CEO Ralph Izzo said. “Lower operating costs helped to offset the impact of mild weather on energy pricing and earnings. We’re in the midst of major change in the electricity market. An unprecedented amount of capacity is expected to retire over the next two years in response to environmental requirements and market economics.”

PSEG’s generation arm’s numbers drooped slightly, reporting earnings of $171 million, or 34 cents a share. Last year, it earned $221 million, or 43 cents a share. Power earned less this quarter, in part because of lower PJM capacity prices, “as well as lower market prices for energy,” said Caroline Dorsa, PSEG’s chief financial officer. PJM capacity prices dropped to an average level of $166/MW-day on June 1, 2014, from $242/MW-day in the prior capacity year.

But Izzo said its generating fleet is well positioned to earn in the changing market. “Power is well situated,” he said. “Its fleet of base-load intermediate and peaking generating assets benefits from access to low-cost gas in the summer and from price volatility in the winter.”

Izzo also announced plans for a 450-MW combined-cycle plant in the New England market, at its Bridgeport Harbor site, a $600 million investment. “The potential investment in Bridgeport Harbor would represent the latest of several opportunities for PSEG,” he said.

Calpine

“Calpine delivered another strong quarter both operationally and commercially, especially considering the mild summer weather in much of the country,” said Thad Hill, Calpine’s President and Chief Executive Officer. “Our hedging activity protected us from a very mild summer,” he said. Hill noted that Calpine continues to build business and gain customers in Texas and California, and sell its power from its Osprey plant in Florida to Duke Energy.

He said Calpine expects to close on the purchase of the Fore River plant in Weymouth, Mass., from Exelon any day, and is expanding its combined-cycle plant near Delta, Pa. Those two facilities illustrate Calpine’s reach in both the PJM and the New England markets.

“We believe that PJM and New England offer upside to strong operators willing to stand behind their operational performance, and that the new capacity and market structures under discussion will prove beneficial,” Hill said. “Unlike many of our peers who have pushed back against some of the proposed changes, we’re willing to take the downside risk when you can’t perform with the possibility of higher compensation if you can.”

AES

AES reported earnings of $488 million, or 67 cents a share, compared to $175 million, or 23 cents, last year. Overall revenue rose to $4.44 billion from $4 billion last year. About $382 million was from asset sales, including $161 million for four wind projects in the United Kingdom and $125 million for its stake in a Turkish hydro and natural gas-fired generation joint venture. (Since 2011, AES has sold $2.4 billion worth of assets in nine countries.)

Adjusted for these and other transactions, earnings were 37 cents a share. Operating earnings were down 5.1% to 39 cents a share, primarily for “persistent drought” in Latin America, where CEO Andres Ricardo Gluski Weilert said conditions are the driest in 50 years. AES has many hydro-electric assets in Panama and Brazil. “Poor hydrology in Latin America has had a substantial impact on our earnings over the past two years,” he said.

In its U.S. operations, Weilert highlighted its plans to build 1,284 MW of gas-fired combined-cycle generation in California, and the recent awarding of a contract for 100 MW of battery-based energy storage, said to be the largest such energy storage contract in the U.S.

He also said the company is investing $332 million to convert its Harding Street plant in Indiana from coal to natural gas, and that it expected future contributions to earnings from DPL due to the ruling from the Public Utility Commission of Ohio allowing the utility to collect so-called “non-bypassable charges” on customer bills relating to transmission cost even if they have a third-party supplier. The charges were effective beginning in 2014.