By Chris O’Malley

Depressed coal stockpiles have led to increases in MISO’s off-peak power prices and the cost impacts could increase with a repeat of last winter’s severe cold, officials said last week.

Coal generators in MISO, SPP and ERCOT have complained of difficulty obtaining coal for more than a year due to insufficient railroad capacity.

MISO clearing prices for fall were up 9% compared to fall 2013, with off-peak prices up 16%, due to increased coal-delivery costs and reduced output by generators seeking to conserve fuel due to low supplies, Todd Ramey, MISO vice present of system operations and market services, told the Federal Energy Regulatory Commission during a presentation at the commission’s open meeting Thursday.

MISO’s Market Monitor estimates that more than one-third of coal generation in MISO has implemented some form of coal conservation measures over the last six months, Ramey said.

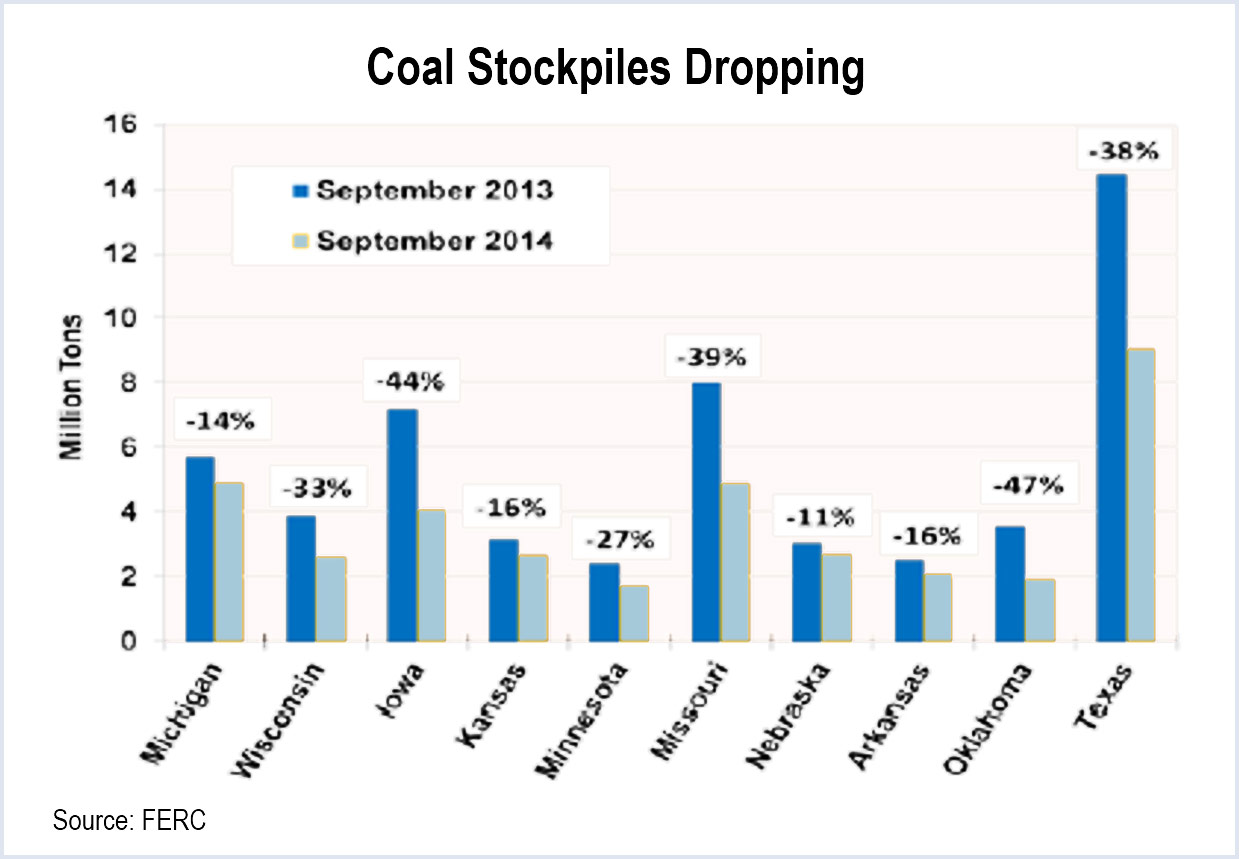

Alan Haymes, of FERC’s Division of Energy Market Oversight, said coal stockpiles in the Midwest have declined since last year and are below five-year averages, although a mild summer helped mitigate the deficiency going into this winter.

“If the coming winter presents challenges similar to last year’s experience, the coal inventory problems could result in significant market impacts,” he said.

“It is likely the below-level stockpiles will persist through 2015 as railroads struggle to keep up with overall demand before system upgrades are complete. This is raising concerns among some generators that low stockpiles coming out of the winter could create challenges in the summer of 2015,” Haymes said.

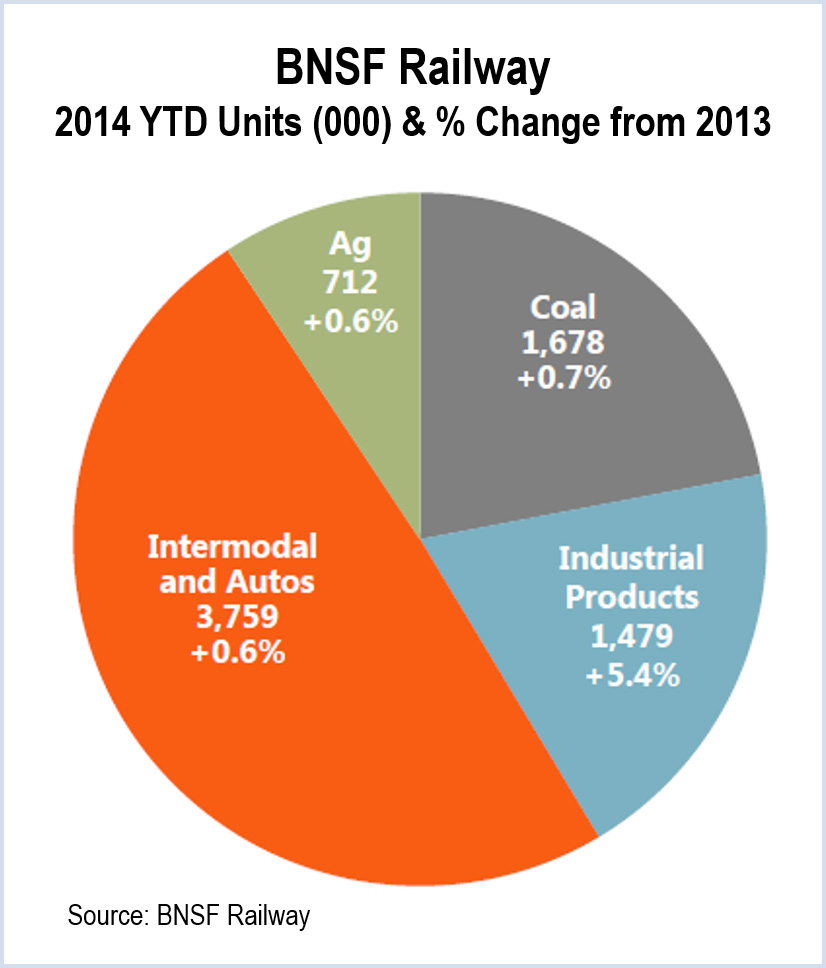

Haymes said 166 power plants that burn coal from Power River Basin Mines in Montana and Wyoming have been struggling to maintain supplies because of insufficient capacity on BNSF Railway.

The railway has been pinched by an increase in shipments of grain and other cargo as the economy has improved. In addition, rail traffic to and from the Bakken oil fields of North Dakota have more than doubled since 2009, BSNF says.

Congestion in the east-west rail gateway in Chicago also has been a problem, said Michael Higgins, deputy director of the Surface Transportation Board.

The railroad, which serves 28 states and three Canadian provinces attributed some of the constraints to construction on its northern routes that increased congestion in the central part of its system. It says it expects to be rebuilding its customers’ coal stockpiles through 2016.

“We clearly understand that our service has not met customer expectations,” said Steve Bobb, an executive vice president of BNSF.

Commissioner Tony Clark asked BNSF whether and how the railroad determines which commodity receives priority during periods of tight constraint. Bobb replied that the railroad focuses on customers who report they have 20 days or less of inventory.

The commission also heard from Minnesota Power, which said that it experienced “severe” disruptions at its coal-fired plants last winter and at one point was down to a four-day supply of coal. Some units had to suspend operations; the utility purchased $27 million of higher-priced replacement power.

“The good news is that organized markets like MISO work and work well. We’ve had no electric service disruptions,” said David McMillan, senior vice president of external affairs at Minnesota Power parent Allete. “The bad news is that purchased energy prices were significantly higher than our own self-generation costs.”