By Chris O’Malley

The Federal Energy Regulatory Commission last week ordered a paper hearing to revisit its decision to prohibit MISO from assessing export charges to PJM for multi-value projects that benefit PJM customers.

FERC’s Jan. 22 order (ER10-1791) is in response to a 2013 remand by the U.S. Seventh Circuit Court of Appeals ordering the commission to determine whether its limitations on export pricing to PJM are still justified.

The commission will accept comments for 45 days, with reply comments due 30 days afterward. The commission urged parties to provide studies or other evidence in support of their positions.

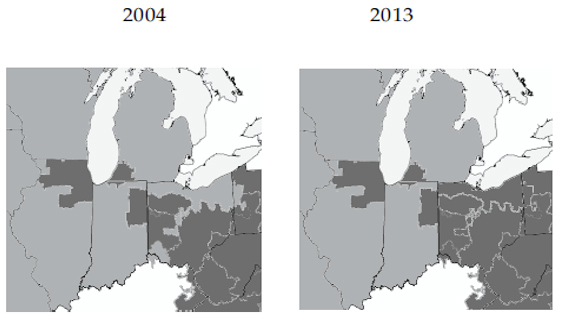

The issue stems from the commission’s July 2002 order allowing American Electric Power, Commonwealth Edison and Dayton Power and Light to join PJM. That left small islands of PJM within MISO territory near Chicago and in southwestern Michigan, dividing highly interconnected transmission systems.

In subsequent rulings, FERC ordered MISO to eliminate rate “pancaking” that it said would otherwise result from the irregular seam, including a prohibition on charging PJM load for multi-value projects.

Less Disjointed Seam

In June 2013, the Seventh Circuit ordered FERC to reconsider whether its prohibitions on charging PJM for multi-value projects was still reasonable in light of membership changes that straightened out the border.

The court also cited the nature of multi-value projects, noting that they are not local in scope and will benefit other regions.

“Since they will benefit electricity users in PJM, those users should contribute to the costs,” the court said.

It added that FERC was being “arbitrary” in continuing to forbid MISO from charging anything for exports of energy to PJM enabled by multi-value projects “while permitting it to charge for exports of energy to all the other RTOs.”

“The commission must determine in light of current conditions what, if any, limitation on export pricing to PJM by MISO is justified.”

PJM TOs Seek Clarity

Impatient at FERC’s inaction since the court’s remand, PJM transmission owners petitioned the commission last May to set the issue for a paper hearing.

Whatever FERC ultimately decides regarding allocation costs of MISO multi-value projects, the TOs said, “there is no disputing the importance of a timely resolution in this matter. At issue are the costs of billions of dollars of projects, some of which are already underway, with others expected to follow.”

“Until this matter is resolved, interested parties will be left with great uncertainty regarding their burdens with respect to the MVP costs.”