VALLEY FORGE, Pa. — PJM will delay action on manual changes on generator notification and start-up times until the Federal Energy Regulatory Commission rules on the RTO’s Capacity Performance proposal (ER15-623, EL15-29).

The issue stems from a four-year-old problem statement drafted to address reliability and market implications of de-staffing little-used generator units during the spring and fall shoulder months. At the time, some manual changes were endorsed, but others were overlooked, and the issue was mistakenly closed.

Chantal Hendrzak, PJM general manager of applied solutions, told the Market Implementation Committee on Wednesday that many stakeholders had provided feedback since the issue was resurrected in February. (See Members Dispute PJM, IMM on Unfinished Changes to Notification, Start-Up Times.)

Some wanted to re-open the issue because they had not been involved in the original talks; others questioned whether years-old solutions were still appropriate.

“A lot’s changed … and we’ve got this thing called [Capacity Performance] coming that talks specifically to this,” she said. “Let’s get that feedback first and then decide how best to handle the remaining scope.”

PJM asked FERC to rule on the Capacity Performance proposal by April 1.

CTS on Track Despite PJM-MISO Interface Pricing Dispute

The dispute between MISO and PJM over interface pricing is not expected to derail the Coordinated Transaction Scheduling product intended to reduce uneconomic power flows between the RTOs, PJM officials told the MIC. In presenting the interregional coordination update, Stan Williams told the committee that MISO believes its Independent Market Monitor’s pricing proposal is superior to PJM’s. (See Patton Asks FERC to Set Deadline on PJM-MISO Interface Pricing Dispute.)

Meanwhile, PJM believes that proposal “will misrepresent the impact of interchange on internal PJM constraints,” he said. PJM staff also believes the impact of the modeling issue has been “significantly overstated,” Williams said.

Regardless, the RTOs plan a joint FERC filing outlining the CTS proposal in May, with hopes of launching it by November 2016.

PJM Drafting Proposal on External Capacity Transfer Rights

PJM staff will draft a detailed proposal for allocating capacity transfer rights to historical external resources and present it to stakeholders in April, MIC members were told Wednesday.

In December, PJM stakeholders agreed to review modeling practices that the RTO said might be shortchanging loads with transmission agreements that pre-date the RTO’s capacity market. (See PJM MIC OKs Capacity Transfer Rights Inquiry.)

The issue involves only a few players, said Stu Bresler, vice president of market operations, who presented the MIC with a “conceptual” proposal. Among them is the Illinois Municipal Electric Agency, which uses capacity resources outside of the Commonwealth Edison locational deliverability area to meet its internal resource requirements.

CO2 Emission Rates Steady

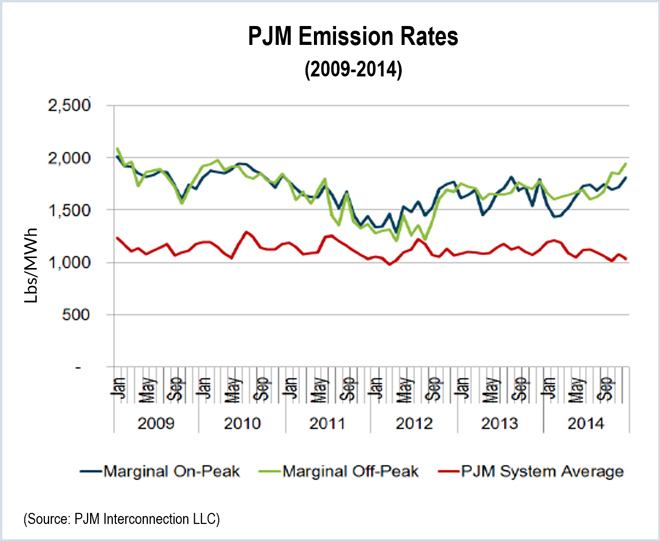

Between 2009 and 2014, PJM’s system average emissions dropped 3% to 1,108 lb/MWh. Marginal on-peak units saw a bigger, 10% drop to 1,646 lb/MWh while off-peak dropped 7% to 1,707 lb/MWh.

The Environmental Protection Agency’s proposed Clean Power Plan would require an overall 30% reduction in power plant carbon dioxide emissions from 2005 levels by 2030.

The burdens will fall unevenly on PJM states, with Kentucky, West Virginia and Indiana — the top-ranked PJM states in 2012 carbon emissions per megawatt-hour — having to cut their emissions by only 20%, while New Jersey, already the least carbon-intensive state in the RTO, having to cut its emissions the most in percentage terms (43%).

PJM’s 2014 system-wide average puts it well above EPA’s proposed targets for New Jersey and four other states but below the targets for eight states. (See Carbon Rule Falls Unevenly on PJM States.)

PJM Releases More Details on Carbon Plan Impact Study

PJM this month released more details on its scenario analyses of the Clean Power Plan with a 129-page study of the economic impacts of adhering to the new carbon rule. The RTO released preliminary results of the study, which was requested by the Organization of PJM States (OPSI), in November.

The study concludes that individual state compliance would be more costly than a regional approach and would increase the capacity at risk for retirement. PJM expanded on the key findings with an appendix providing state-by-state impact.

PJM will use the results of the economic analysis as the foundation for reliability analyses to determine transmission needs resulting from potential generator retirements. (See related item in PJM TEAC Briefs.)

(Prior coverage PJM: EE, Renewables Could Save Some Coal Plants under Carbon Rule.)

— Suzanne Herel