The PJM request to delay May’s Base Residual Auction has drawn more than two dozen comments — mostly from supportive stakeholders.

By Suzanne Herel

PJM’s request to delay May’s Base Residual Auction has drawn more than two dozen comments — mostly from supportive stakeholders, but also from critics who say a postponement would create more market uncertainty than it is seeking to quell.

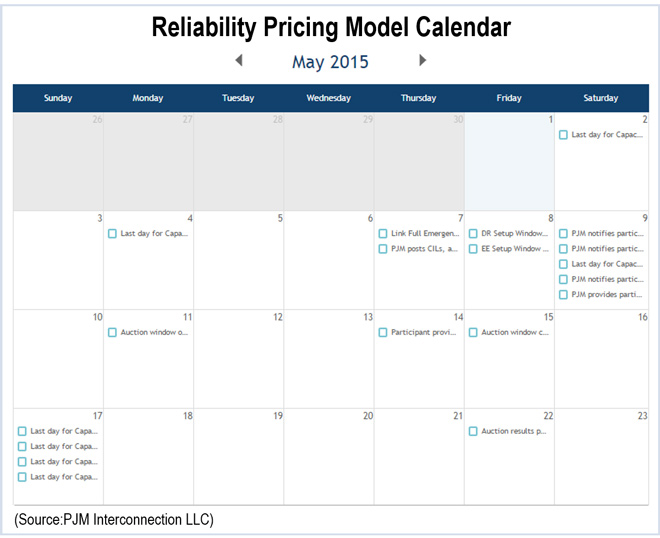

(Click to zoom.)

The RTO asked the Federal Energy Regulatory Commission for a Tariff waiver allowing the delay on April 7 (ER15-1470) after responding to FERC’s deficiency ruling over its proposed Capacity Performance plan (ER15-623). (See PJM Responds to FERC Queries on Capacity Performance, Requests Approval.)

Among those opposing the delay are American Municipal Power, Old Dominion Electric Cooperative and Southern Maryland Electric Cooperative. “The commission should not allow PJM to create destabilizing market uncertainty by holding the BRA hostage until it secures a Capacity Performance ruling to its liking,” they said in a joint filing.

“Indeed, PJM’s transparent attempt to blame the commission for the uncertainty — by requiring that PJM provide additional support for its deficient Capacity Performance proposal — only underscores that it is PJM, through the filing of its waiver request, that has created the very uncertainty it now asks the commission to cure.”

Supporters, however, not only urged FERC to grant the waiver, but to approve the Capacity Performance proposal in time for a delayed BRA. The proposal would increase capacity payments for over-performing participants and penalties for non-performers.

AES, Calpine, Dynegy, Exelon, FirstEnergy, PPL, Public Service Enterprise Group, Topaz Power Management, AEP Generation Resources, East Kentucky Power Cooperative and NRG Energy filed a joint statement saying that holding the auction under the current Tariff “will expose our customers and the PJM market to unacceptable reliability risks.”

“Additionally, further delay in approving these reforms creates significant market uncertainty given the myriad business decisions that depend on clear market rules and price signals,” they said. “State default procurements, retail contracts and capital investment decisions all hinge on knowing both when to expect commission resolution and what the commission has decided.”

Transitional Incremental Auction

Rockland Capital and others opposing the delay suggested that if FERC approves a version of the Capacity Performance plan, it should allow PJM to hold a transitional Incremental Auction for the 2018/19 delivery year.

PJM filed a response opposing that proposal.

“At bottom, protestors ignore the essential ‘phase-in’ nature of the transition auctions and are in reality simply seeking to put off Capacity Performance reforms for at least another year. That patently does not achieve the purposes of PJM’s requested waiver of preserving a genuine opportunity to implement Capacity Performance for the 2015 BRA and therefore should not be deemed an acceptable alternative to the waiver,” PJM said.

In its protest to the waiver, Panda Power Funds said it would create “significant uncertainty not only as to the timing of the BRA, but also as to the capacity products to be offered in the BRA, the costs of participating in the BRA and other rules related to the BRA. Postponement of the BRA also threatens to delay the completion of needed new capacity and thus prevent PJM from meeting its own reliability objectives.”

Others opposing the waiver request include several environmental organizations, the Advanced Energy Management Alliance, energy trading companies, state regulators in Maryland and New Jersey and some consumer advocates. Utilities largely supported PJM’s request.

“By granting PJM’s waiver request, the commission mitigates market uncertainty by allowing market participants to know what the performance requirements are in order to value risk accordingly,” said the Public Utilities Commission of Ohio.

Shell Energy took the opportunity to urge FERC against a “hasty roll-out” of PJM’s plan, while noting it does not oppose “these much-needed reforms.”

“In addition to the direct effects of the Capacity Performance proposal, the commission must provide a fair opportunity for market participants to assimilate the indirect effects of the proposal as approved on bilateral transactions, such as off-take agreements or agreements involving long-term hedges of retail electric supply,” it said.

Shell requested a technical conference in which PJM and the Independent Market Monitor would make presentations on the details of the program and answer questions on the record.

In its filing, PJM said that if FERC does not respond by April 24, it will consider the waiver withdrawn and proceed with the May 11 BRA as scheduled.