By Chris O’Malley

MISO stakeholders will complete voting on June 16 on three options for responding to the Federal Energy Regulatory Commission’s final rule on coordinating gas and electric schedules (RM14-2, Order 809). MISO could post ballot results as early as June 19 and announce a decision by June 30 for discussion at the July 7 Market Subcommittee meeting.

Order 809 moved the timely nomination cycle deadline for scheduling gas transportation from 11:30 a.m. to 1 p.m. CT (from 12:30 p.m. to 2 p.m. ET). It also added a third intraday nomination cycle.

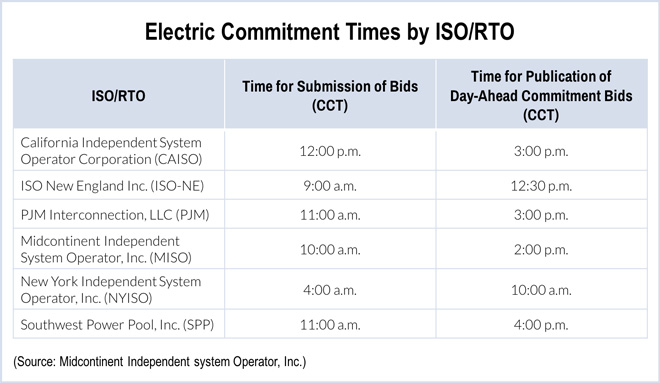

MISO and other RTOs are required to make compliance filings by July 23 that move the clearing and posting of the day-ahead market’s results to before the timely nomination deadline — or explain why it is not appropriate within their footprint. During a joint meeting last week of the Market Subcommittee and of the Reliability Subcommittee, Jeff Moore of Ameren asked MISO officials to what degree stakeholder votes will influence MISO’s final decision. “Is MISO going to consider themselves bound by the stakeholder vote? Are there other considerations?”

Kevin Vannoy of MISO said stakeholder votes “are very important to us” but noted a number of considerations are in play, including alignment with other RTOs and scheduling, staffing and market administration issues.

Moore said his takeaway from a natural gas availability study presented earlier in the week led him to believe natural gas supplies appear to be adequate in MISO in the years ahead and asked whether that would affect MISO’s decision regarding the three options presented for the day-ahead market.

“That’s something we’ll discuss as part of our final decision,” Vannoy said.

The three alternatives are:

- No changes. The day-ahead market closes at 11 a.m. ET, with next-day forward reliability commitment assessment (FRAC) results posted by 8 p.m. ET.

- Align the day-ahead market with the timely gas nomination cycle by closing the day-ahead two hours earlier during daylight saving time (one hour earlier during standard time) and reducing clearing windows by one hour.

- Align the FRAC with the evening gas nomination cycle by closing the day-ahead one hour early during daylight saving time and reducing the clearing window by one hour.

The status-quo alternative would require MISO to make a convincing filing with the commission, Joe Gardner, vice president of forward markets and operations services at MISO, told the Electric and Natural Gas Coordination Task Force on June 10.

Gardner said MISO estimates that alternative No. 2 could make available over one year an average of 7,500 MW more generation, while No. 3 could free up about 5,000 MW more than under the current system.

“Units that previously were not able to be considered because they [had] an hour or two longer start-up notification time than other units are able to be considered” in alternatives 2 and 3, he said.

“This allows basically just a few more units to be available for reliability purposes as part of the normal process,” Gardner added. “There is a reliability and an economic benefit.”

Other RTOs

ISO-NE reported last year that system operations had improved following changes it implemented in 2013 to move the day-ahead market and initial reserve adequacy analysis (RAA) timelines earlier in the day. It said the number of units committed in the day-ahead or RAA that were completely unavailable in real time due to gas procurement issues dropped from seven in the winter of 2012/13 to zero in the winter of 2013/14. Over the same period the number of generators with long start-up times dispatched before the day-ahead offer and bid deadline dropped from 12 to zero.

PJM, which currently posts its day-ahead results at 4 p.m. ET, is considering ways to post its results by 1 p.m., an hour before the first gas nomination deadline at 2 p.m. (See PJM Markets and Reliability Committee Briefs, “Members OK Gas-Electric Initiative.”)

Importance of Stakeholder Votes

During Friday’s MSC/RSC meeting, Lin Franks, senior strategist at Indianapolis Power & Light, said stakeholder votes are important for MISO to have a better understanding of generation owners’ concerns. That came after one stakeholder expressed reservations about MISO releasing to the public comments stakeholders made with their votes. (MISO agreed to withhold release of those comments upon a stakeholder’s request.)

“Fuel assurance is not MISO’s responsibility and that’s at the crux of this issue — managing the risks of natural gas. MISO did an amazing amount of work to formulate options for stakeholders to consider that appear to mitigate most of the concerns and risks we expressed with MISO collectively and individually,” Franks said.

MISO estimates that natural gas-fired generation could rise to 50% of its generation pool in 2016/2017 as coal-fired plants are shuttered in response to the Environmental Protection Agency’s Mercury and Air Toxics Standards. EPA’s proposed Clean Power Plan is expected to increase natural gas use further.