By Rich Heidorn Jr.

MILWAUKEE — MISO will reevaluate the metrics used in evaluating market efficiency transmission projects because of concerns they are unduly conservative and preventing viable solutions to congestion, officials said last week.

MISO requires economic projects to clear a 1.25-1 benefit-cost ratio, based on an assumed 20-year lifespan rather than the actual life of 40 years or longer. In addition, projects are discounted based on transmission owners’ cost of capital (currently about 8%) rather than a “societal” discount rate of about 3%.

“So essentially we have three layers of conservatism,” Clair Moeller, executive vice president of transmission and technology, told the Board of Director’s System Planning Committee meeting.

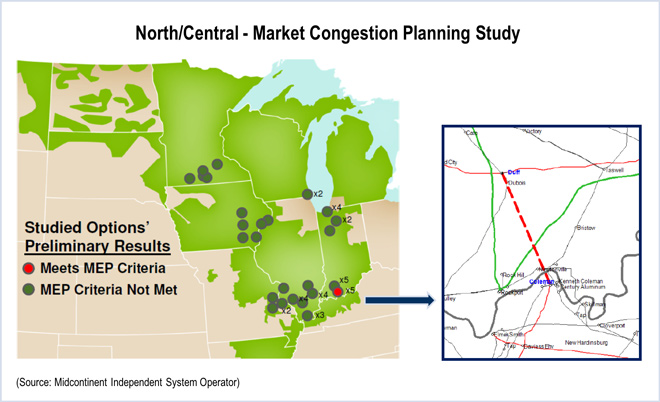

The issue came up during a briefing on MISO’s North/Central market congestion planning study, which analyzed 48 proposed projects, only one of which — the Duff-Coleman 345-kV project to reduce congestion in southern Indiana — cleared the 1.25 threshold.

“It appears to me there’s clearly congestion in three or four key zones,” said Director Thomas Rainwater, noting the number of rejected projects clustered together on MISO’s North/Central map. “Something looks to be broken when one out of 48 projects gets approved. It just strikes me by looking at it visually: Is the criteria right?”

Cost Concerns

Moeller said the difficult hurdle was the result of stakeholders’ cost concerns. “When we first had the notion of cost allocation, the constituency was very interested in us being very conservative. So there are several things inside the business case parameters that we’re required to follow inside the Tariff that causes … the economics of the projects to be fairly modest.”

Moeller said it was time “to take a look at those business case parameters and see what the appetite is for relaxing some of those now that we’ve had a better track record and a better understanding of how to model these things.”

“We will be doing the reevaluation because it’s a good idea,” he added. “Whether we end up changing the business case is an open question.”

In an interview after the meeting, Moeller said the review of the metrics will likely begin this fall at the stakeholders’ Planning Advisory Committee.

General Counsel Steve Kozey noted that states could authorize any transmission that would reduce their constituents’ costs “as long as it doesn’t hurt” MISO reliability. The question is whether load wants to pay for the upgrades, he said.

The fact that congestion remains on the system “doesn’t mean that there are a lot of super obvious projects,” he said.

Committee Chairman Michael Evans — who was surprised at the end of the meeting with a carrot cake to celebrate his 70th birthday — asked staff to provide a list of projects that would clear the threshold using a more realistic 40-year lifespan.

Competitive Solicitations Coming

The Duff-Coleman project, which has a benefit-cost ratio of 3.6 to 12.9 depending on assumptions used, is expected to be one of the first tests of the competitive solicitation process for nonincumbent transmission developers under the Federal Energy Regulatory Commission’s Order 1000.

John Lawhorn, director of regional and economic studies, told the board there is also a “50-50” chance that staff will recommend opening a competitive window under Order 1000 for a project in MISO South. He did not identify the project.

Board Chairman Judy Walsh said she feared MISO’s role in evaluating competing proposals was a “slippery slope.”

Rainwater and Evans also expressed misgivings. “We have a common concern about wading into this river,” Evans said.

Moeller said MISO has had difficulty attracting top-tier engineering firms to conduct evaluations because they prefer to pursue more lucrative work with the developers themselves.

Joint Study with ERCOT

Moeller also said MISO and ERCOT expect to begin a joint study in about six months to evaluate the potential for HVDC facilities to address seams issues in the Houston area.