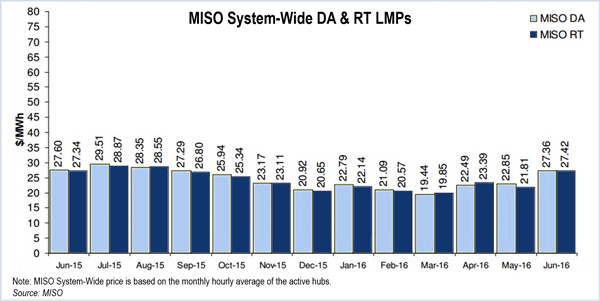

CARMEL, Ind. — Increased natural gas prices and congestion in MISO South boosted energy prices 23% in June, according to the RTO. Day-ahead energy prices in June averaged $27.36/MWh; the real-time average price followed closely at $27.42/MWh.

MISO also reported that above normal temperatures in June drove the average load to 83.1 GW, a 3.5% increase in a year-over-year comparison. Load peaked at 112.5 GW on June 20.

“We did see above normal temperatures generally throughout the region, throughout most of the month, and we did issue several hot weather alerts in different parts of the footprint on various days,” Vice President of System Operations Todd Ramey said during a July 26 Informational Forum.

Ramey also said MISO tested its new emergency pricing structure on July 21 during a three-hour maximum generation event. Ramey said a Detroit-area thunderstorm and market participants self-deploying emergency resources upon the event declaration reduced peak load by “a couple thousand megawatts,” which resulted in “plenty of supply cushion as [MISO] moved across the peak that day.” MISO’s peak on the day was 121,000 MW, below the forecasted 126,000 MW.

A review by MISO’s pricing team of the emergency event uncovered a software logic error that required a fix from the vendor, Ramey said. MISO will review the event and post recalculated real-time prices for July 21 before the Aug. 2 Market Subcommittee meeting, at which RTO officials will explain the issue and the correction, he said. The RTO rolled out the new emergency pricing structure on July 1. (See “MISO to Set Two Emergency Pricing Offer Floors,” MISO Market Subcommittee Briefs.)

Ramey also said MISO plans to present its response to the eight new recommendations in the Independent Market Monitor’s State of the Market report at the September meeting of the Markets Committee of the Board of Directors. (See Monitor’s State of the Market Report Seeks Changes to MISO ELMP.) In the meantime, he said, the RTO is working with Monitor David Patton “to make sure we understand all of the new recommendations.”

MISO Asks Members to Consider Bylaw Changes

MISO is considering reducing or eliminating the service prohibition on members of its Board of Directors in revisions to its Transmission Owners Agreement and Bylaws.

Deputy General Counsel Eric Stephens said the RTO is considering “less onerous” restrictions on the directors, who currently have two-year pre- and post-service prohibitions from utility and wholesale energy market participants. Stephens said the rule could be eliminated or reduced to either one-year pre- and post-service prohibitions or a one-year pre-service prohibition and no post-service prohibition.

Easing the restrictions would improve director recruiting and be more consistent with other RTOs, Stephens said. Seats currently occupied by Chair Judy Walsh and members J. Michael Evans and Paul Feldman are up for election this year.

Other bylaw revisions could mean that MISO would no longer be required to hold its annual meeting on the second Thursday of December. The RTO also is considering holding board elections — currently held at the annual meeting — earlier to ensure consistency with the new board meeting schedule. The slate would be announced in September, with results announced as early as the Oct. 25 Informational Forum.

Another revision would clarify that a majority of the directors constitutes a quorum for calling a meeting or tallying a vote.

Stephens said MISO also is seeking to change the invoicing of the $1,000 annual membership fee from the current Jan. 1 to dates tied to the time of year each member joined.

The bylaw changes were suggested by MISO’s Corporate Governance and Strategic Planning Committee. Stephens said none of the revisions would impact transmission owner rights or obligations.

MISO is seeking stakeholder feedback on the proposed changes by Aug. 15. If stakeholders are in accord, the RTO could file revisions by the fourth quarter.

EPA Official Makes Case for CPP

Janet McCabe, EPA’s acting assistant administrator for the Office of Air and Radiation, made a case for the Clean Power Plan, saying MISO’s comments to the agency were “incredibly constructive.”

She also expressed confidence that the rule will survive legal challenges. Oral arguments on the challenge are scheduled before the D.C. Circuit Court of Appeals for Sept. 27.

EPA is accepting comments until Sept. 2 on its Clean Energy Incentive Program (CEIP), an optional early-action program that would help states meet their CPP emission targets through incentives for investment in demand-side energy efficiency and solar power generation in low-income communities. The program also encourages early investment in non-emitting wind, solar, geothermal and hydropower generation.

MISO Executive Director of External Affairs Kari Bennett said MISO and PJM plan to conduct a joint impact study on the CPP during the second half of this year. MISO stakeholders have asked for a similar study with SPP.

ARPA-E Program Director: Research Collaboration Discussion to Take Place at Symposium

Tim Heidel, program director of the Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E), previewed MISO’s Aug. 18-19 Market Symposium, which will focus on technology partnerships among researchers, startups and RTO stakeholders. Heidel will be a panelist at the session in Indianapolis. (See Energy Department’s ARPA-E to Join MISO for First-Ever Market Symposium.)

— Amanda Durish Cook