By Robert Mullin

Southern California’s winter grid operations are unlikely to be compromised by natural gas pipeline restrictions stemming from the shutdown of Aliso Canyon, even in the event of a once-in-a-decade cold snap, according to an interagency assessment released Monday.

Still, tight gas supplies could leave the region vulnerable to load shedding during a significant grid contingency — such as the loss of transmission import capability or unexpected outages at outside generators serving the region, the report says.

The Southern California Gas (SoCalGas) storage facility north of Los Angeles was closed after a leak released massive amounts of methane between October and February, prompting the company to impose daily balancing requirements on its customers in order to ensure reliable gas delivery to gas-fired generators during the summer’s peak season for electricity demand. (See CAISO Seeks Rapid Response to SoCal Gas Restrictions.)

The report was produced by technical staff from CAISO, the California Public Utilities Commission, the California Energy Commission (CEC), Los Angeles Department of Water and Power (LADWP) and SoCalGas — the owner and operator of the region’s pipeline system.

Cold Day Design Standard

The region’s one-in-10-year “cold day design standard” would require SoCalGas to send out 5.2 Bcfd on its system, the report shows. However, without the ability to withdraw from Aliso Canyon, the company is limited to a maximum sendout capacity of 4.7 Bcfd, assuming there are no other storage or pipeline outages and a full utilization of receipt point and storage withdrawals.

Gas supplied to electric generation could be curtailed if the region’s total demand exceeds 4.5 Bcfd under a scenario in which generators utilize 100% of their gas receipts or 4.2 Bcfd under 85% utilization, the report said, indicating the importance for generators to tightly balance their schedules with their gas burns.

Nevertheless, the region’s electricity grid is expected to operate reliably “so long as the total SoCalGas supportable gas delivery and supply is greater than 4.1 Bcfd under normal pre-contingency conditions and 4.2 Bcfd to support N-1 contingency conditions” — such as the loss of a key generating unit or transmission line serving a load pocket.

While the report finds that the area affected by the gas restrictions should have sufficient transmission and electricity supply from outside resources during winter, it acknowledges that neighboring balancing areas may have to provide emergency assistance “depending on the magnitude and timing of gas curtailments.”

The report offers another caveat: “If supportable SoCalGas supply falls below 4.1 Bcfd during peak winter gas demand conditions, it may be necessary to withdraw from Aliso Canyon to avoid electric load interruption.”

Recent history suggests that gas should be available despite a lack of injections into the facility for almost a year.

“Because of the effectiveness of the Aliso Canyon summer action plan, as of the time of this report, no gas has been withdrawn from Aliso Canyon to maintain electric reliability,” the report notes.

15 Bcf in Storage

The facility still contains about 15 Bcf of working gas in storage, unchanged from the volume that the PUC last January ordered be left in the facility to cover summer needs.

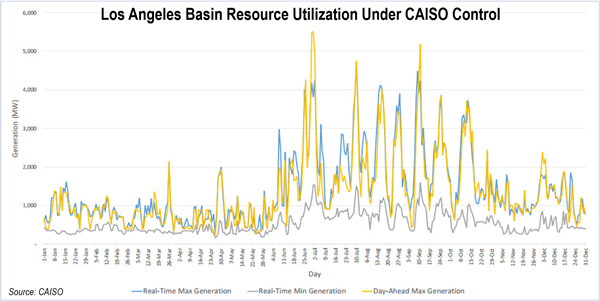

Summer has seen CAISO manage two heat-driven conservation alerts without having to tap that supply, and the grid’s gas needs are sure to drop significantly during winter. Last year, the ISO utilized less than half as much gas-fired generation in the Los Angeles Basin during winter than in summer.

LADWP, which operates its own balancing area, passed through its summer peak season without the benefit of its 287-kV Mead‐Victorville Line 1, which is slated to return to service by winter. The additional transmission capacity should provide 5,010 MW of winter import capability, compared with a forecast peak load of 4,309 MW. The upshot: The utility could meet its reliability requirements without relying on any of the basin’s local gas-fired generation, absent the loss of any of its four synchronous condensers needed for voltage regulation and support.

The interagency assessment was accompanied by a winter action plan developed to reduce the potential for gas curtailments large enough to interrupt Southern California’s electric service. Among the measures is a recommendation that CAISO impose a generator gas burn ceiling for very cold days.

“Effectively, it curtails some of the electric generation load in advance and increases the probability that SoCalGas will not have to curtail further,” the plan says.

The plan also recommends that:

- The PUC require that SoCalGas implement a demand response program that rewards large natural gas consumers for reducing demand when requested;

- SoCalGas maintain requirements that non-core gas customers tightly balance their schedules with actual use and develop a similar provision for core customers;

- The CEC and PUC investigate what “affiliate impediments” would prevent SoCalGas parent company Sempra Energy from buying LNG from its own Costa Azul LNG facility in Mexico and delivering it into the Southern California gas system; and

- The CEC identify and solicit additional sources of gas supply, including more in-state production.

The California agencies are seeking comments on the winter action plan, the subject of an Aug. 26 public workshop.