By Amanda Durish Cook

The Brattle Group last week endorsed MISO’s proposed Competitive Retail Solution, conditioned on the RTO adopting a wider demand curve that the consulting firm developed.

© RTO Insider

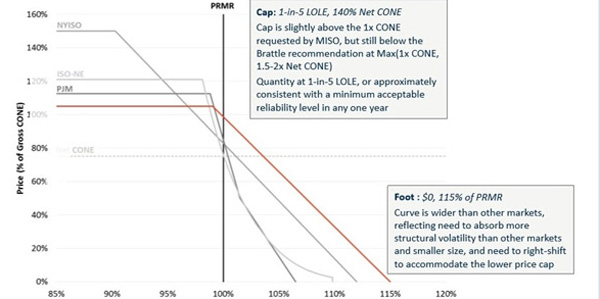

Brattle’s demand curve, revealed in its latest analysis of MISO’s proposed forward auction, is capped at 140% of the net cost of new entry (CONE). The foot of the curve lands at 115% of MISO’s planning reserve margin requirement and a $0 net CONE.

Brattle said the net CONE cap is “slightly above” MISO’s requested $195/MW-day figure for Zones 4 and 7 and the $185/MW-day price elsewhere.

Brattle analyst Samuel Newell said the analysis concluded that MISO’s separate forward auction solution will address reliability concerns while inviting merchant investment. It projects volatility will be reduced by 6 to 15% compared to a status quo case Brattle researched.

Volatility

Newell said the wider curve Brattle recommends seeks to “absorb more structural volatility than other markets,” and the curve’s shift to the right is needed to accommodate a lower CONE price cap than what’s in use at other RTOs. Brattle said the curve “allows some shortage at high prices.”

He said Brattle has recommended caps ranging from 1.5 times to two times net CONE in other regions. The recommended sloped demand curve is less steep than other regions’ and extends farther to the right.

“A reason to have a higher cap is to put more money in the market, and it helps protect against the risk of under-procurement if you’ve underestimated CONE,” Newell said. “Yes, the pricing is going to be volatile because of all that uncertainty that goes into the system. But as long as you have enough money built into the curve and the curve is shifted far enough right, you will attract enough megawatts.”

Brattle’s analysis predicts the new capacity structure would meet or exceed the one-day-in-10-years loss-of-load expectation (LOLE) and attract an additional 1,800 MW of merchant supply. Brattle also said the forward auction on average is predicted to clear an extra 120 MW. The analysis results will be included as testimony in MISO’s FERC filing to win approval of the forward auction.

The firm also said use of the sloped demand curve in the long run should result in average forward prices that spur merchants to build; however, Newell said the analysis didn’t forecast prices under the new auction construct. “The reason we’re here isn’t to forecast prices. It’s to address the widespread belief — that I think is right — that current prices won’t support merchant supply meeting need.”

Status Quo Falls Short

Brattle did find that in the long run, use of the demand curve under the forward design reduces the instances of auction prices clearing at the demand curve cap to 39% of years. When Brattle tested a status quo scenario in retail-choice zones, clearing at the demand curve cap amount happens 65% of the time in Zone 4 and 67% of the time in Zone 7. Brattle maintains some capacity prices clearing at the cap is needed to keep average clearing prices closer to net CONE.

Newell said Brattle tracked enough merchant supply to assume a one-in-10 standard with the curve, but MISO can also assume its utilities own supply averaging 3% more than their individual requirements. Brattle found that continuing with the status quo would result in MISO falling 891 MW short of its planning reserve margin requirement in the long term in MISO North. The status quo auction, Brattle said, also results long-term in a one-in-5.2 LOLE “with frequent severe shortage” events and a majority of auction offers clearing at the price cap.

Bill Booth of the Mississippi Public Service Commission asked if Brattle did its own analysis of MISO’s CONE value. Newell said his firm did not test the accuracy of MISO’s net CONE. But even if MISO does revise its CONE values, Newell said, results wouldn’t be affected much, as Brattle’s higher, 1.4-times CONE cap “mitigates reliability risk of administrative error in estimating net CONE.”

“This aspect is exactly the same as the one we went through for PJM and New England. This aspect of it is very established ground,” Newell said.

Newell said the bigger issue is whether Brattle’s assumptions regarding cap and foot values and utilities’ ownership is correct. Brattle analyst David Oates said a lot of the modeling, including the Monte Carlo-style analysis, is similar to what was done in PJM and ISO-NE.

MISO South

Indianapolis Power and Light’s Ted Leffler asked why MISO South was again left out of the analysis, as it was in a Brattle review released in July. (See MISO Backs Forward Auction Plan, Rejects Prompt Proposal.)

Brattle maintained the omission of MISO South was inconsequential, saying the 876 MW available for imports from the South is covered in varying megawatt amounts that utilities offer in the Monte Carlo analysis.

The company also modeled capacity import limits but not export limits and assumed utilities have a preference to build their own capacity instead of purchasing it from other utilities.

Zone 2 in Wisconsin and Michigan, which holds a small amount of participating demand, was initially included in the analysis, but Brattle found that it didn’t meet MISO’s materiality threshold.

In response to a question from Madison Gas and Electric’s Megan Wisersky, Newell said Zone 2 was initially included because it contains some competitive load. But MISO’s Mike Robinson said the inclusion was a relic of the RTO’s earlier work with Brattle and could be omitted altogether.

“It would be nice not to see that ever,” Wisersky joked.