By Robert Mullin

CAISO expects to hold its 2017 revenue requirement to this year’s level despite a planned $4.3 million increase in spending driven by rising labor costs, the ISO’s chief financial officer said Thursday.

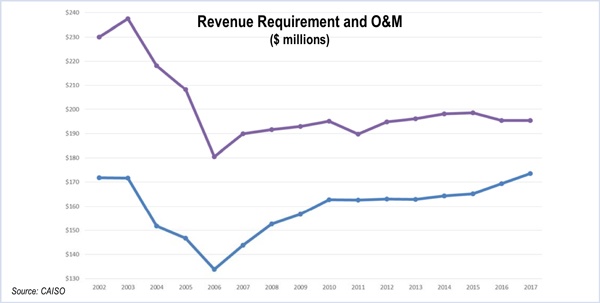

Although next year’s proposed budget is projected to increase 2% to $214.5 million, the ISO is seeking maintain its revenue requirement at $195.3 million for a second straight year, CFO Ryan Seghesio said during a Sept. 29 stakeholder call.

The additional expenses will be offset by revenues from other sources, including money earned from the operation of the Western Energy Imbalance Market.

Although the revenue requirement has increased 0.3% annually since 2007, it is 18% below its 2003 peak, when the ISO’s yearly debt service costs were more than three times as high as today.

“This shows our commitment to a stable revenue requirement,” Seghesio said.

CAISO recovers its annual revenue requirement through grid management charges assessed to market participants based on their use of the transmission system to serve load or deliver exports. Two out of three of those charges are slated to decline slightly next year, while a service charge associated with congestion revenue rights is expected to see an uptick.

Other fixed fees contributing to the requirement — such as those related to bidding into CRR auctions and trades by scheduling coordinators — are expected to remain unchanged.

The ISO’s operations and maintenance budget, which accounts for more than 80% of total spending, is expected to rise 2.5% next year on the back of a $4.6 million (3.8%) increase in salary and benefits expenses. The salary figure includes merit increases for existing staff and plans to hire seven new employees, bringing the total headcount to 600.

“We’ve held a very tough line on headcount for a while, but there’s some stress points [in various departments] that need to be relieved,” Seghesio said, adding that the number of full-time equivalent employees has fallen since 2012.

CAISO expects to reduce expenses related to outside contractors, consultants, training, travel and building leases, while fees to outside professionals such as attorneys are projected to rise.

Next year’s proposed revenue requirement also includes a $24 million cash-funded capital component, of which $20 million will be budgeted for approved projects, with the remainder to be held in reserve.

Debt service costs remain at $16.9 million, a figure Seghesio said will hold steady until 2023, when some of the ISO’s bonds become eligible for refinancing.

Declining transmission usage coupled with a steady revenue requirement will cause CAISO’s pro forma bundled cost per megawatt-hour — a measure of the ISO’s costs per transmission volumes used by market participants — to increase by $0.004/MWh to $0.809/MWh.

Next year’s transmission volumes are forecast to fall by 1.2 TWh to 241.5 TWh, continuing a trend in recent years.

CAISO attributes the decline to California’s extended drought — which has reduced both hydroelectric output and the amount of energy needed to move water supplies throughout the state — and the increased adoption of distributed generation, which is increasingly displacing the state’s reliance on central station power. Recent estimates indicate that rooftop solar now accounts for about 5,000 MW of capacity within the ISO’s balancing area.

Stakeholder comments on the proposed 2017 budget are due by Oct. 6. CAISO will seek board approval for a final budget in mid-December.