By Amanda Durish Cook

CARMEL, Ind. — Facing a FERC complaint from transmission customers, MISO last week defended its calculation of sub-regional transfer limits for the 2016/17 Planning Resource Auction and recommended that it continue to use the same numbers for future auctions.

The RTO made its recommendation based on stakeholder feedback it received, which shows general support for maintaining the status quo, said Kevin Sherd, director of forward operations planning, during a presentation at the Oct. 5-6 Resource Adequacy Subcommittee meeting.

MISO calculates the transfer limits between its North and South regions by deducting firm reservations from 2,500 MW for flows South to North and 3,000 MW for North to South. The initial transfer limits were prescribed in the RTO’s settlement with SPP that became effective in February.

Last month, a coalition of transmission customers filed a challenge to the results of the PRA with FERC, arguing that the limits are too strict and trapped capacity in MISO South, driving up clearing prices. (See MISO, IPPs Ask FERC to Reject Bid to Redo Capacity Auction.)

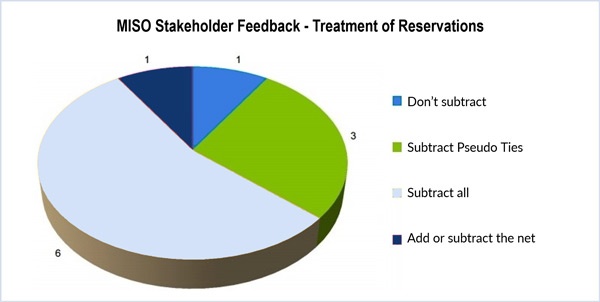

Six of 11 stakeholder respondents to a MISO survey on the issue endorsed deducting all firm reservations, while three wanted only pseudo-ties subtracted, and one apiece wanted nothing subtracted and net reservations subtracted. Seven recommended maintaining the current initial limits, with the minority split between using 1,000 MW or another method altogether.

Sherd said MISO doesn’t have much of a choice in subtracting firm reservations. “It’s firm transmission service. Firm transmission reservations can be scheduled at any point. It can’t be reduced absent a transmission congestion event,” he said.

But some stakeholders at the meeting disagreed that all firm reservations are absolute and must be subtracted.

In this year’s State of the Market report, MISO’s Independent Market Monitor recommended subtracting “a derating factor that represents the probability that MISO neighbors will request a derating” of the current initial limits.

“MISO is saying there’s no room for redispatch when all of the firm transmissions are subtracted,” Monitor Michael Chiasson said. “We’re saying there has to be something in between. … What’s the chance of that really being the norm and what’s the more likely case?”

Steve Leovy, a transmission engineer at WPPI Energy, agreed and said a “probabilistic” approach was needed.

But ITC Holdings’ Ray Kershaw said he had never heard of using transmission-use probability. “We can throw out terms like ‘probability,’ but I don’t know of a method for calculating the probability of transmission use. There are certain things that need to be assumptions; there’s the [loss-of-load] expectation, I understand that. Could someone put this method down on paper?”

Leovy said MISO should make a best effort to estimate expected system capability and not focus so much on making sure it does not exceed the limit under any circumstances.

Sherd said it would be an “administrative nightmare” to track individual firm reservations and monitor the likelihood of it being used. “It’s not on a planning year basis; it’s on a daily, weekly, monthly basis,” he said.

According to MISO, the Monitor’s suggestion is not allowed, as MISO and SPP’s settlement agreement forbids a “unilateral” lowering of the sub-regional limit.

Firm Flow Limits Study

Rather than the existing initial limits or 1,000 MW, one stakeholder suggested a study of firm flow limits to establish new initial limits.

Per that request, MISO reviewed market flows compared with firm flow limits on several days this summer, examining 19 Tennessee Valley Authority flowgates that experienced transmission loading relief anytime in 2016. The analysis, MISO said, showed that South-to-North market flows “would generally be firm at flows near or above 2,500 MW.” The RTO said only one of the analyzed flowgates averaged below 2,500 MW.

MISO said it plans to continue reviewing transmission loading relief annually. The RTO is seeking final feedback on reusing the limit approach in the PRA by Oct. 12. MISO staff plan to review a limit proposal at the Nov. 2-3 RASC.

Per SPP and MISO’s settlement, firm transmission reservation holders have until Dec. 1 to confirm or cancel service above 1,000 MW for planning year 2017/18. MISO will publish its sub-regional import constraint and sub-regional export constraint values for the 2017/18 PRA before March.

Dynegy’s Mark Volpe asked if MISO could even discuss its North-South contract limit plans given the complaint at FERC.

“I think given the complaint is public and MISO’s response is public, there should be very little issue in discussing it,” MISO’s Jacob Krause said.