By Tom Kleckner

American Electric Power CEO Nick Akins hardly sounded like someone whose company had just taken a $2.3 billion impairment Tuesday, telling investors and analysts he is “very happy with the strategic process” and that “conditions are in place that are conducive to us achieving our objectives.”

Akins’ comments came as he led a panel of AEP executives briefing investors and analysts in New York following the company’s third-quarter earnings release. With the one-time charge, AEP posted a loss of $765.8 million (-$1.56/share) for the quarter, compared with a profit of $518.3 million ($1.06/share) for 2015’s third quarter. Sales were up from $4.4 billion to $4.7 billion, partly because of a warm summer.

“The new story of AEP is one of higher growth, higher dividends, more regulation and more certainty,” Akins said. “When you stop chasing the wrong things, you give the right things the chance to catch you.”

The impairment reflects AEP’s ownership share of 2,684 MW of competitive generation in Ohio, including its Cardinal, Conesville, Stuart and Zimmer plants. It also includes the competitive portion of the coal-fired Oklaunion Plant in West Texas, the Desert Sky and Trent Mesa wind farms, also in West Texas, and some coal-related properties.

Akins said the company will spend $17.3 billion in capital investments through 2019 — $9 billion on transmission — an increase of $4.3 billion from plans laid out last year through 2018. The company owns the largest transmission system in the U.S., with 40,000 miles of lines and more 765-kV extra-high voltage than all other transmission systems combined.

“We’re focusing the proceeds on the [transmission business] we find attractive,” said Akins, who noted AEP already accounts for 14% of the country’s transmission investment. “We’re able to invest in transmission in an order of magnitude not many others have. If you’re looking for a transmission company, AEP is certainly that. We’re well-positioned as a regulatory business.”

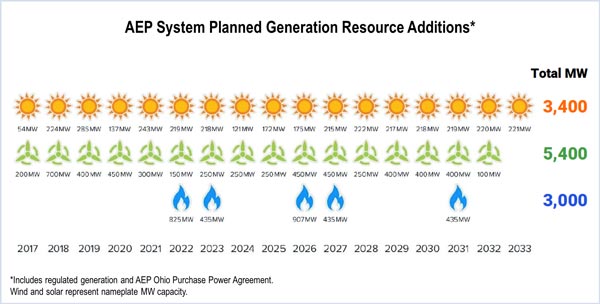

The company also plans to increase its renewables through long-term power purchase agreements. AEP expects to add 5,400 MW of wind energy and 3,400 MW of solar power through 2033.

Investors didn’t respond positively to the news. AEP shares closed Wednesday at $62.61/share, down 77 cents (-1.21%) on the day.

AEP’s embrace of regulation also allows it to escape the problems it faces in Ohio’s competitive-generation market. Many of the company’s coal plants date back to the 1970s and earlier, making them underperformers against other power units. Coal resources accounted for 71% of AEP’s generation in 2005, but that figure is projected to drop to 47% next year.

“Fortunately, AEP’s balance sheet can withstand this impairment,” CFO Brian Tierney said. “Combined with other sales of generating assets, it puts the Ohio generation debacle behind us. We also have wires companies in the states with very attractive returns.”

Akins said AEP would continue working with legislators to restructure the Ohio market.

Both AEP and FirstEnergy attempted to get relief from the Public Utilities Commission of Ohio with what amounted to a subsidy request for their competitive generation. While what opponents called a “bailout” was approved by PUCO, FERC effectively scotched the deals, saying they needed to undergo a more stringent review.

AEP decided to work to get favorable reregulation legislation approved.

But FirstEnergy — which reported a $1.1 billion loss in the second quarter, much of it related to the closure of five coal-fired units — filed a modified request with PUCO seeking a $558 million-a-year rate stability rider for eight years.

In October, PUCO voted instead to give the company $204 million a year for only three years. FirstEnergy has until Nov. 11 to file for a rehearing on the order, which it called “disappointing.” (See PUCO Rejects FirstEnergy’s $558M Rider, OKs $132.5M.)