The third quarter was a good one for the RTO Insider Top 30, as companies reported a 4% increase in revenues over a year earlier and a 22% increase in net income.

American Electric Power, which wrote down the value of its Ohio merchant generation by $2.3 billion, was the only company to report a loss for the quarter. (See related story, AEP Ohio Rate Plan Excludes Merchant Generation.)

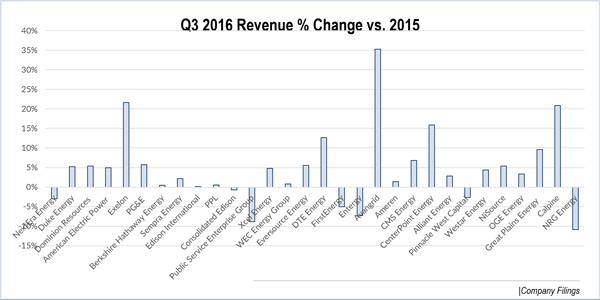

Consolidated Edison, Pinnacle West Capital, NextEra Energy, FirstEnergy, Entergy, Public Service Enterprise Group and NRG Energy all reported drops in revenue.

NRG reported a six-fold increase in net income despite a nearly 11% drop in revenue, thanks largely to a $266 million gain on sale of assets in the third quarter. Excluding the sale, and $263 million of impairments in the third quarter of 2015, net income declined $203 million because of lower energy margins and increased debt costs, the company said. (See NRG Continues to Pare Down Businesses, Affirms Guidance.)

Sempra Energy and Avangrid each saw profits more than double over 2015.

| Company | Market Cap ($ billions) | Revenue Q3 2016 ($ billions) | % change vs. 2015 | Net income Q3 2016 ($ millions) | % change vs. 2015 |

|---|---|---|---|---|---|

| NextEra Energy | 54.15 | 4.81 | -3.01 | 789.00 | -10.54 |

| Duke Energy | 51.05 | 6.82 | 5.21 | 1181.00 | 26.31 |

| Dominion Resources | 46.57 | 3.13 | 5.42 | 690.00 | 16.36 |

| American Electric Power | 31.57 | 4.65 | 4.98 | (765.80) | -247.67 |

| Exelon | 30.74 | 9.00 | 21.63 | 526.00 | -16.38 |

| PG&E | 29.59 | 4.81 | 5.71 | 391.00 | 26.13 |

| Berkshire Hathaway Energy | NA | 5.09 | 0.45 | 1047.00 | 18.44 |

| Sempra Energy | 26.80 | 2.54 | 2.18 | 622.00 | 150.81 |

| Edison International | 23.54 | 3.77 | 0.11 | 449.00 | 0.22 |

| PPL | 23.48 | 1.89 | 0.59 | 473.00 | 20.36 |

| Consolidated Edison | 22.95 | 3.42 | -0.76 | 497.00 | 16.12 |

| Public Service Enterprise Group | 21.18 | 2.45 | -8.85 | 327.00 | -25.51 |

| Xcel Energy | 20.90 | 3.04 | 4.79 | 457.80 | 7.35 |

| WEC Energy Group | 18.90 | 1.71 | 0.81 | 217.30 | 19.07 |

| Eversource Energy | 17.19 | 2.04 | 5.51 | 267.20 | 12.36 |

| DTE Energy | 16.81 | 2.93 | 12.70 | 325.00 | 23.11 |

| FirstEnergy | 14.08 | 3.92 | -5.00 | 380.00 | -3.80 |

| Entergy | 13.74 | 3.12 | -7.32 | 388.17 | -153.69 |

| Avangrid | 12.91 | 1.42 | 35.31 | 109.00 | 101.85 |

| Ameren | 11.93 | 1.86 | 1.42 | 369.00 | 7.58 |

| CMS Energy | 11.72 | 1.59 | 6.80 | 186.00 | 25.68 |

| CenterPoint Energy | 10.00 | 1.89 | 15.89 | 179.00 | -145.78 |

| Alliant Energy | 8.72 | 0.92 | 2.86 | 131.00 | -28.22 |

| Pinnacle West Capital | 8.46 | 1.17 | -2.69 | 263.03 | 2.30 |

| Westar Energy | 8.04 | 0.76 | 4.34 | 158.55 | 12.80 |

| NiSource | 7.78 | 0.86 | 5.40 | 27.20 | -655.10 |

| OGE Energy | 6.31 | 0.74 | 3.35 | 183.60 | 65.11 |

| Great Plains Energy | 5.88 | 0.86 | 9.65 | 133.60 | 5.36 |

| Calpine | 4.54 | 2.36 | 20.89 | 301.00 | 7.89 |

| NRG Energy | 3.54 | 3.95 | -10.87 | 402.00 | 509.09 |

| TOTAL | $87.51 | 3.9% | $10,704.64 | 21.6% |

NOTE: Net Income figures include minority interests; exclude income not available to common shareholders.

Aliso Canyon Injections by Year-end?

Sempra reported third-quarter 2016 earnings of $622 million, up from $248 million a year earlier. Its California utilities saw earnings rise by $21 million, primarily because of higher margins.

San Diego Gas & Electric won state regulators’ approval to own and operate 37.5 MW of energy storage expected to enter commercial operations in the first quarter of 2017.

The company said its Southern California Gas unit “has made significant infrastructure technology and safety enhancements” to the Aliso Canyon gas storage facility and hopes to win regulators’ approval to resume injections by the end of the year.

Avangrid Adding 2,350 MW of Wind Capacity

CEO James P. Torgerson credited the improvement to “solid earnings” in its networks and renewables businesses, thanks to a rate settlement in New York, higher wind production and the “extension of the useful life of certain wind assets.” The company’s networks unit includes electric and gas utilities in New York, Maine, Connecticut and Massachusetts. Its renewable unit owns 53 wind farms with 5,643 MW of capacity in 18 states.

The company said it will purchase equipment for up to 2,000 MW of additional wind generation and more than 350 MW to repower existing wind turbines by the end of the year to obtain the full value of production tax credits.

“Also, we are contracting additional power purchase agreements as we continue to manage our merchant exposure,” Torgerson said.

Previous stories on third-quarter earnings:

Westar Boosts Earnings Amid Pending Acquisition

PJM Third-Quarter Earnings Roundup

CenterPoint Energy Fine-Tunes its Gas Businesses

AEP Turns Away from Generation to Transmission, PPAs

FirstEnergy Wants out of Competitive Generation

Earnings Up, Xcel Touts ‘Steel-for-Fuel’ Strategy

Entergy Earnings Surpass Expectations; Wall Street Unimpressed

– Rich Heidorn Jr.