VALLEY FORGE, Pa. — PJM is preparing several proposed rule changes in response to FERC Order 825, which requires RTOs to align their settlement and dispatch intervals and implement shortage pricing.

PJM’s Ray Fernandez walked the Market Implementation Committee through planned Operating Agreement and Tariff revisions that would be part of a compliance filing planned for Jan. 11. The changes would calculate balancing operating reserve deviations in five-minute intervals but aggregate charges and credits daily for allocations. (See “More Adjustments for Five-Minute Settlement,” PJM Market Implementation Committee Briefs.)

Fernandez’s presentation included an example in which a unit with no net deviations during a day would have incurred balancing charges under the current process but wouldn’t under the proposed one.

“With the proposal that PJM has, we wouldn’t be breaking down [imbalances] to the bus level,” he said. “It minimizes the pot of dollars that we’re charging.”

Stakeholders, however, voiced skepticism on multiple points. Brock Ondayko of American Electric Power expressed concern that units might not be able to follow generation signals so precisely and risk incurring additional penalties.

Generators are “basically chemical factories whose byproduct is energy” and “don’t necessarily follow things perfectly,” he said. “We’re never right on. … I’m concerned that the quantity of operator imbalance could be increased significantly.”

Other members questioned who would lose out on the changes, noting that reduced charges for one unit implies reduced credits for someone else.

“Whether it’s a positive impact on balancing congestion or a negative one is unclear,” Direct Energy’s Jeff Whitehead concluded. “I’m trying to understand the tradeoffs.”

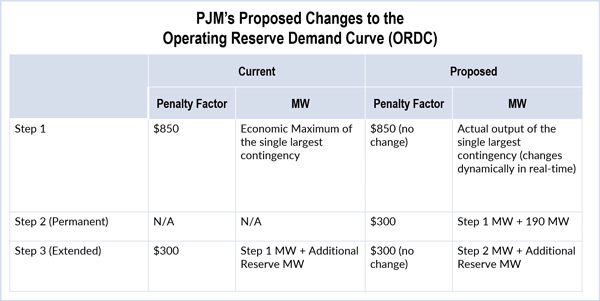

In a separate presentation, PJM’s Lisa Morelli unveiled proposed revisions to the operating reserve demand curve, which PJM believes are necessary to appropriately implement Order 825’s five-minute interval requirement. PJM hopes to submit the revisions as a Section 205 filing around March 1.

The revisions would add an additional step in the curve at the $300 penalty factor that would allow the reserves to be “extended,” or increased. Currently, reserve requirements can only be extended in specific situations related to the issuance of hot or cold weather alerts.

PJM increased the day-ahead scheduling reserve requirement for 901 hours between January 2015 and September 2016, almost 6% of total hours. On average, PJM increased the requirement by 5,000 MW.

While Order 825 specified a May 11, 2017, implementation date, PJM plans to request implementation of its proposals on five-minute settlements and shortage pricing simultaneously on Feb. 1, 2018. It would seek a response by Feb. 15.

If FERC approves the delayed implementation date, PJM would relax its timeline for the 205 filing until April. Otherwise, it will keep its March 1 target for the 205 filing and request shortage pricing be implemented simultaneously with five-minute settlements.

Rules on Fuel-Cost Policy Revocations Continue to Hang Up Approval

Stakeholders are nearing agreement on fuel-cost policy revisions but remain concerned about proposed protocols for revoking policies. (See “Fuel-Cost Policy Revisions Face Another Hurdle,” PJM Markets and Reliability and Members Committees Briefs.)

Despite assurances from PJM that the revocations are very unlikely to be used and are meant as a last resort in the event of fraud or some other egregious problem, members were not satisfied.

“I think we’ve spent more time talking about this than we will ever spend using it,” PJM’s Steve Shparber said. “This is not expected to occur likely ever.”

“From a culture standpoint, it strikes me as something we should not be doing to write things up that we think will never occur,” countered American Municipal Power’s Ed Tatum. “I just think it’s inappropriate. It’s impossible. And if we’re going to do it, let’s do a good job of it. … What we’re talking about right now is some language that is unclear as to how it’s going to work.”

He and other stakeholders argued that PJM hadn’t clearly defined parameters for issuing a revocation. Bob O’Connell of PPGI Fund A/B Development expressed concern that PJM appeared to be implying it would be making judgments about whether operators were committing fraud.

Joe Bowring, PJM’s Independent Market Monitor, questioned the RTO’s insistence on getting the fuel-cost policy revisions approved prior to any requirement from FERC.

“Why wordsmith it now when there’s no order?” he asked.

Bowring also said his office is “remaining agnostic” on variable operations and maintenance costs and “not focusing on VOM primarily at the moment.” He later clarified that he was talking about whether it should be included in fuel-cost policies, not whether he planned to investigate them as part of validating cost-based offers.

No Solution Yet for Energy Offer Validation

PJM is still considering how it will comply with FERC’s requirements in Order 831 to verify incremental energy offers above $1,000/MWh. (See New FERC Rule Will Double RTO Offer Caps.)

“We haven’t done a lot of work on validating” offers, PJM’s Adam Keech said. A multi-phased approach may be adopted, depending on the result of the fuel-cost policy proposal, he said.

The rule’s effective date is Feb. 21, but PJM’s compliance filing isn’t due until May 8, so the RTO intends to implement its final plan immediately following the compliance filing.

Bowring suggested asking FERC to clarify its wishes on the topic. The current plan “doesn’t seem like a great process,” he said.

Credit Limit Changes Pass Despite Exelon Objections

Exelon’s Sharon Midgley spoke passionately in opposition to PJM’s proposed alternative to the current credit requirements for participation in financial transmissions rights auctions, but she found no other vocal support.

Under current rules, FTR credit requirements are calculated in two parts: one based on price and the adjusted historical values of individual FTRs, and the second a portfolio-based “undiversified credit adder” applied to net counterflow portfolios.

Some FTR holders sought an alternative, saying the undiversified adder caused clearing delays and credit uncertainty.

The alternative, previously approved by the Credit Subcommittee, eliminates the portfolio adder in exchange for increasing the historical adjustment factor in underlying credit calculations for historically counterflow paths from 10% to 25%.

“We do think they increase our credit requirements,” Midgley said. No one shared her concern, however, and the proposal was endorsed 88-34 with 15 abstentions.

PJM, IMM Partner on Capacity-Replacement Revision

In a swift response to rule changes they felt weakened market safeguards, PJM and the Monitor presented a jointly developed proposal to again revise Manual 18.

At November’s Markets and Reliability Committee meeting, members ignored objections from both PJM and the Monitor and approved Manual 18 revisions that allowed for immediate replacement of capacity obligations. PJM had offered an amendment to the proposal that would have addressed its concerns, but it never came to a vote, as the original proposal was endorsed. (See “Citigroup Wins Change on Capacity Resales,” PJM Markets and Reliability and Members Committees Briefs.)

The Monitor filed a complaint with FERC in response and joined PJM in proposing the newest revision, which is similar to their original amendment. At least some stakeholders were receptive.

“The IMM has convinced Calpine that we do need to put something in place,” said David “Scarp” Scarpignato in noting his company’s support of the new proposal.

Bowring said it was “not as strong as the optimal rules” and suggested returning to the previous protocols if the current proposal wasn’t satisfactory, but stakeholders said the proposal broached issues that needed to be addressed.

Operating Parameters, ARR Enhancements Endorsed

Members endorsed by acclamation and with little discussion new definitions for operating parameters and rule changes regarding residual auction revenue rights.

The updated definitions for “soak time” and “minimum run time” affect several manuals and governing documents. (See “Monitor Concerns Delay Operating Parameter Revisions,” PJM Market Implementation Committee Briefs.)

The changes on residual ARRs, proposed by Exelon and Direct Energy, will require PJM to run another simultaneous feasibility test proration with all negatively valued bids removed. (See “Stakeholders Debate ARR Changes,” PJM Market Implementation Committee Briefs.)