FERC last week ordered American Electric Power and FirstEnergy subsidiary Allegheny Power to refund more than $7 million to ratepayers for the canceled Potomac-Appalachian Transmission Highline (PATH) project (ER09-1256; ER12-2708).

The ruling upheld most of the $10 million in refunds recommended in an initial ruling by Administrative Law Judge Philip C. Baten, backing the judge’s decision to deny recovery of $6.2 million in advertising, lobbying and “advocacy-building” costs. But the commission reversed Baten on his rejection of some legal costs and losses on the sale of properties the companies acquired for the project. (See FERC ALJ Rejects $10 Million in PATH Transmission Project Recovery.)

The commission also found that PATH’s base return on equity should be reduced from 10.4% to 8.11% and disallowed recovery of $1.1 million in expenses booked into a wrong account.

The companies have 60 days to submit revised information, including an updated Form 1 that recalculates costs of service and estimated refunds.

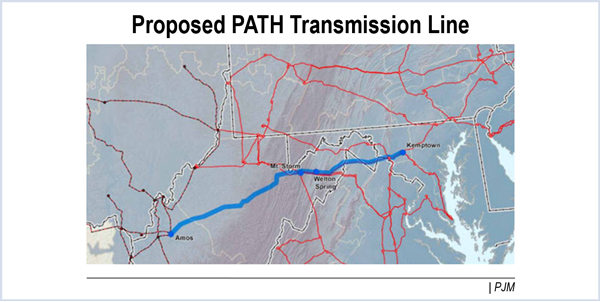

Approved in PJM’s 2007 Regional Transmission Expansion Plan, the $2.1 billion project would have run from AEP’s John Amos coal generator in St. Albans, W.Va., to New Market in Frederick County, Md. PJM canceled the project in 2012 after determining it was not needed based on revised load forecasts.

The ruling was a victory for two PATH opponents from West Virginia who filed a pro se intervention challenging the companies’ recovery request for recovery of $121.5 million.

FERC Orders Investigation into Overcharging for Natural Gas Pipelines

The commission is investigating the rates charged by two natural gas pipelines, one of which delivers into the PJM footprint in Chicago (RP17-302 and RP17-303).

FERC believes Wyoming Interstate Co. and Natural Gas Pipeline Company of America, both Kinder Morgan subsidiaries, may have both been overcharging customers, based on reviews of their 2014 and 2015 FERC Form No. 2 annual reports.

FERC estimates Natural’s ROE for those calendar years to be 28.5% and 20.8%, respectively. Natural owns the Amarillo and Gulf Coast Lines, both of which terminate in the Chicago area.

The commission estimates WIC’s ROE for those calendar years to be 17.7% and 19%, respectively. WIC owns 850 miles of pipeline, including a mainline system between western Wyoming and northeast Colorado.

FERC says it’s concerned that both Natural’s and WIC’s level of earnings may exceed their actual cost of service, including a reasonable ROE. The commission ordered the companies to file full cost and revenue studies within 75 days.

ODEC Tariff Revisions Approved Subject to Compliance Filing

FERC last week approved a revised cost-of-service rate schedule that changes how Old Dominion Electric Cooperative collects demand costs from its 11 distribution cooperatives in Virginia, Delaware and Maryland.

The new formula replaces one that has been in place since 1992 that recovered demand costs based on each cooperative’s coincident peak (CP) usage. The new formula includes rates that ODEC said more accurately reflect market conditions and its costs under PJM’s methodology.

The commission affirmed the initial decision by ALJ H. Peter Young that found several portions of ODEC’s filing, including its four-year average “proxy rate” for PJM capacity costs and the 12 CP true-up mechanism for PJM capacity costs and third-party transmission costs, unjust and unreasonable.

It reversed the judge’s finding that ODEC’s proposed zonal averaging mechanism and the use of add-backs in 2014 were unjust and unreasonable.

The revisions were backdated to Jan. 1, 2014, and ODEC is required to make refunds and file a refund report (ER13-2483).

FERC Approves FE Companies’ Filings on Affiliate PPA Waiver

The commission last week approved tariff revisions filed by FirstEnergy Solutions and several affiliates to comply with a FERC order ruling that a power purchase agreement in which the company’s regulated utilities would buy energy from the company’s merchant generators would be subject to its affiliate abuse review (ER16-1807, et al.). FirstEnergy asked the Public Utilities Commission of Ohio to withdraw the PPA following the FERC ruling. (See FirstEnergy Foes Ask FERC to Step in Again in Ohio Dispute.)

– Rory D. Sweeney