PJM Uncomfortable with Separate Pseudo-Tie Rules

WILMINGTON, Del. — PJM must determine how to handle different rules for new and existing pseudo-ties after stakeholders vetoed a package of reforms for external resources at Thursday’s Markets and Reliability Committee meeting but then agreed on applying the updated rules only to new pseudo-tie requests.

The package appeared headed back to the drawing board after failing to reach the 3.33 out of 5 necessary in a sector-weighted vote. But Exelon’s Jason Barker immediately motioned for a vote on an “alternative” package that excluded existing pseudo-ties from the new requirements, saying it would “move toward something that we think is an improvement over the status quo.”

The original proposal, developed through the Underperformance Risk Management Senior Task Force, called for making deliverability requirements uniform for resources within and outside of PJM’s footprint and requiring confirmatory feasibility studies for all pseudo-ties. Existing pseudo-ties would have had until delivery year 2022/23 to conform to the deliverability standards for internal resources. (See No End in Sight for PJM Capacity Market Changes.)

By Oct. 1, 2018, PJM would notify external resource owners whether their pseudo-tie is operationally feasible. Owners of resources that fail would be required to perform the required upgrades or would be declared ineligible to offer capacity.

Stakeholders balked at the implication that their units might become nonviable if the transmission owner — over which neither they nor PJM has authority — declined to meet the new standards.

“It’s their system; they can do things their way,” said Mike Borgatti of Gabel Associates.

PJM’s Adam Keech acknowledged, “We’re not in a place where we can require someone to upgrade to our standards.” He estimated there is roughly 3,500 MW of external generation pseudo-tied to PJM.

Joe Bowring, PJM’s Independent Market Monitor, called the original proposal “a significant step forward” but still inadequate because imported capacity remains an inferior substitute for internal capacity resources and suppresses market prices.

“If units don’t meet the rules and requirements, they don’t meet the rules and requirements. That should be the end of the story,” he said.

When the measure failed and Barker proposed applying the updated standards to new pseudo-ties, Bowring questioned whether Barker intended for existing pseudo-tied units to then be grandfathered in perpetuity. Stakeholders agreed that the alternative proposal would be silent on existing pseudo-ties and that portion would be sent back to the task force for further consideration. The measure was endorsed, receiving 3.97 in favor on a sector-weighted vote. The same proposal was later approved during the Members Committee meeting with 3.88 in favor.

PJM Senior Vice President of Operations and Markets Stu Bresler said there will need to be a discussion with the Board of Managers on having separate rules for similar groups. “We certainly can’t live that way for very long,” he said.

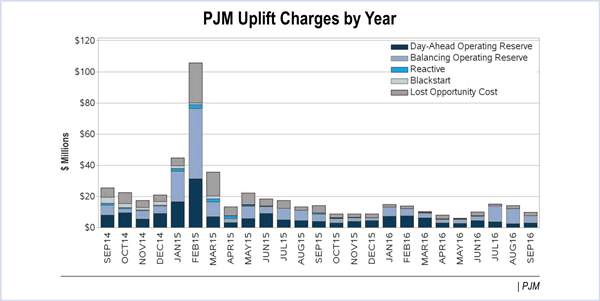

Work on Uplift Moves Forward Despite NOPR

In three decisive votes, stakeholders swiftly moved forward on efforts to address uplift.

The action was a far cry from last month, when PJM’s Dave Anders explained that the Energy Market Uplift Senior Task Force had only been successful in half of its goals. The task force endorsed two proposals to reduce uplift and volatility. However, it considered more than a dozen proposals to address cost allocation issues and couldn’t find majority agreement on any of them. The MRC instructed the task force to revote on the top five.

Earlier this month, the task force endorsed a package for the MRC to consider on Thursday. The proposal would maintain much of the status quo but include up-to-congestion transactions in the allocation of day-ahead and balancing operating reserves in the same way incremental offers and decremental bids are included. It would also remove the ability for internal bilateral transactions to offset deviation charges.

However, with FERC having issued a Notice of Proposed Rulemaking on uplift and UTCs on Jan. 19, PJM staff assumed stakeholders might want to postpone action on the issue until receiving clear direction from the commission. (See FERC Proposes More Transparency, Cost Causation on Uplift.)

Not so. “I think that PJM has shown in a lot of studies that UTCs do impact commitment and decommitment … and that’s a cause of uplift,” FirstEnergy’s Jim Benchek said. “If down the road that NOPR results in rulemaking actually happening … then we’ll deal with that rulemaking at that time. My final comment is let’s vote today.”

So they did: The Phase 1 proposal was approved with a sector-weighted vote of 4.1 out of 5. It largely maintains the status quo, except that it includes in the determination of balancing operating reserve credits only the day-ahead revenues from the hours the resource operated in real-time, not all day-ahead revenues.

The proposal to postpone voting on Phase 2 for one year was opposed by 3.8 out of 5 in a sector-weighted vote, and a vote on the package succeeded with 4.01 out of 5. The proposals will go for a vote before the Members Committee at its Feb. 23 meeting to approve the Operating Agreement revisions and endorse revisions to the addendum to Attachment K of the Tariff. The Tariff revisions will then need to be approved by the Board.

Separately, stakeholders also approved a problem statement and issue charge to reconsider historical practices and provisions in the Operating Agreement and Manual 33 restricting the sharing of data that is considered confidential or market sensitive. Changes could result in more transparency on transmission constraints, the reliability assessment commitment process and conservative operations in day-ahead and real-time operations.

Stakeholders OK Manual Changes

Stakeholders endorsed by acclamation several manual revisions and other operational changes:

- Revisions to Manuals 11 and 12 to account for the updated regulation requirement developed by the Regulation Market Senior Issues Task Force. (See “Regulation Requirement Changing from ‘Peak’ to ‘Ramp,’” PJM Operating Committee Briefs.)

- Revisions to Manual 27 developed as part of an annual review.

- Revisions to Manual 38 developed as part of a periodic review to provide more clarity on outage coordination.

- Revisions to Manual 40 that, among other things, reduce the grace period for completing operator training. (See “Manual 40 Revisions Approved with Exelon’s Addendum,” PJM Operating Committee Briefs.)

- Revisions to the PJM Tariff and Manuals 11, 12 and 28 regarding operating parameters. (See “Operating Parameters, ARR Enhancements Endorsed,” PJM Market Implementation Committee Briefs.)

- Revisions proposed by the Governing Document Enhancement & Clarification Subcommittee to clean up definitions in the Tariff, Operating Agreement and Reliability Assurance Agreement.

Members Committee

Members Approve Charter for Security Committee

Despite stakeholder inquiries about its non-decisional status, the Members Committee endorsed by acclamation the charter for a new Security & Resiliency Committee.

American Municipal Power’s Ed Tatum asked what purpose the group would serve if it didn’t make any decisions. PJM staff said it would operate in an advisory capacity like the Transmission Expansion Advisory Committee. Exelon’s Gloria Godson clarified that the group was not formed at the behest of transmission owners.

“This was not a [Transmission Owners Agreement-Administrative Committee] idea,” she said. “In fact, a lot of TOA-AC folks have an issue with this idea.” (See “Preview of Security Committee Receives Tepid Response,” PJM Markets and Reliability and Members Committees Briefs.)

According to PJM, the new committee will serve as a forum to discuss threats and hazards and offer case studies, solutions or other best practices. To avoid compromising company security, the committee won’t include any Critical Energy Infrastructure Information in meetings and the news media will be barred. It will password-protect its minutes and only allow external partners by invitation. Corporate nondisclosure agreements will be used as needed.

Consent Agenda Endorsed

The committee also endorsed:

- Operating Agreement revisions associated with residual auction revenue rights enhancements.

- Revisions to the Tariff resulting from discussions at special Planning Committee sessions regarding new service request cost allocation and study methods. (See PJM Considering Injection Rights for Demand Response.)

- Tariff and Operating Agreement revisions developed by the Governing Document Enhancement & Clarification Subcommittee related to pumped hydro storage.

– Rory D. Sweeney