By William Opalka

The New England Power Pool’s Integrating Markets and Public Policy collaborative process will suspend its monthly meetings until May to allow ISO-NE more time to develop a market design for accommodating state-sponsored clean energy contracts without disrupting the Forward Capacity Market.

In addition to providing the RTO with time to develop a “conceptual market approach that could be implemented in the near term,” the delay will give states time to analyze long-term proposals discussed to date and for them to hold “off-line” discussions with stakeholders, IMAPP Chair William Fowler said in a memo released Wednesday.

ISO-NE’s proposal could be presented to the IMAPP group as soon as May and implemented for FCA 13 in February 2019, which will procure resources for the 2022/23 capacity commitment period. Any proposed market rule changes to its Tariff would require FERC approval.

NEPOOL Secretary David T. Doot told RTO Insider that FERC’s plans for a technical conference were cited by one IMAPP participant in a conference call Thursday as another reason to go slow. (See related story, LaFleur Plans Technical Conference on State Generator Supports.)

The original timeline set out last summer had hoped to have NEPOOL complete its work in December 2016. A revised schedule issued in November contemplated a proposal sent to ISO-NE by the second quarter of this year.

“The ISO’s near-term priority is for the region to develop a workable proposal for accommodating state-supported resources while minimizing their potential to suppress FCM prices and affect regional reliability,” ISO-NE spokesman Marcia Blomberg said.

Stakeholders in the IMAPP process have identified multiple paths to accommodating clean energy resources, including the introduction of a price on carbon or a two-tiered approach to the FCM that creates a separate class for clean energy. (See Markets vs. Climate Goals the Subject at NECA Conference.)

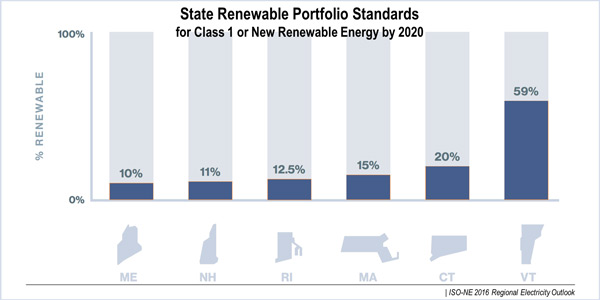

New England is the furthest ahead in contemplating the effects of out-of-market contracts on wholesale electricity markets, but the issue is gaining currency in NYISO and PJM. Three New England states are currently reviewing out-of-market long-term contracts for clean energy procurement. (See New England to Charge Ahead on Clean Energy Makeover in 2017.)

“Once the ISO has a market-based proposal, it would go through the NEPOOL Markets Committee for discussion. With recent state targets in mind, the ISO anticipates needing a near-term solution in place for FCA 13, likely requiring a FERC filing by the end of 2017 to impact the March 2018 FCM windows [for resource qualification]. The ISO is examining options and is targeting additional stakeholder discussions by May 2017,” Blomberg said.

Work on proposals will continue among stakeholders over the next several months, with interim IMAPP updates provided at NEPOOL’s monthly Participants Committee meeting.

“These are very complex discussions and sometimes there were reasons for a high [degree of] optimism and other times a low [degree of] optimism,” said Doot, an attorney with Day Pitney. “But this is hard and it’s going to take some time.”