Potomac Economics’ Beth Garza, director of ERCOT’s Independent Market Monitor, summed up her 2016 market year-in-review as simply as she could at the Board of Directors meeting Feb. 14. “Cheap, windy and all RUCed up,” she said to laughter.

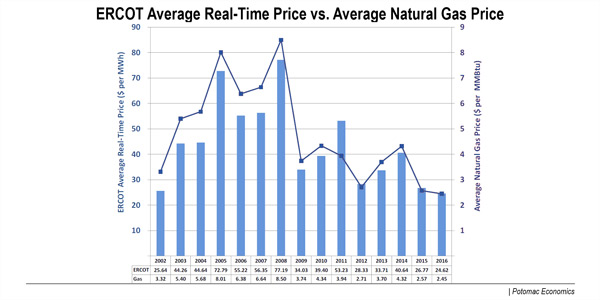

Market prices dropped to an all-time low of $24.62/MWh for load-weighted average real-time energy and $2.45/MMBtu for natural gas, down from $26.77 and $2.57, respectively. While prices were low, a 30% increase in wind energy production led to an increase in its curtailments, and reliability unit commitments almost quadrupled, from 70 “unit days” to 269.

Garza said almost a third of those RUC events are under review as potential enforcement actions primarily from generators failing to comply with ERCOT dispatch instructions or not accurately reflecting the resource’s status.

“We see evidence of uncertainty and confusion about what you’re supposed to do when you receive a RUC instruction,” she said. “Thirty percent of RUC events in 2016 had something wrong with them. That’s too much. We either have a problem with the rules or people’s understanding of the rules.”

It was the same message Garza delivered to the Technical Advisory Committee in January. (See ERCOT RUC Activity Jumps Sharply in 2016.)

“When ERCOT issues a RUC instruction, there are ways for that generator to express a preference to opt-out. ‘Yes, I will come online, but I’m forgoing any make-whole payments that might come my way’ in exchange for, ‘I get to keep all the revenue,’” she said. “Because of that mechanism, I believe the increase in RUC activity that we’re seeing is a … result of generators trying to get some assistance in making that commitment decision.”

Garza pointed out that the ERCOT market is a self-commitment market, without rules or obligations to commit in real time besides financial incentives.

“Just because you have a day-ahead award does not mean you are required to start your unit in real time. That’s very different than other markets,” she said. “That difference leads to a commitment decision that is de-centralized. Every generator is making their own decisions. ‘Does it make sense for me to start today or tomorrow evening?’

“ERCOT is in the tenuous position of sometimes trying to figure out [whether] that action will actually happen, and when do they have to step in and ensure the adequacy of the grid, which they do through RUC instructions.”

Much of that problem is expected to be resolved by a rule change approved by the board and the TAC last year and scheduled to be implemented in late June. NPR744 enables qualified scheduling entities that submit bids and offers on behalf of resource entities or load-serving entities to opt out of RUC settlement by telemetering a resource’s status during the first interval it is online and available.

When unaffiliated Director Peter Cramton suggested the problem was a procedural issue that would be corrected by the protocol change, Garza said, “That’s my hope.”

“There are myriads of individual-type situations that could continue to be problematic,” she said. “We’re working with the ERCOT 744 team to understand how it’s being implemented. I hesitate to say it will all go away, but I will continue to raise awareness of this issue.”

The 269 unit days (a unit committed for as little as an hour counts as a day) resulted in only $1.2 million in make-whole payments, which are paid for by entities that were short generation. Another $1.4 million was clawed back from generators with offers in the day-ahead market and distributed to all load, the difference being market energy prices don’t cover start-up or minimum energy costs.

Half of the payments from day-ahead offers are clawed back from generators that opt out of RUC dispatch orders. Garza said generators RUCed for a thermal constraint are often motivated to opt out because their real-time energy prices will likely exceed their operating costs. But those RUCed for a local voltage issue, which would not cause a price spike, would generally obey the RUC order to qualify for make-whole payments, she explained. The bulk of RUC activity took place in the Houston area and South Texas, two regions where infrastructure projects have recently been energized or are under construction.

Garza also said zonal price differences indicated that wind energy once trapped behind constraints is now serving load. The West zone’s increased oil and gas production activity and congestion around Houston instead of the West led to lower prices in the West, reversing recent trends.

ERCOT Releases 2016 State of the Grid Report

ERCOT has released its 2016 State of the Grid report, titled “Inside the Promise.”

The promise, the ISO said, “is to coordinate the operation of the grid and market that serve electric consumers. In 2016, ERCOT implemented new tools to help manage more renewables and upgraded aging equipment for increased functionality. ERCOT also worked closely with stakeholders to update criteria used to determine the need for new transmission projects and improvements.”

The report highlights the ISO’s demand and energy usage records set last year, new milestones for wind generation, the doubling of installed solar capacity and new lows for average wholesale market prices.

Magness Foresees Growth in Utility-scale Solar

CEO Bill Magness began his regular report to the board and members by asking, “What could be more romantic than an ERCOT board meeting on Valentine’s Day?”

Magness said the Long-Term System Assessment shows continued load growth for the ERCOT market, with every scenario indicating significant increases in utility scale solar resources that could accelerate the need for additional transmission infrastructure in West Texas. He said the falling costs of solar and its potential to replace older generation may shift the “summer resource adequacy challenge” from the traditional 4-5 p.m. window to the 8 p.m. hour.

“A lot of the best solar resources are not congruent with the best wind resources,” Magness said. “Net peak resource adequacy issues are something we have to keep an eye on. We’ll have to work on ramping issues, just like we did for wind.”

Staff and the Regional Planning Group endorsed six major transmission projects in West Texas last year, and others are under review.

The Port of Brownsville near the Mexico border, where several LNG facilities have been proposed, could be “the big wild card,” Magness said. That will require additional generation in the fast-growing Lower Rio Grande Valley or additional transmission, he said.

“We’re going to have continued challenges to meet that load,” he said.

ERCOT’s preliminary net revenues for 2016 show a $13.4 million favorable balance, Magness said. The system administration fees were up $2 million, thanks to a stronger Texas economy. Personnel costs and purchases of computer hardware and other equipment were a combined $6.2 million under budget.

However, milder weather at the start of 2017 has left ERCOT “a little behind,” Magness said. Administrative fees are already $1.4 million under budget.

According to the CEO’s operational report, ERCOT has 254 active generation-interconnection requests totaling 59,896 MW, including 26,732 MW of wind generation, as of Dec. 31. The ISO had 17,604 MW of wind capacity in commercial operation at year-end.

Another Above-Normal Texas Summer Seen

ERCOT Senior Meteorologist Chris Coleman predicted another hotter-than-normal summer in Texas this year, saying it will follow recent patterns.

“Eight or nine of the past summers have been hotter than normal,” he said. “That’s just been the trend. It would really be going out on a limb to forecast a mild summer for Texas this year.”

Using the latest information from the National Oceanic and Atmospheric Administration, Coleman said 2016 was Texas’ third warmest year on record, dating back to 1895. He said this winter has been the sixth-warmest on record, with Austin recording 17 days of 80-degree temperatures or warmer.

Still, frigid temperatures early in the year helped ERCOT set a new winter peak of 59,650 MW on Jan. 6, breaking the previous record of 49,263 MW, set in January 2016.

Coleman said there is increasing potential for a warmer-than-normal spring that will likely produce a spring load peak in May. He will issue his final spring forecast and preliminary summer forecast March 1 as part of ERCOT’s Seasonal Assessment of Resource Adequacy, but he said there’s “no reason to deviate from a warmer-than-normal spring” prediction.

He also projected a wet spring. Texas recorded its two wettest years on record, with almost 74 inches of rain, in 2015 and 2016. The rainfall ended the state’s drought and any possibility of long-term droughts into the next decade, Coleman said.

Technology Refresh on Schedule, Budget

CIO Jerry Dreyer told the board that ERCOT’s four-year effort to update its software and hardware technology — some of it dating back to the last decade — is on schedule and “on budget, or slightly below.”

The $48 million DC4 program, the ISO’s fourth data center refresh, is aimed at replacing technology at the end of its life and support, including networks, telecommunications, servers and storage. It was approved as part of ERCOT’s administrative fee request in 2015.

“Most equipment we’re running today is from the 2010 era,” Dreyer said. “You take on a lot of risk when you’re running outdated equipment. You take on compliance risk and security risk.”

Dreyer said he had no major risks and issues to report. He said 38% of the new technology has been deployed and 40% of the budget was spent through 2016. Some new technology has completed testing and is already being migrated.

Dreyer pointed out that his IT group supports three data centers, 4 million GB of stored data, more than 400 distinct applications and 1,400 servers. He said that at the same time the DC4 program is replacing 400 systems, ERCOT will also be making architectural improvements.

The project will conclude in 2019.

“The intention is to reduce the impact of an outage across multiple lines of business,” Dreyer said. “IT does not run the grid … but reliable technology is key. In order to ensure reliability at the top, we need to keep the underpinnings working as well.”

Board Approves 5 Revision Requests

The board unanimously approved four nodal protocol revision requests (NPRRs) and one Planning Guide revision request (PGRR) previously approved by the TAC. (See Revision Requests, Shadow-Price Cap Change Endorsed, ERCOT Technical Advisory Committee Briefs.)

- NPRR794: Moves reporting requirements for unregistered distributed generation from the Commercial Operations Market Guide to the protocols.

- NPRR800: Incorporates futures prices in calculations of collateral requirements.

- NPRR805: Clarifies the criteria under which congestion revenue right (CRR) account holders can submit multi-month offers for long-term auctions. The months must be consecutive, within the period covered by the auction and during months when the account holder has ownership of the CRR.

- NPRR806: Clarifies that municipalities and cooperatives not participating in ERCOT’s competitive market (non-opt-in entities, or NOIEs) have the option of accepting a refund or capacity for their pre-assigned CRR-eligible resources. The NOIEs cannot select one option for some months of the year and the other option for the remaining months.

- PGRR053: Modifies the conditions proposed generating resources must meet to be included in steady state working group base cases, requiring only the data provided for full interconnection studies.

TAC Cancels February Meeting

With a “limited number” of voting items on the agenda, the TAC has canceled its Thursday meeting. The committee will resume its regular schedule March 23 before the board’s next scheduled meeting in April.

TAC Chair Adrianne Brandt told committee members to expect an email vote on a revision to the Commercial Operations Market Guide (COPMGRR044), which aligns with NPRR794.

– Tom Kleckner