The Waiting is the Hardest Part

WILMINGTON, Del. — After months of rule changes, PJM stakeholders decided to largely take a break at last week’s Markets and Reliability Committee meeting. Aside from endorsing some administrative revisions and an uncontroversial exception to competitive bidding for substation equipment, members rejected or deferred votes on all other voting items, often citing FERC’s lack of a quorum for why there is no pressing need to decide.

Decision on Order 825 Implementation Postponed Until March

Stakeholders agreed to delay voting for a month on additional rule changes associated with Order 825, which requires that shortage pricing be triggered for any period of energy or operating reserve. The order required PJM to eliminate its practice of waiting until a shortage is forecast for a sustained period before shortage pricing. (See FERC Issues 1st RTO Price Formation Reforms.)

To continue to avoid “transient shortages,” PJM has proposed a two-part response to the order. The first part, which was filed last month, satisfies FERC’s requirements for initiating shortage pricing. The second part — which PJM plans to submit to FERC as a Federal Power Act Section 205 filing contingent upon approval at the Members Committee meeting in March — would adjust its operating reserve demand curves. (See “Order 825 Implementation Moves Forward,” PJM Market Implementation Committee Briefs.)

“Is this a decision the commission could make absent a quorum?” American Municipal Power’s Ed Tatum asked. PJM staff confirmed that there has been a challenge in the docket, so FERC wouldn’t be able to accept it via delegated approval.

Susan Bruce of the PJM Industrial Customer Coalition asked if a vote could be delayed another month to work out issues. It’s possible, PJM’s Adam Keech responded, but the delay might create exposure for PJM’s markets if FERC requires implementation of five-minute settlements, also mandated by Order 825, by May.

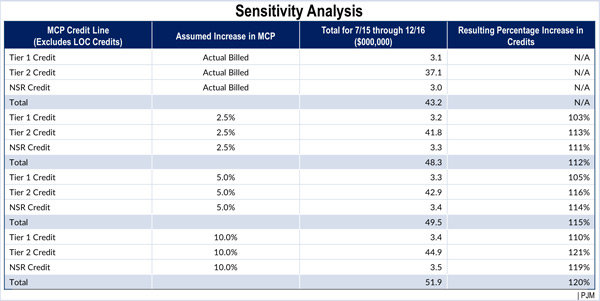

Keech also explained that an increase in the market clearing price will have as much as triple the impact on reserve clearing price credits. PJM’s analysis found that a 5% increase in the clearing price would add about $6.4 million, or 15%, to the credits, while a 10% increase in the price would add about $8.7 million, or 20%.

For the purposes of simplicity, the sensitivity study assumed that lost opportunity cost credits remained static. Generally, however, “as the clearing price credits go up, the opportunity cost credits go down,” Keech said.

Stakeholders Deny Replacement Capacity Initiative; Consider Other Incremental Auction Changes

A problem statement and issue charge to address replacement capacity failed to garner 50% approval after presenter Bob O’Connell of Panda Power Funds navigated around objections to secure a vote. He’ll get another chance on a separate problem statement involving incremental offers next month, when members also will consider the proposed charter language for the Incremental Auction Senior Task Force.

Several members had attempted to postpone voting on the problem statement for a month, but a vote to postpone fell short, receiving 3.33 in a sector-weighted vote that required 3.34 to pass. That allowed O’Connell to call for a vote.

Tom Rutigliano of consulting firm Achieving Equilibrium said a delay would help alleviate problems with the problem statement, such as what he called a mischaracterization of some FERC orders that put stakeholders “on a path to repeat the same conclusions that FERC has already rejected.” But O’Connell was intent on bringing the motion to a vote. Rutigliano then proposed some hastily devised amendments, some of which O’Connell accepted.

Citigroup Energy’s Barry Trayers also proposed amending the language to focus on streamlining the replacement-capacity process and reducing PJM staff discretion. O’Connell considered this a friendly amendment and included the revisions.

“Really this is a vote about whether we want to try to solve the problem on our own or if we want to have the commission solve it for us,” O’Connell said.

The proposal to revise the replacement-capacity rules comes after recent stakeholder debates about the impact of “paper capacity” — when a market participant offers into Base Residual Auctions and buys out of the obligation during subsequent Incremental Auctions to take advantage of price differences. (See “PJM Has No Objection to IMM’s ‘Paper Capacity’ Report,” PJM Market Implementation Committee Briefs.)

Regarding his second problem statement proposal, O’Connell said PJM’s opportunity-cost calculator needs to be recalibrated to account for penalty rates implemented along with the Capacity Performance market construct.

Independent Market Monitor Joe Bowring challenged a work activity to find ways to incorporate nonperformance charge rates into the calculators. O’Connell agreed to add “where appropriate” or “if necessary” as a revision.

The task force charter language was developed in response to a problem statement presented by Direct Energy that was approved in November. It focuses on the Incremental Auction structure and how excess capacity is sold back by PJM.

PJM’s Brian Chmielewski, who is facilitating the task force, said detailed replacement capacity issues will be addressed in a separate problem statement and issue charge.

Transmission Replacement Activity Hiatus Extended

Stakeholders agreed to extend the Transmission Replacement Process Senior Task Force’s hiatus for another 90 days, citing FERC’s continued silence on the issue.

In August, the commission issued an Order to Show Cause questioning whether PJM transmission owners are complying with their local transmission planning obligations, specifically with respect to supplemental projects, as required by Order 890. (See “Transmission Task Force Halts Most Action in Response to FERC Order,” PJM Markets and Reliability and Members Committees Briefs.)

The TOs responded in October, but FERC has not acted on the filing and has no deadline for doing so.

PJM’s Fran Barrett, who is facilitating the task force, said the commission’s loss of its quorum was unexpected and recommended extending the deferral.

Some stakeholders called for using the downtime to resolve the problems. “We can work a thorny issue for FERC so FERC doesn’t have to work it for us,” Tatum said, who added that he has “great concern” with extending the hiatus.

“The time we have been waiting for FERC to act has not been wasted time. We have been working hard,” Exelon’s Gloria Godson said.

O’Connell said the decision should be based on whether there is anything to talk about. “Just go ahead and tell Fran: ‘Fran, we have enough meat for a meeting. Go ahead, and schedule it. If we don’t have enough meat, don’t schedule it,’” he said.

Barrett agreed to return to next month’s meeting with an update.

Stakeholders Endorse Revisions

Stakeholders endorsed by acclamation several manual revisions and other operational changes:

- Revisions to Manual 22 to update terms and definitions, developed as part of a periodic review of the manual. The term revisions largely replace “partial outage” so that the manual now refers to forced, maintenance and planned outages as “derated.” For example, “Equivalent Forced Partial Outage Hours” became “Equivalent Forced Derated Hours.”

- Revisions to manuals 13 and 27 will add the Mid-Atlantic Interstate Transmission Co. as a transmission owner in PJM. MAIT is a new subsidiary of FirstEnergy that owns and operates the company’s transmission assets in the Met-Ed and Penelec utility territories. (See NJ Opposition Derails FirstEnergy’s Tx Reorganization — but not Projects.)

- Revisions to the RTEP and the Operating Agreement to exempt certain transmission substation equipment from Order 1000 competitive bidding. (See “Endorsements Sail Through by acclamation,” PJM Planning Committee and TEAC Briefs.) John Farber of the Delaware Public Service Commission staff took the microphone to thank PJM for its attention to the topic. The measure was also later endorsed by the Members Committee.

Members Committee

Members Approve Uplift Proposals

Following up on swift action taken at last month’s MRC meeting, members endorsed a two-phase implementation of revisions to address uplift. (See “Work on Uplift Moves Forward Despite NOPR,” PJM Markets and Reliability and Members Committees Briefs.)

Two stakeholders complained that the proposals didn’t align with FERC’s order on the issue. “I don’t agree that the package is counter to FERC’s order,” PJM Public Power Coalition’s Carl Johnson replied. “In fact, I think it’s the first step to something they might approve.”

Consent Agenda Endorsed

The committee also endorsed:

- Tariff, Operating Agreement and Reliability Assurance Agreement revisions to update definitions.

- Revisions to the PJM Tariff regarding operating parameters.

— Rory D. Sweeney