By Amanda Durish Cook

MISO and PJM staff broke their silence Tuesday on ongoing efforts to solve the RTOs’ pseudo-tie congestion double-counting problem.

At a Feb. 28 MISO-PJM Joint and Common Market Initiative meeting, Kevin Vannoy, MISO director of forward operations planning, said the RTOs would solve the double counting of congestion for pseudo-tied resources in the near term by providing congestion rebates, while they would develop a way to allow pseudo-ties in the day-ahead scheduling process by 2018.

The fix may also be applied to pseudo-ties between MISO and SPP.

“MISO now has over 5,000 MW of pseudo-ties in and out [to PJM and SPP] that could be subjected to this congestion overlap,” Vannoy said.

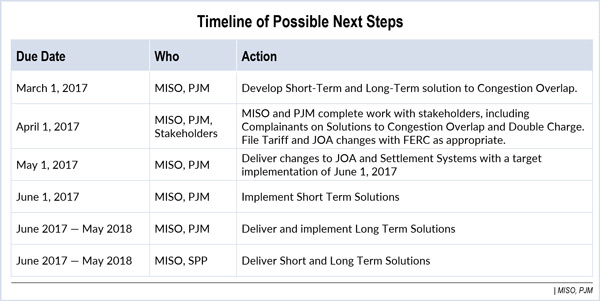

MISO and PJM said they hope to roll out the first phase of the changes by June 1. They will include accounting for market flows in market-to-market settlements so attaining balancing authorities have enough revenue to issue refunds. The congestion overlap will be addressed by allowing attaining BAs to provide congestion rebates for generators.

Beginning in June 2018, the RTOs plan to have Tariff and joint operating agreement changes in place that let pseudo-ties schedule and settle in the source BA’s day-ahead market. The day-ahead coordination will take significantly more work than the near-term rebate plan.

“Right now, the day-ahead markets in MISO and PJM might not be aligned,” Vannoy said, adding that each RTO is only aware of the other’s constraints in real time.

MISO and PJM officials acknowledged that creating a rebate process by June 1 is ambitious. “This is a very aggressive timeline. For something to be in place by June, we have to work on Tariffs and JOAs,” Vannoy said. He asked for stakeholder comments by March 7.

Both MISO and PJM staff said they could convene a special meeting to discuss the proposal before the next scheduled Joint and Common Market meetup in May.

SPP Also?

The process could also be applied to MISO and SPP’s pseudo-tied generation and load. Unlike MISO and SPP, MISO and PJM don’t share any pseudo-tied load; all pseudo-ties are generation-based. Vannoy said the proposed rules could apply to MISO and SPP’s pseudo-tied generation and load “to the extent that we can get to a solution.”

Solution to FERC Complaints

Vannoy said MISO and PJM will also discuss the proposed solutions with two municipal power agencies and a generator that have filed complaints with FERC over the double counting to “explore resolution outside FERC.”

In November, both RTOs declined to publicly discuss the double-counting issue until the complaints were resolved. (See PJM, MISO Go Quiet on Pseudo-Ties; Reach Interface Pricing Accord.)

Tilton Energy, the owner of a 180-MW natural gas generator in Eastern Illinois, filed a complaint in August arguing that MISO is violating its Tariff by assessing congestion and scheduling fees on Tilton’s pseudo-tied transactions that have already been assessed by PJM (EL16-108).

In a late December complaint, the Northern Illinois Municipal Power Agency asked for a “full evidentiary proceeding involving PJM, MISO and the numerous pseudo-tying entities being harmed by the implementation of MISO-PJM pseudo-ties” (EL17-31).

And in January, American Municipal Power asked FERC to stop PJM from collecting charges from generators pseudo-tied out of the MISO balancing authority area where congestion charges were already assessed (EL17-37).

MISO Assistant General Counsel Michael Kessler has said FERC might combine the complaints.

Asked whether the RTOs would share with stakeholders details of their discussions with the plaintiffs, MISO Managing Assistant General Counsel Erin Murphy said the current meeting’s discussion might solve the complaints.

“I can’t say that there won’t be separate discussions,” she added.

Generator Skeptical

Tilton representative Elena deLaunay asked why PJM would be the appropriate side of the double count to be refunded, saying that MISO’s congestion charges were more inappropriate for PJM-based Tilton. She asked why PJM should have to provide refunds when its congestion is in the market the generator is being settled in, is created through the market-to-market process and flows through the make-whole calculation.

“We are being dispatched into price signals on the MISO side that we can’t follow as a PJM resource,” deLaunay said.

She also said the long-term solution to solve congestion double counting may be flawed: “Forcing us to speculate on which market we will be dispatched in [day-ahead or real-time] can create additional risk rather than mitigating it.”

Vannoy said the rebate will be based on physical transmission usage charges, and not on a pseudo-tie transaction basis. He also said MISO already provides congestion rebates through financial transmission rights, so he didn’t see it as “appropriate” that the RTO would only charge once and offer rebates twice.

Stricter Rules Coming

Both PJM and MISO are also focused on introducing stricter pseudo-tie rules.

Vannoy said MISO’s more stringent pseudo-tie process will be filed with FERC in the “near term,” despite staff putting the proposal on hold to better explain it to its stakeholders. (See “RTO Delays Filing Pseudo-Tie Proposal,” MISO Advisory Committee Briefs.)

Tim Horger, manager of interregional coordination at PJM, said his RTO will soon file its own more stringent pseudo-tie rules with FERC as well. Last month, stakeholders approved more stringent rules for new pseudo-tie applications but declined to endorse them for existing pseudo-tied units. PJM announced last week that it is going to file the new rules for FERC approval for both new and existing pseudo-ties. (See PJM to Tighten Pseudo-Tie Rules Despite Stakeholder Pushback.) A first-ever PJM pseudo-tie pro-forma agreement, however, was postponed last week after stakeholder concerns.

PJM and MISO pseudo-tied 2,061 MW of transfers for the 2016/17 planning year, compared with 156 MW during the previous year.

The increased pseudo-ties have produced more congestion and brought more attention to pricing discrepancies along the border between the RTOs, which can result in revenue imbalances between RTOs and increased uplift payments in addition to the double counting of congestion. The RTOs last year said MISO would use data from December 2016 to begin an analysis of pseudo-tie congestion in mid-2017.

The RTOs will also adopt a new common interface definition beginning June 1, moving from about 1,800 nodes inside PJM to a common interface consisting of 10 nodes close to the seam. Beibei Li, of MISO’s market evaluation and design team, said the change will reduce congestion overlap.

“We’re moving from a fairly large interface definition to something closer to the seam,” Li said.

A MISO 2016 study shows the new common interface definition affects real-time and day-ahead prices by less than $5/MWh in almost all cases, she added. The interface definition change is meant to eliminate overlapping congestion pricing incentives.

“The price incentive on June 1 shouldn’t differentiate all that much,” Li said.

The RTOs have made 23 successful day-ahead firm-flow entitlement exchanges since the exchange process began in January 2016. None of PJM’s 15 requests or MISO’s eight have been refused by the other RTO. (See “Regions Begin FFE Exchanges,” MISO/PJM Joint and Common Market Meeting Briefs.)