By Rich Heidorn Jr.

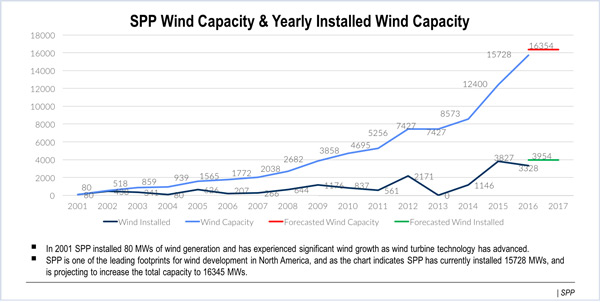

CARY, N.C. — SPP cannot absorb much more wind power within its footprint, CEO Nick Brown told the RTO Insider/SAS ISO Summit last week.

“I believe we’re at a saturation point in terms of the appetite of load within our footprint to want more wind,” said Brown. “How much is too much? I think we’re nearing that, although the [generator interconnection] queue is still full and we are seeing more and more and more wind interconnected. So what happens when we can’t accommodate anymore? We’ll curtail it for reliability reasons.”

On March 14, the day of the panel discussion, SPP was getting 55% of its electricity from coal, with about 18% each from wind and natural gas and 7% from nuclear.

On March 19, the RTO announced it had set a new wind-penetration record of 54.22% early that morning, with 12,078 MW produced.

“How can it keep growing? … There is going to have to be a demand for wind outside our footprint. And so far, we’re not seeing requests for that. We’re not seeing people come in to our transmission queue and say ‘I want transmission service to move wind from the western part of SPP footprint the east or to the west,’” Brown said. “[Wind] is incredibly efficient in how its produced, but if we don’t see that demand to the eastern load centers, it will saturate.”

The variability of wind has provided its own challenges.

On some days, SPP has seen 10,000 MW of wind disappear and reappear. “That’s the equivalent of 10 nuclear units,” Brown noted. “We are becoming so much more dependent on big data. Tons and tons and tons of granular information from all the wind in the footprint across 14 states.”

Update on Expansion

That footprint may be expanding with the potential addition of the Mountain West Transmission Group, a partnership of seven transmission-owning entities within the Western Interconnection, including the Western Area Power Administration’s Loveland Area Projects and Colorado River Storage Project. (See Mountain West to Explore Joining SPP.)

“As we continue to work through the details of integrating them into our wholesale markets, it will create new technical challenges operating a market across two interconnections tied together by four DC ties,” Brown said.

Brown said SPP has considered both operating two separate markets and solving a single market across the two interconnections. “We’re mostly leaning towards a single [market] across the entire footprint constrained by the DC ties,” Brown said.