By Robert Mullin

CAISO’s real-time market experienced an uptick in volatility during the fourth quarter of 2016, as five-minute prices at times spiked to well above day-ahead and 15-minute levels on unexpected variability in output from solar resources.

On the flip side: Solar generation increasingly sent mid-day prices into negative territory during the quarter, a trend that the ISO’s internal Market Monitor says is continuing into this year.

“November did see a fairly high frequency of prices above the $250 level in the five-minute market,” Gabe Murtaugh, a senior analyst with the ISO’s Department of Market Monitoring, said during a March 22 call to discuss his group’s quarterly market issues report. “You’d have to go back to the beginning of 2015 to see this frequency.”

In November, real-time prices surged to $250 or higher during nearly 1.5% of intervals, compared with fewer than 0.4% of intervals during the same period in 2015. Prices hit $750 or more during 0.6% of intervals, up from 0.3% a year earlier.

Murtaugh attributed the prices spikes to more cloud cover than was forecast by CAISO, translating into lower solar output than was accounted for in the day-ahead market during specific intervals. The ISO was forced to move up the bid stack to secure higher-priced resources in real-time to cover the shortfall — especially during the afternoon ramp as solar resources began to reduce output.

“This outcome resulted in part from a combination of solar deviations and tight supply conditions during intervals when system ramping needs were greatest,” the department said in its report.

Contributing to the price discrepancies between the five- and 15-minute markets were differences in the solar forecasting methodologies used for each, an issue the ISO addressed through changes to its forecasting software in December.

Still, instances of high prices during the fourth quarter were “fairly irregular,” according to Murtaugh. More frequent were intervals of negative prices, the Monitor noted.

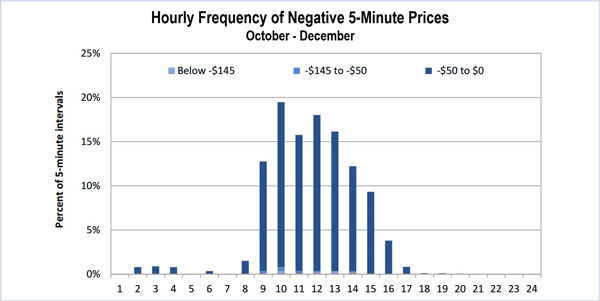

The department observed negative prices during 4.7% of intervals during the five-minute market and 1.8% of those in the 15-minute market. By comparison, during the same period a year earlier, negative prices occurred in 2% and 1% of five- and 15-minute market intervals, respectively.

The last quarter of 2016 also saw five-minute prices go negative nearly 20% of the time during the 10 a.m. interval — the beginning of the mid-day period most subject to solar-drive price dips.

Nearly all of the negative prices were the result of the ISO’s market mechanisms — and not the result of out-of-market operations to curtail output.

“These are conditions where an economic downward dispatch is issued to a unit with a negative marginal cost, so negative marginal cost units are setting the marginal price in the system,” Murtaugh said. “This is a solution that is arrived at from the market optimization and it’s similar to any other solution that we would see in the market during other times of the day when marginal costs are set at a marginal level.”

The Monitor’s data showed that most of the negative prices held to a range between $0 and -$50/MWh.

Carrie Bentley of Resero Consulting wondered where most of the negative prices clustered — closer to $0 or $50?

“Off the cuff, it tends to be more clustered between the $0 and $25 range,” Murtaugh responded. “That typically tends to be the amount of tax incentives that are given out on a per-megawatt-hour basis to solar facilities and wind facilities — and those tend to be the ones we see setting the price more frequently.”

Murtaugh also offered call listeners a “teaser” regarding the first quarter: “For the data that we’ve already looked at in 2017, the [negative price] numbers are fairly high for the first quarter as well.”

Wei Zhou, a senior project manager with Southern California Edison, probed Monitor staff about an observed increase in negative prices in the ISO’s day-ahead market this year.

“What’s the expectation for the frequency of negative pricing in the day-ahead market?” Zhou asked.

Keith Collins, CAISO manager of monitoring and reporting, called the development an “improvement” that would allow the ISO to better align resource commitments in the day-ahead market with actual conditions in real-time, decreasing the potential for oversupply.

“So shifting [negative prices] to the day-ahead is not necessarily in and of itself a bad thing, but it’s not a trend that was observed prior to the last few weeks,” Collins said, adding that it was a topic that could be covered in a future Market Performance Planning Forum.