By Michael Kuser

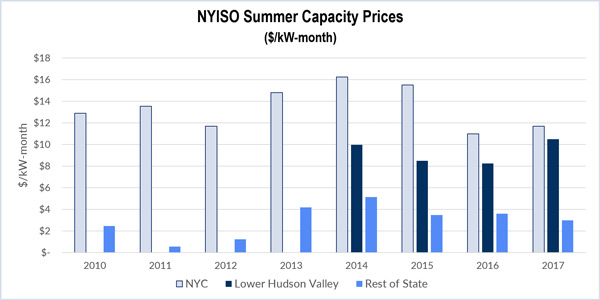

NYISO’s summer 2017 capacity auction results surprised analysts last week with higher-than-expected prices for New York City — up 72 cents year over year to $11.71/kW-month.

Prices for the Lower Hudson Valley rose even more, jumping $2.25 to $10.50/kW-month, while the Rest of State dropped 62 cents to $3. Long Island was up $1.50 to $5.79.

In an April 5 market analysis, UBS Securities analyst Julien Dumoulin-Smith said the results were higher than “we had initially expected as a new, more bearish demand curve was put into effect alongside weak demand forecasts.”

Retirements and New Entry

The results indicated that the 312-MW Cayuga coal-fired plant — which is operating under a reliability support services agreement with New York State Electric and Gas that ends in June — cleared the auction. Without higher prices, however, Cayuga Unit 2 could face retirement next year because of environmental upgrades needed to operate past mid-2018, UBS said.

Riesling Power, a company affiliated with The Blackstone Group, purchased Cayuga and the Somerset coal plant outside Buffalo — the only two operating coal-fired plants in the state — last year from a group of bondholders that had purchased them from the bankrupt AES Energy East in 2012. The sale came after New York regulators rejected a request to have ratepayers fund a $102 million conversion of the plant to natural gas. (See Cayuga Coal Plant in Jeopardy.)

The higher New York City prices suggested that 79 MW of uprates did not clear, but UBS said it expects prices to drop by $1/kW-month next year because of the uprates and exports from the Bayonne Energy Center, which is adding two new turbines that will boost its capacity from 512 MW to 644 MW. The New Jersey plant is connected to a substation in Brooklyn via a 345-kV transmission line under New York Harbor.

Additional downward pressure on New York capacity prices may come in the future from two new combined cycle gas turbine generators under construction, including the 1,100-MW Cricket Valley plant in Dover, expected to be operational by the first quarter of 2020.

The 650-MW CPV Valley plant has targeted a February 2018 opening, but construction has not yet begun on a 7.8-mile lateral to supply the plant. Millennium Pipeline sued the state Department of Environmental Conservation in December over the department’s refusal to issue a required water quality permit and expects a decision from the D.C. Circuit Court of Appeals in April or May. (See Pipeline Sues to Force NY to Issue Permit for CPV Plant.)

One wild card is the 1,242-MW Roseton power plant in the Lower Hudson Valley, which has approval to export 500 MW to New England for the 2018/19 period. Roseton’s decision to export or not may depend on “whether a half year capacity obligation for the winter can be established to maximize its position in both markets,” UBS said. (See FERC Sides with ISO-NE in Capacity Dispute with NYISO.)

UBS said prices are unlikely to rise for the next three years. “With more renewables coming, it is hard to point to much of a bullish prospect on either energy or capacity until Indian Point retirements hit in 2020 and 2021,” it said in a March 23 report. (See NYISO, PSC: No Worries on Replacing Indian Point Capacity.)

The mothballed 435-MW Dunkirk coal-fired plant near Buffalo has “little chance” of converting to natural gas and returning to the grid, UBS said — a prediction that was strongly denied by NRG spokesman David Gaier.

“UBS doesn’t speak for NRG. Our plans are to move the gas addition project forward, as I’ve said several times since November,” Gaier said.

Impact on IPPs

The results were good news for NRG, for which NYISO represents 10% of its fossil-fueled generation. Two other independent power producers, Dynegy (4%) and Calpine (1%) have much lower exposures to the state.

NRG’s share price rose from $18.86 to $19.05 following the announcement of the results April 4, but the boost was short-lived and shares closed the week at $18.49.