By Michael Kuser

The New York Public Service Commission voted Thursday to maintain current incentive payment rates for utilities’ dynamic load management (DLM) programs through 2017 while ordering the companies to standardize their enrollment processes and approving other changes that the commission said would “ease DLM program enrollment and participation.”

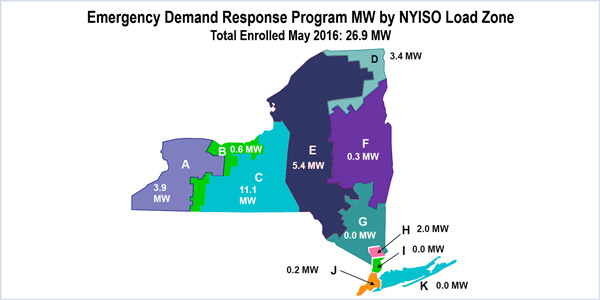

| NYISO

Approved in 2014, New York’s DLM initiatives include:

- A peak load-shaving commercial system relief program (CSRP), which is called 21 hours in advance of a need for load relief, as determined by day-ahead load forecasts;

- A distribution load relief program (DLRP) to support local reliability, called two hours in advance during contingencies and system emergencies; and

- A direct load control (DLC) program, which allows utilities to cycle residential and small commercial customers’ air conditioning and other controllable loads.

In their December 2016 annual reports on the programs, Central Hudson Gas & Electric, Niagara Mohawk Power and Orange and Rockland Utilities proposed changes. New York State Electric and Gas and Rochester Gas and Electric did not seek changes.

Before calling a vote on the order, which was included in the consent agenda, Interim Commission Chair Gregg Sayres asked for any comments. Only one other commissioner remains on the PSC following the March resignation of Chairman Audrey Zibelman and the retirement of Commissioner Patricia Acampora: Commissioner Diane Burman, who spoke up.

She said she voted no on some aspects of the demand response cases last year out of “a concern that the commission take a more holistic approach.”

However, Burman said there was a need to act now to set the DR rules for the summer 2017 capability period, which runs from May 1 through Sept. 30. “There needs to be regulatory certainty,” she said. “If we delayed action here it could mean changes being made mid-period or not at all.”

Incentive Changes Deferred to 2018

While maintaining the current incentive payments for 2017, the commission said it will consider changes for 2018 based on the results of marginal cost of service (MCOS) studies and the Value of Distributed Energy Resources proceeding initiated in March. (See NYPSC Adopts ‘Value Stack’ Rate Structure for DER.)

“Avoided [transmission and distribution] infrastructure costs constitute the majority of the benefits applicable to DLM programs,” the commission said. “DLM program incentive payment rates are directly influenced by the [benefit-cost analysis] relying on those benefits, and the MCOS studies used by the utilities to determine the per-kilowatt cost of avoided T&D for use in the BCA. Therefore, the MCOS studies are critical to determining if the DLM programs are being administered in a cost-effective manner, and if changes to such program incentive payment rates are justified.”

The commission said the MCOS studies are being reviewed and may be changed as part of the Value of DER proceeding.

Central Hudson

In addition to rejecting Central Hudson’s request to significantly lower CSRP incentive rates, the commission also rejected its proposal to eliminate its DLC program, which the company said has no participants (15-E-0186).

As it had in 2016, the commission also rebuffed Central Hudson’s request to remove the month of May from the capability period. The company said curtailments are unlikely during May, noting that the maximum demand experienced during the month has not exceeded 88% of the annual peak demand for the last decade. But the commission said “a lack of historic peak load conditions does not preclude future heat waves in May,” and that a change “would detract from tariff uniformity.”

The regulators approved the company’s proposal to increase the trigger for calling CSRP events to 97% of the summer peak forecast load from the current 92%.

The company said that the large number of events called in its service territory using the 92% threshold “led to less than optimal participant performance” in 2016, the commission noted. The 97% trigger would capture the top 10 load hours during the summer and would result in about three events each summer, the company said.

“Although the commission established a consistent 92% CSRP dispatch threshold for all of the utilities in the 2016 DLM order, experience during the 2016 summer capability period suggests that a standard statewide threshold may not result in optimal program performance,” the PSC said. “This is evidenced by the fact that, despite each utility having the same 92% threshold, CSRP planned events were called many more times in utilities with smaller service territories compared to those with a larger footprint. For example, there were 13 CSRP planned events called by RG&E, and nine by Central Hudson, but only four, two and one event called by Niagara Mohawk, NYSEG and O&R, respectively.

“Instead of maintaining a consistent 92% threshold across all utilities, the utilities should design CSRP thresholds that both recognize the unique features of their service territories and seek to balance the interests of CSRP participants and of other customers.”

Niagara Mohawk

While rejecting Niagara Mohawk’s proposal to modify CSRP, DLRP and DLC incentive rates, the PSC approved its proposed expansion of the DLRP to up to eight additional areas of its service territory in 2017 (15-E-0189).

“In only offering the DLRP in certain areas where there are specific T&D infrastructure projects [that] can be avoided, Niagara Mohawk is using the DLRP as a non-wire alternative (NWA) demand response program instead of as a generalized program to support distribution system reliability,” the commission said.

“While Niagara Mohawk will be allowed to continue to operate its DLRP in this manner for the 2017 summer capability period, the commission expects Niagara Mohawk to expand the DLRP to its entire service territory for 2018. Instead of limiting the DLRP only to specific NWA areas, Niagara Mohawk should offer different values in NWA areas for both the CSRP and the DLRP, depending upon whether the need for the NWA is based on load growth, reliability issues or both.”

Orange and Rockland

O&R’s proposed modification to its DLRP incentive payment rates was rejected while its proposed addition of CSRP notices was approved (15-E-0191).

The utility proposed adding a 21-hour advance advisory notice, with intraday two-hour minimum advance notification of confirmation or cancellation of a planned CSRP event. The advisory notice would be triggered when its day-ahead forecasted load is 92% or more of the forecasted summer systemwide peak.

The company said that under the current notification rules, it is unable to cancel a planned event even if conditions change, eliminating the need for load relief.

The commission approved the proposal while also directing Central Hudson, Niagara Mohawk, NYSEG and RG&E to propose similar notifications for 2018. The PSC had permitted an identical modification to Consolidated Edison’s CSRP in December.

Also approved was O&R’s proposal to allow direct participants and aggregators to increase their kilowatt pledge between capability periods and plan for easing the generator emissions and permitting process. As with the notice rule, the commission ordered the other utilities to make similar changes.

Under prodding by the Advanced Energy Management Association, NRG Energy and Direct Energy, the PSC ordered the utilities to standardize their DLM enrollment and settlement processes for 2017 and allow batch enrollments by 2018.

Pre-REV DR

“For me, these demand response programs fit into a specific bucket,” Burman said. “They’ve been in place in New York City for many years, pre-[Reforming the Energy Vision], and should be expanded statewide. They are intended to be cost-effective programs that produce real peak load reductions at critical periods in the summer.”

While last week’s order addresses inter-day reliability problems, Burman said other issues remain unresolved under REV, including utility earnings adjustment mechanisms and setting a “Value D” — the PSC’s plan to calculating the value of distributed energy resources by adding a distribution component (“D”) to wholesale LMP pricing. (See NYPSC Outlines Reforming the Energy Vision Changes.)

“But here, this action is really targeted to those demand response programs,” said Burman. “It does not have a fatal impact on the utility … and all the other proceedings.”

Ravenswood Sale Approved

In a separate electric power case, the PSC approved a petition for the expedited sale of TransCanada’s 2,400-MW Ravenswood generating facility in Queens, N.Y. to Helix Generation for $2.5 billion — with Burman voting to approve a one-commissioner order issued to that effect by Interim Chairman Sayres the previous day.

Burman noted that the order is clear in deferring to NYISO and “FERC on matters that deal with the market power and other pending matters dealing with AC transmission and western New York.”

Noting policymakers’ concerns over market power and state resource planning, Burman said she is looking forward to FERC’s technical conference on May 1-2, “where many of these issues will be fleshed out.” The conference will focus on tensions between state public policies and wholesale markets in NYISO, ISO-NE and PJM (AD17-11).