By Robert Mullin

Financial traders made clear last week that they won’t give up CAISO’s congestion revenue rights (CRR) auctions without a fight, sparring with the ISO’s internal Market Monitor at the first meeting to discuss the auctions’ revenue shortfalls.

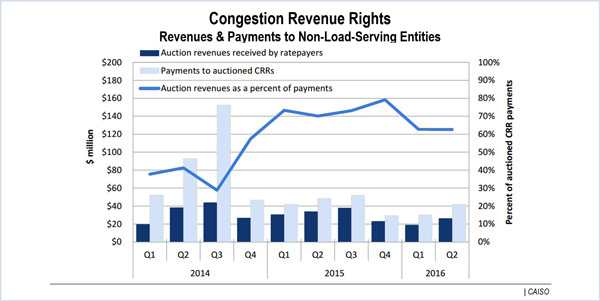

At a contentious meeting of the Congestion Revenue Rights Analysis Working Group on April 18, the CAISO Department of Market Monitoring was unyielding in its position that the auctions should be scrapped and replaced with a bilateral swap market that doesn’t burden California ratepayers. The department said ratepayers have paid more than $560 million since 2012 to cover the shortfalls, receiving only 49 cents of every dollar paid out.

Opponents of the initiative complained in January that it lacks widespread stakeholder support. (See CRR Initiative Elicits Mixed Reviews from CAISO Participants.) In comments filed with the ISO earlier this year, the Western Power Trading Forum (WPTF) criticized it as the Monitor’s “pet project.”

Who Owns the Transmission System?

The Monitor has argued that the main beneficiaries of the existing auction structure are financial speculators rather than load-serving entities or generators. Its objective is “to not have ratepayers offer financial swaps at a zero-dollar reservation price,” said Ryan Kurlinski, manager of the department’s analysis and mitigation group.

“If there were no CRRs, no auction, no allocation, who would get the [congestion] rent? Transmission ratepayers,” said Roger Avalos, a lead analyst with the Monitor. “Who would get the auction revenues? Ratepayers.”

“You’re making that as a conditional statement upon this alternate universe you’ve created, but you don’t know that’s actually what would happen through the course of policy decisions,” countered Seth Cochran, manager of market affairs and origination at DC Energy, which trades CRRs and other financial instruments tied to the power and natural gas markets.

Neil Huber, an energy trader with XO Energy, took issue with the fact that the Monitor was using the terms LSEs and ratepayers “interchangeably.” He contended that “we would all agree that the LSE may be paying for the underfunding” of the auctions, but that use of the term “ratepayer” seemed “politicized” within the context.

Kurlinski explained that transmission developers recover their capital costs through CAISO’s transmission access charge, which is charged to metered load — a cost that LSEs pass directly to their customers.

“So that’s where we’re getting to the concept of ratepayers ultimately paying for this physical transmission, and therefore they have the rights to revenues generated from those assets in the day-ahead market — which are the congestion rents,” Kurlinski said.

“Everything in the [auction] balancing account is passed to ratepayers, not the shareholders of LSEs,” Avalos added.

Michael Rosenberg, principal trader with ETRACOM, questioned the assumption that the transmission system is effectively owned by ratepayers.

“Right now, it’s not clear to me, after all this discussion, why that transmission congestion revenue belongs to — quote-unquote — transmission ratepayers or ratepayers, and why the current market mechanism is inferior,” Rosenberg said.

CRRs Benefits to Ratepayers

In a presentation to the group, Abram Klein of Appian Way Energy Partners said that “CRRs are not bad for consumers — it’s really the opposite.”

“And what matters for consumers is not how much money they’re getting from the CRRs, but what’s the premium and the cost to certain load in the competitive wholesale market,” Klein said.

In a well-designed market, he said, CRRs actually lower risk premiums for serving wholesale load, which brings down forward prices. The upshot: Consumer costs are ultimately reduced by the increased transparency and liquidity provided by CRR auctions, he said.

Klein said the auctions will become increasingly important as California moves toward more retail choice through the growth of community choice aggregators, which will rely on CRRs to keep their forward prices in check.

Doug Boccignone, a consultant representing Silicon Valley Power, the CCA for Santa Clara, noted that CCAs are eligible to participate in the ISO’s CRR allocations after effectively taking over the role of their host utilities. “They have all the rights and obligations that any other LSE has,” he said.

Boccignone added that LSEs appear to be participating in the auctions to unwind their own allocation positions rather than to acquire more CRRs.

Other Markets for Hedges?

Klein said that although congestion costs are relatively small — representing just 2% of the cost of serving load — the CRRs are “a crucial piece because they are really embedded in the LMP market design.” Eliminating the CRR auction would remove “one of the pillars” of the market, he said.

Ellen Wolfe, a consultant speaking for the WPTF, said that LSEs indirectly benefit from the CRR auctions through deals made “more efficient” by access to CRRs outside the allocations.

“A seller cannot necessarily transact with a buyer well unless there is some way to hedge, and those deals become more efficient with the ability to hedge well, and the CRRs in a nodal market allow that process,” Wolfe said. Without the auction, there’s no way for third parties to get hedges, she said.

“I don’t think that we’re in any way talking about eliminating all markets for these kind of financial hedges,” Kurlinski said. “I think the purpose of this initiative is, ‘What are the options for replacing the current CRR auction? Does it have to be this CRR construct? Does it have to be the ISO deciding how many of these financial swaps to offer up?’”

“Another market can evolve if there’s actually demand for these hedges,” Kurlinski said. He said such a market wouldn’t be liquid today because the ISO is selling a “huge quantity” of what are effectively financial swaps at a zero-dollar reservation price.

“Nobody else is going to be able to come in and compete with that,” Kurlinski said.

Need for Root Cause Analysis

Wolfe said the Monitor seems to be concerned that when revenues are sold for below-market value that “there’s some kind of transfer of wealth” and that there’s no remedy available to address that.

“Along the way, there’s been no real explicit investigation of the root causes of why those CRR clearing prices are less than day-ahead congestion and what’s driving” the discrepancy between auction revenues and CRR payouts, Wolfe said.

Kolby Kettler of energy and commodities trader Vitol encouraged market participants to consider the “intangible” transparency benefits of the CRR auctions. The transparency behind auctioned CRRs is used by lenders to price their financing to energy project developers, Kettler contended.

“Do they pull up the CRR price and use that as it is? Maybe not,” Kettler said. “But it goes into consideration and it reduces the premiums back to load based on this information. So that’s something we need to take into consideration. It’s very hard to quantify some of those things.”

The intangible benefits do exist, agreed Alan Wecker, market design analyst at Pacific Gas and Electric. But he offered a significant qualification.

“It’s just that the magnitude of the loss is so large that it causes me to want to have a better way to make those intangible benefits tangible,” Wecker said. “Without that, it’s so ethereal that it’s really hard for us to agree that no change needs to be made or that the changes don’t need to be that massive.”