WESTBOROUGH, Mass. — Although the Marcellus Shale is currently producing about 19 Bcfd of natural gas, it remains a challenge to get that gas to New England, Tom Kiley, CEO of the Northeast Gas Association, told the ISO-NE Planning Advisory Committee on Wednesday.

“What we’re seeing now is that while projects have FERC approval, they are being denied permits by state agencies,” said Kiley, whose group represents gas distribution and transmission companies, and LNG importers.

“Projects are often being delayed one or more years — even with federal permits in hand, even with contract commitments,” Kiley said in a presentation.

Kiley cited National Fuel Gas’ response to the New York State Department of Environmental Conservation’s April 7 decision to deny water quality permits for its Northern Access pipeline. “National Fuel made a very strong statement, so we’re hoping that this pushback will lessen the resistance to new pipelines,” Kiley said. “Something has to give.”

In the statement, CEO Ronald J. Tanski said any impact of the pipeline construction on water quality would be “temporary and minor.”

“These construction activities would certainly have less effect than either exploding an entire bridge structure and dropping it into Cattaraugus Creek (Route 219) or developing and continuously operating a massive construction zone in the middle of the Hudson River (Tappan Zee Bridge) for a minimum of five years, both NYSDEC-approved projects,” Tanksi continued.

He said the state is attempting to create “a new standard that cannot possibly be met by any infrastructure project in the state that crosses streams or wetlands, whether it is a road, bridge, water or an energy infrastructure project.”

ISO-NE Embeds Behind-the-Meter PV in Load Forecasting

ISO-NE planners will capture about three-quarters of the region’s behind-the-meter solar PV in their 2017 capacity, energy, loads and transmission (CELT) load forecast, Manager of Load Forecasting Jon Black said.

The RTO began forecasting BTM PV in 2014 in response to concerns that its rapid growth would not be captured within the long-term load forecast, which relies on historical load trends. The RTO has contracted with Quantitative Business Analytics for PV production data at five-minute intervals from more than 9,000 installations in New England.

“We’re taking a lesson from Germany, where they don’t have telemetrics on every source, but a representational subset,” Black said during an update on the RTO’s efforts.

Black said that RTO staff used the last five years of data. “Before 2012, PV was insignificant, just background noise,” he explained. He used the same term — “noise” — to describe the scale of storage of PV-generated energy today and explain why the grid operator does not yet have projections for storage growth or its potential load impact.

For forecast year 2017, the CELT’s net load projections includes 479 MW of “embedded” PV, which represents 83% of the PV indicated by the forecast for the year. The RTO predicts that the embedded PV — 1.6% of load for 2017 — will rise to nearly 3% of load by 2026.

“Some people think we’re just subtracting something off the load forecast, but separate component forecasting requires reconstituting the element to have an accurate PV reading on net load data,” Black said.

He also said separately forecasting and accounting for BTM PV as the RTO is doing will provide protection against the risk of under-forecasting load if the timing of the summer peak shifts later in the day as PV output diminishes, or if growth in BTM PV slows down from its recent pace.

Eversource to Build Control House at Mount Tom

Eversource Energy and ISO-NE told the PAC they support a $7.7 million project to keep the Mount Tom switchyard and build a control house.

Eversource’s Carl Benker gave a presentation on the plan, a response to Dynegy’s announcement that it will retire its 146-MW coal-fired Mount Tom Generating Station on June 1, 2018, and demolish the facility.

Because the three 115-kV transmission lines to which the plant is connected (line 1039 to Midway, 1447 to Pineshed and 1428 to Fairmont) will remain in service, the protective relays, controls and a DC control power source located within the plant must be relocated.

A previously recommended solution that would reconfigure the three 115-kV lines would be less than half the cost at an estimated $3.7 million, but ISO-NE and Eversource no longer support it because it would expose Pineshed to an additional N-1 contingency that would result in disconnecting all of the line’s load.

ISO-NE and Eversource also considered and rejected three other options ranging from $9 million to $10.1 million.

ISO-NE Post-Winter Review: Uneventful

The RTO’s resource adequacy engineer, Mark Babula, said system operations over the winter months were “relatively uneventful,” but he advised the PAC that fuel security will be an issue in future, as will pending generation retirements.

The Winter Reliability Program was instrumental in augmenting liquid fuel security for the region.

Eighty-four generating units participated in the program to procure back-up oil supplies, burning 114,000 barrels and leaving more than 3 million barrels left in inventory eligible for compensation at a cost of $31.2 million (at $10.21/barrel).

Six assets provided 23 MW of interruption capability through the demand response program at a cost of $70,500. The RTO dispatched the assets once, between 6:39 and 8 a.m. on Jan. 10.

Two generators participated in the LNG program, which will cost $291,000 (171,000 MMBtu at $1.70/MMBtu).

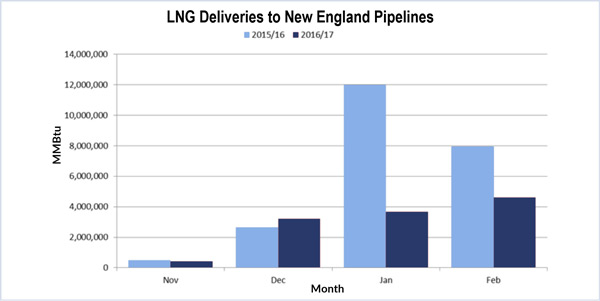

Asked why LNG deliveries to New England pipelines showed such a sharp decline from last winter, especially in January, Babula had a one-word answer: economics.

“We … didn’t see gas go above eight bucks this winter,” he said. “Henry Hub has been like $3. Pipeline gas is always cheaper than LNG.”

According to FERC’s 2016 State of the Markets report, Algonquin Citygate prices averaged $3.10/MMBtu for all of 2016, a 35% reduction from 2015. Henry Hub prices averaged $2.48/MMBtu, down 5%, while Transco Zone 6-NY dropped 42% to $2.19/MMBtu. (See FERC: Gas Continued to Dominate in 2016.)

Next winter will be the last for the reliability program, which will be replaced in June 2018 with the Pay-for-Performance market design. The new design will increase penalties for generators that fall short of capacity commitments and provide bonuses for those that overperform.

Babula said that the 15 to 20 critical notices or operational flow orders issued by natural gas pipelines this winter — all related to extreme weather — were typical for winter. There also were six unplanned pipeline outages, all related to compressor station outages.

The region benefited from expanded gas capacity as Spectra Energy put the final piece of its 342,000 Dth/d Algonquin Incremental Market project into service on Jan. 7. Tennessee Gas Pipeline’s Connecticut Expansion project (72,000 Dth/d) was delayed until 2018, however.

On March 27, FERC gave Algonquin Transmission permission to begin construction on the Connecticut portion of its Atlantic Bridge gas project connecting points in New Jersey and New York with New England and Canada’s Maritime provinces (CP16-9). The commission granted a certificate of public convenience and necessity for the project in January. (See Atlantic Bridge Project Approved by FERC.)

– Michael Kuser