By Robert Mullin

Reforms to CAISO’s congestion revenue rights auctions will come only after painstaking analysis of what is causing the auctions to pay out significantly more money than they take in as revenue, the ISO official leading the effort told stakeholders Tuesday.

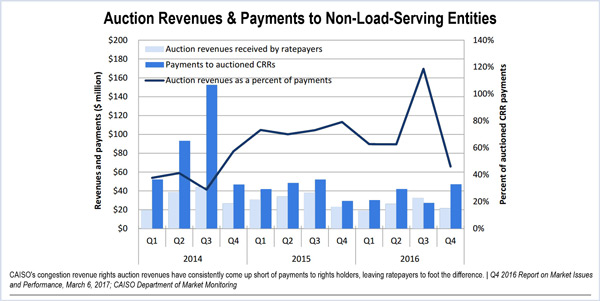

The shortfalls have cost California ratepayers more than $560 million over five years, according to the ISO’s internal Market Monitor. (See CAISO Monitor Proposes End to Revenue Rights Auction.)

“We really want to lay down what’s going on and understand the dynamics of the auction,” Guillermo Bautista Alderete, CAISO director of market analysis and forecasting, said during a May 16 Market Performance and Planning Forum. “We want to understand what are the drivers [of revenue shortfalls] and have an informed set of data that can guide us into what the policy’s going to be.”

Any policy changes are likely to prove contentious among market participants with a stake in the auctions.

The CAISO Department of Market Monitoring insists that the ISO-sponsored auctions should be replaced with a bilateral market that doesn’t leave utility ratepayers as unwilling counterparties in losing deals.

On the other side stand the Western Power Trading Forum and DC Energy — a firm specializing in trading CRRs and other financial instruments tied to power and natural gas markets — which argue that the auctions provide the only liquid market for hedging congestion risk in the ISO’s wholesale market.

Most stakeholders, including the ISO’s load-serving entities, sit somewhere in the middle of the debate but tend to agree the auctions require significant changes, if not dissolution.

Bautista Alderete said the CAISO plan for examining the CRR auctions was shaped by suggestions coming out of an April 18 working group convened to kick off the initiative. (See Heated Start for CAISO CRR Reform Initiative.)

The analysis phase will begin with ISO staff picking off the “low-hanging fruit” to be found in the auction results: “Profits, losses, who’s losing, who’s winning over time [and outcomes of] the annual [auction] versus the monthly,” Bautista Alderete said.

A second, “more complex” phase will look at how various auctions were modeled and compare that information to how the transmission system was modeled in the day-ahead markets on which CRR payments are settled. That will require an accounting of transmission outages, and whether they were included in auction models.

“These types of metrics are not that simple” to produce, Bautista Alderete said.

A third, “most complicated” phase will delve into the transmission system constraint by constraint, focusing on those constraints that did not bind (or show high congestion) in the auctions but paid out to CRR holders in the day-ahead market, as well as constraints responsible for the largest payouts.

“That is the type of analysis that we want to take on to understand the efficiency of the auction, because once we can understand what is behind the specific divergence between day-ahead and [the auctions] — the specific driver for revenue insufficiency — we can really start putting the pieces together for why we landed there, [for] why we have a systemic constraint that is always on the winning side or the losing side,” Bautista Alderete said.

In order for the findings to be “meaningful,” he added, the ISO must undertake a time-consuming process of examining constraint data going back to the start of the auctions, which will include determining how nomograms modeled in the CRR auctions may have changed in the corresponding day-ahead market.

Bautista Alderete expects the first round of “straightforward” data analysis related to auction results and settlements to be complete in two months. He provided no timeline for the other two phases.

“Once we complete the analysis phase, then we’re going to start moving into the discussion of the policy — what we need to do. Do we need to scrap the auction? Do we need to tweak the auction? That is the piece we need to reach only when we have determined, based on the analysis, what we need to do.”