RENSSELAER, N.Y. — NYISO reported Wednesday that natural gas prices rose 73% in April year-on-year but were still “historically low.” Natural gas (Transco Z6 NY) in April cost $2.81/MMBtu, down from $3.49/MMBtu in March.

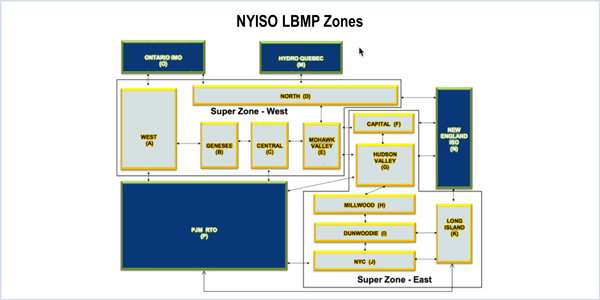

In his Market Operations Report to the Business Issues Committee, Rana Mukerji, senior vice president for market structures, reported an average year-to-date cost in April of $37.05/MWh, up 21% from $30.71/MWh in April 2016. Locational-based marginal pricing (LBMP) for April came in at $31.06/MWh; down from $34.97/MWh in March 2017 and higher than $27.96/MWh in April 2016.

Generation averaged 377 GWh/day in April, down from 419 GWh/day in March 2017 and 385 GWh/day in April 2016.

April distillate prices came in higher compared to the previous month and up 29.5% year-on-year, with Jet Kerosene Gulf Coast at $11.15/MMBtu, up from $10.69/MMBtu in March, and Ultra Low Sulfur No. 2 Diesel NY Harbor at $11.31/MMBtu, up from $10.90/MMBtu. Uplift rose in April to 12 cents/MWh (excluding NYISO cost of operations), higher than the 46 cents/MWh in March. The local reliability share was 20 cents/MWh, lower than 21 cents/MWh in March, and the statewide share was -8 cents/MWh, higher than the -67 cents/MWh in March. Total uplift costs with Schedule 1 components, including NYISO cost of operations, were higher than in March.

MISO Refunds Paid out to TOs

Mukerji also presented NYISO’s monthly Broader Regional Markets Report, highlighting that the grid operator in May completed paying refunds totaling $16.3 million and $1.27 million in interest to transmission owners for the Michigan-Ontario phase angle regulator. FERC last September rejected a MISO/ITC Holdings proposal to allocate 30.9% of the cost of ITC’s Michigan-Ontario PARs to New York, ruling in favor of NYISO and PJM. NYISO received the refund payment from MISO. (See MISO not Allowed to Allocate Lake Erie PARs Costs to PJM and NYISO.)

NYISO Complies with FERC Order 831

The ISO submitted an Order 831 compliance filing to FERC on May 8. The commission’s November 2016 order requires NYISO to 1) cap each resource’s incremental energy offer at the higher of $1,000/MWh or its verified cost-based incremental energy offer, and 2) to cap verified cost-based incremental energy offers at $2,000/MWh when calculating LBMPs.

Con Ed-PSEG Wheel Enters New Protocol

NYISO and PJM this month implemented a new protocol for the Con Ed-PSEG “wheel” to replace the agreement that expired after Consolidated Edison chose not to renew the contracts for the wheel. NYISO and PJM filed jointly with FERC on Jan. 31. FERC accepted the NYISO-PJM filing effective May 1, subject to refund and further FERC order. (See NYISO Members OK End to Con Ed-PSEG Wheel.)

Con Ed Gets Approval to Install 2nd PAR at Ramapo

The committee voted to recommend Management Committee approval of a tariff modification to fund Con Ed’s replacement and operation of the Ramapo PAR #3500, destroyed in a fire last June. Con Ed, though opposed to what it sees as cumbersome Tariff and rate schedule filings, pledged to complete installation of the second PAR by early fall 2017.

The cost allocation is statewide across all New York load-serving entities, but the proposed rules would reimburse the LSEs with any monies eventually paid by PJM and its TOs, or refunded by Con Ed. Contingent on approval by the Management Committee, the Board of Directors would vote on the proposal in June or July. (See NYISO, PJM Discuss PARs’ Benefits, Cost Allocation.)

NYISO to Eliminate Bond Fund Options

The BIC also voted to recommend Management Committee approval of a proposal to eliminate the bond fund options as an alternative to cash collateral. Sheri Prevratil, manager of corporate credit, said that historically there has been very low market participant use of the bond funds — on average, only $500,000, or 0.17%, of total cash collateral has been invested.

No other ISO/RTO offers bond funds for cash collateral investments. If the NYISO board approves it, the measure would be filed under Section 205 of the Federal Power Act, with revisions to Attachment K of the Market Administration and Control Area Services Tariff and Attachments U and V of the Open Access Transmission Tariff.

– Michael Kuser