By Jason Fordney

FOLSOM, Calif. — Energy transfer capacity in the Western Energy Imbalance Market (EIM) footprint is now sufficient to justify removing bid limits that are in effect for members PacifiCorp, NV Energy and Arizona Public Service, CAISO’s internal Market Monitor said last week.

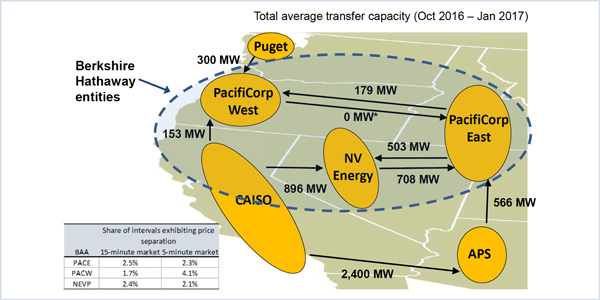

Analysis by the Department of Market Monitoring found that EIM areas are structurally competitive during almost all intervals, Director of Market Monitoring Eric Hildebrandt said July 13 in a briefing to the EIM Governing Body at CAISO headquarters.

The power sellers are now limited to submitting EIM energy bids at or below cost-based default energy bids at all hours. They must get permission for the change from FERC, which requires companies joining the EIM to file for authority to charge market-based rates. PacifiCorp and NVE are both subsidiaries of Warren Buffett’s Berkshire Hathaway Energy.

“We are prepared to submit comments in support of the filing” to lift the restrictions, Hildebrandt said, noting that the Berkshire companies are potentially pivotal in a very small portion of intervals. Automated bid mitigation procedures effectively mitigate market power when imbalance demand is greater than transfer capacity, he said.

Under-mitigation in the 15-minute market, when congestion occurred but bid limits were not triggered as they should have, fell to 1.5% of intervals in the first half of 2017, compared with 17% a year earlier, he said. CAISO’s rules effectively limit the companies’ market power when EIM areas are not competitive.

The companies have been trying to get the mitigation measures lifted. They had argued that the measures imposed by FERC are out of proportion to the market power risks from imbalance energy, because of the small amount of load served by imbalance. They also said they have no incentive to exercise market power because they are large consumers of imbalance energy and would lose money if prices are too high.

But FERC cited market power concerns in May 2016 when it denied a request by NVE and PacifiCorp to rehear a previous decision that prohibited the two companies’ generating units from offering energy into the EIM at prices above default energy bids. (See Berkshire Denied Rehearing on EIM Market Power.)

An economist with the Market Monitor said late last year that increased transfer capacity in the EIM is limiting congestion and reducing participants’ ability to use market power in their balancing authority areas. (See Increased Transfer Capacity Reducing EIM Congestion.)

FERC late last year also denied a request by NVE, PacifiCorp and 19 other Berkshire affiliates to rehear a decision prohibiting the companies from offering power at market-based rates in four neighboring balancing areas in the West, including the PacifiCorp East (PACE), PacifiCorp West (PACW), Idaho Power and NorthWestern Energy areas. The commission rebuffed the companies’ contention that an earlier ruling had denied them due process because it failed to notify them of “newly announced standards” for determining market power. (See FERC Upholds Berkshire Market-Based Rate Ruling.)

The EIM already includes the PACE and PACW areas, while Idaho Power is slated to join the market in April 2018.