By Rich Heidorn Jr.

Calpine announced Friday it has agreed to be acquired by Energy Capital Partners and other investors for $5.6 billion in cash, or $15.25/share, a 51% premium to Calpine’s share price when news of a potential deal became public in May, and a 13% bump from Thursday’s close.

Energy Capital Partners, a private investment firm, is being joined by a group of investors led by the Canada Pension Plan Investment Board, which said it will invest $750 million, and Access Industries, a privately held company with investments in a wide variety of industries and companies, including Warner Music Group, Houston-based oil and natural gas producer EP Energy, and Russia-based aluminum manufacturer UC RUSAL.

The investors will be purchasing Calpine’s 26-GW fleet of 80 power plants in operation or under construction, the largest fleet of natural gas generators in the U.S. Its assets are concentrated in California (5,500 MW of natural gas and 725 MW of geothermal); Texas (13 combined cycle plants totaling 9,000 MW) and the East (31 plants totaling 9,400 MW in 14 states and Canada, most of them in PJM and ISO-NE).

In addition to its generation assets, Calpine also has two retail businesses — Calpine Energy Solutions and Champion Energy — which operate in 25 states, Canada and Mexico.

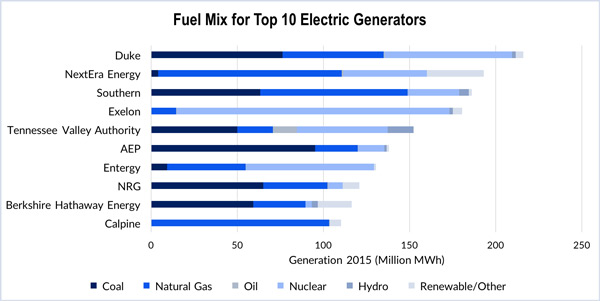

| M.J. Bradley & Associates (2017); “Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States”

M.J. Bradley & Associates ranked Calpine as the nation’s 10th largest power producer in 2015. Calpine claims to be the top-ranked generator in gas-fired capacity in Texas, with a No. 2 ranking in California and No. 3 rankings in the Mid-Atlantic and New England states.

Undervalued

During a call to discuss second-quarter results before the deal was announced, CEO Thad Hill explained the rationale for going private, saying “the public equity markets have undervalued our business and underappreciated our strong track record of executing on our financial commitments and our stable cash flows.”

Hill, who became COO in 2010 was promoted to CEO in 2014, said the acquisition will not change the company’s operations. The company will maintain its headquarters in Houston and its current management team, he said.

The sale will allow the company to “continue to strengthen our wholesale power generation footprint, while benefiting from ECP’s support, industry expertise and long-term investment horizon,” Hill said in a statement.

| Calpine

ECP partner Tyler Reeder confirmed that the deal would not result in operational changes, saying that the investors “see significant value in Calpine’s operational excellence and strong and stable cash flows, and have been impressed by the company’s exceptional leadership and talented employees.”

“We do not intend to make any changes to the company’s financial policy or previously announced $2.7 billion deleveraging plan,” he added, referring to plans to pay off the debt in full by 2019.

Including debt, The Wall Street Journal reported, the deal’s enterprise value is $17 billion.

The deal allows Calpine a 45-day “go-shop” period to seek a higher offer. The company would have to pay the ECP group a $142 million termination fee for canceling the deal. The fee would be reduced to $65 million if Calpine terminates the agreement within 106 days.

“We don’t think it is likely there is a topping bid,” Greg Gordon, an analyst at Evercore ISI, wrote in a research note, according to Bloomberg. “It was probably very hard to pull together an equity consortium for this size of a deal and it was a competitive process.”

The acquisition is subject to approval by Calpine stockholders, antitrust regulators, FERC and state regulators, including those in New York and Texas, the company said. Closing is targeted for the first quarter of 2018.

Seesaw Ride for Investors

Founded in 1984, Calpine went public in 1996 and grew steadily over the next several years before falling into bankruptcy in 2005. It moved its headquarters from California to Houston after exiting bankruptcy in 2008.

Like other independent power producers, Calpine has been pinched by low power prices and competition from renewables.

NRG Energy, which lost $626 million last quarter, is planning to sell as much as $4 billion of its assets, and last month it ordered an undisclosed number of layoffs. Dynegy, which lost $296 million in the second quarter, is reportedly considering an acquisition by Vistra Energy. (See Report: Vistra Energy Suggests Takeover of Dynegy.)

Calpine’s 2016 profit of $92 million was a 60% drop from 2015. It reported a second-quarter loss of $216 million after losing $56 million in the first quarter. Rising gas prices have resulted in reduced capacity factors for the company’s non-peaker plants, falling to an average of 43.6% in the first six months of the year from 48.8% a year earlier.

After peaking at almost $25/share in late 2014, Calpine’s share prices fell as low as $10 in April before news of a potential deal. Shares closed Friday at $14.92.

Energy Capital’s Plans

Based on its history, ECP may not keep Calpine for very long.

In 2015, it sold EquiPower — a company it created five years earlier to oversee a portfolio of fossil generators in the eastern U.S. — to Dynegy. In 2008, two years after acquiring it, ECP sold FirstLight Power Resources, a 1,440-MW portfolio of mostly hydro generation, to a subsidiary of GDF SUEZ, now ENGIE.

The firm also helped Dynegy finance its $3.3 billion acquisition of 17 U.S. power plants, selling its stake to Dynegy last year for $750 million. The company was Dynegy’s largest stakeholder as of June, according to Bloomberg.

ECP’s current holdings include Wheelabrator Technologies, which generates power from municipal solid waste and other renewable waste fuels.