By Tom Kleckner

Sempra Energy has wasted little time getting to know Texas stakeholders, embarking on a “listening tour” just days after its surprise announcement it was seeking to acquire the state’s largest utility, Oncor.

“We’re approaching North Texas with a fair amount of humility,” Sempra CFO Jeff Martin told financial analysts Friday during a conference call.

Martin and Sempra CEO Debbie Reed conducted the call from a hotel room in Austin, Texas, taking a break from meeting with Texas regulators, intervenors and other key Sempra and Oncor stakeholders.

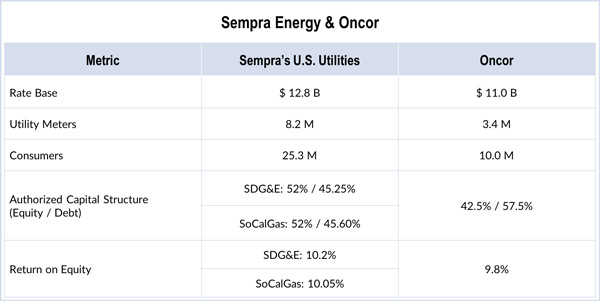

The San Diego-based company last week announced an agreement to acquire Energy Future Holdings, Oncor’s bankrupt parent and indirect 80% owner, for $9.45 billion, besting Berkshire Hathaway Energy’s $9 billion offer. (See Sempra Outmuscles Berkshire for Oncor.)

Sempra had been eyeing Oncor for several years, but “this deal came together very quickly,” Reed said. Company staff have been reviewing the history and transcripts of previous proceedings before the Public Utility Commission of Texas, which denied previous attempts by Hunt Consolidated and NextEra Energy to acquire the utility. The PUC rejected both suitors because of their inability to meet strict ring-fencing measures put in place after EFH declared bankruptcy in 2007.

“We tried to listen and learn from prior transactions, and we’re working to understand the issues that are important to the regulators and intervenors,” Reed said. “We intend to be a long-term owner of Oncor and want to ensure the company continues to do an exceptional job meeting the needs of its customers.”

Reed pointed to Oncor’s “incredible history of success,” its ability to pay dividends and recent completion of a rate case as reasons for Sempra “to get comfortable with the requirements that the regulators had put on in prior transactions.”

Those requirements have included an independent board of directors, a continued Texas presence and reinvestment of capital expenditures.

“If Oncor needs those funds to invest in their business, we are very supportive of that because we see the utility investment is positive,” Reed said, referring to Oncor’s plans to spend about $7.5 billion in capital over the next five years.

“We’re all about partnerships and making sure that from a stakeholder analysis standpoint, we’re doing all the right things to address those concerns,” Martin said. “We’re just starting that process, and we’re confident about telling our own story. I think we’re comfortable with a lot of the issues that have been raised with us.”

However, some intervenors in Oncor’s prior proceedings are skeptical of Sempra’s offer, a source told RTO Insider. BHE had reached a settlement agreement with key intervenors based on its ability to wipe out the utility’s debt overhang with an all-cash deal, but those parties now complain that Sempra is providing very little information in what has been called a “half-baked” proposal.

Sempra executives said Friday that they intend to fund the $9.45 billion purchase with $3 billion of investment-grade non-course debt, with the company providing about 60% of the remaining $6.45 billion and third-party investors covering the rest.

Martin said Sempra is not considering EFH’s current creditors or hedge funds; instead, it is looking to partner with investors that are “aligned with our long-term interest in reinvesting and growing Oncor,” such as pension or infrastructure funds. He said the company plans to issue a combination of debt and equity to fund its 60% portion, with equity representing at least half that.

Sempra agreed to a $190 million termination fee, compared with BHE’s $270 million fee.

The California company now faces two important regulatory hurdles. The U.S. Bankruptcy Court for Delaware will consider the merger agreement Sept. 6, followed by a hearing to confirm EFH’s reorganization plan. That second hearing would take place about 30 days should the PUC approve Sempra’s offer. Reed said Sempra plans to file with the commission shortly after the merger agreement is approved.

The PUC meanwhile last week sent Oncor CEO Bob Shapard a letter asking him and board Chair Jim Adams to appear at Thursday’s open meeting in Austin.

The commission told Shapard it wants to discuss Oncor’s views “as to the likely structure and timing” of Sempra’s proposal, and the utility’s current financial condition and liquidity as it relates to the PUC’s “legal obligation to protect” the company’s financial integrity. The commission said it also wants to delve into accrued expenses over the last two years as a result of the Hunt and NextEra acquisition attempts.