By Jason Fordney

CAISO’s Department of Market Monitoring on Friday amplified its opposition to a fundamental aspect of the ISO’s plan for mitigating market power in generators’ commitment costs.

The department told the Market Surveillance Committee on Friday that it “fundamentally disagrees” with the Commitment Cost and Default Energy Bid Enhancements (CCDEBE) initiative. The program, which CAISO Senior Market Policy Developer Cathleen Colbert outlined in a presentation, is designed to better reflect unit commitment costs and overhaul how the ISO calculates the default energy bid (DEB) used for units with market power.

The Monitor had previously raised concerns with the CCDEBE proposal, which would apply to both the ISO and the Western Energy Imbalance Market (EIM). (See CAISO Monitor Says Bid Rule Changes Flawed.)

The debate has large financial implications for EIM power sellers subject to default bidding, such as Berkshire Hathaway Energy entities PacifiCorp and NV Energy, which last month asked FERC to lift their DEB restrictions. (See Berkshire Companies Request EIM Rate Authority.) The restrictions also apply to Arizona Public Service.

“We think there are a lot of questions left on the dynamic mitigation,” the department’s Michael Castelhano said. The Monitor has urged splitting the proposal into two parts and getting a new process for reference levels in place by fall 2018. Then commitment cost bidding and mitigation could be addressed “in a more robust way than we have been able to do so far,” Castelhano said.

The ISO has suggested it will use a static competitive path assessment (CPA) on a seasonal basis to determine which constraints should be tested for commitment cost market power. In other CAISO proceedings, stakeholders have proposed eliminating the CPA because it is designed for the seasonal level and not a daily or hourly market.

The static CPA often fails to capture market power for commitment costs, which potentially has more financial impact than missing market power for energy costs, Castelhano said. “You will never get the models right,” he told ISO officials.

“Conceptually, we would support the opposite approach,” he said, which would assume the paths are competitive unless proven otherwise. “We really think that is the right thing to do in this situation.”

“We think it is really important that this is vetted and [discussed] in the stakeholder process,” Castelhano added. He said it appears the ISO is adapting energy market mitigation methods for commitment costs.

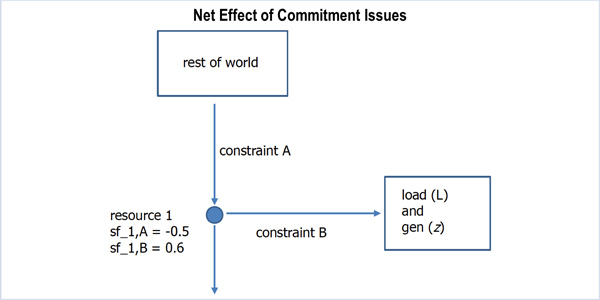

Energy market mitigation has to do with the effect of market power on LMPs, while commitment cost mitigation asks how different constraints affect the likelihood of a resource to be committed, he said in the presentation. “You are not starting with the right question,” he told ISO officials.

CAISO says its goal is to submit the proposal to the EIM Governing Body for an advisory vote on Oct. 10 and to the Board of Governors for approval on Nov. 1.