By Amanda Durish Cook

MISO is recommending a new version of a transmission project intended to alleviate constraints in the West of the Atchafalaya Basin (WOTAB) area straddling Texas and Louisiana, but some stakeholders are balking at assumptions underpinning the proposal.

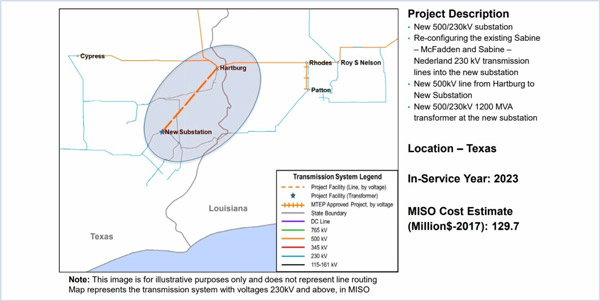

The $129.7 million project involves construction of a new substation in eastern Texas equipped with a 500/230-kV transformer. The facility would accommodate a new 500-kV line running from Hartburg, Texas, as well as a reconfiguration of the existing Sabine-McFadden and Sabine-Nederland 230-kV lines. The expanded voltage is expected to fully relieve area congestion and reduce the amount of voltage and local reliability make-whole payments needed in the WOTAB load pocket.

New WOTAB Project | MISO

“We’ve looked at this project every which way … and this is robust and cost-effective, even under conservative assumptions,” said Arash Ghodsian, MISO manager of economic studies.

Flowgate Oversight

An earlier $137.6 million proposal called for a new 500-kV line from Hartburg to Sabine and an expansion of two existing substations. That project was identified in MISO’s annual Market Congestion Planning Study, which this year focused exclusively on possible MISO South projects.

After local transmission owner Entergy increased a flowgate rating in March, the project no longer met the 1.25 benefit-cost ratio required to qualify as a market efficiency project for this year’s MISO Transmission Expansion Plan. While TOs can increase or decrease line ratings without permission from MISO, they must update facility ratings with the RTO.

MISO initially overlooked the spring flowgate rating change. The RTO waited until July to model that change and study three project alternatives, eventually settling on the revised 500-kV proposal. Some stakeholders objected to last month’s last-minute unveiling of possible projects, noting that the Board of Directors reviews MTEP projects in early December.

Two other smaller projects resulting from the Market Congestion Planning Study — also in the WOTAB load pocket — were unaffected by Entergy’s flowgate change. (See Congestion Projects, Siting Review on MISO Slate.)

Last-minute Concerns

Xcel Energy expressed concerns about MISO’s decision to change the modeling and weighting of MTEP futures for the study after having developed and approved the study’s supporting models and initially identifying congestion in the area. While stakeholders last year agreed on the relative weight of MTEP futures in planning studies, the RTO allowed a unique weighting for MISO South after the region’s TOs and state regulators asked for reduced emphasis on a future scenario involving accelerated alternative technologies. (See MISO Changes MTEP Futures Weighting for South.)

Xcel said that MISO — in the spirit of openness — should have reopened the planning study’s project submission window after changing the weighting.

“Without reopening the entire development process and reopening the window after the new models and weights were decided, MISO set a very concerning precedent which introduced gaming of the study results by allowing this unacceptable change to happen without a sufficient level of stakeholder involvement,” Xcel said in comments filed with the RTO.

NRG Energy also cautioned MISO against making last-minute modeling changes.

“New or changes in modeling assumptions can be requested at the beginning of each Market Congestion Planning Study cycle,” the company said in comments. “However, last-minute modeling changes should not be allowed unless they are necessary to correct gross errors. Otherwise, this would set a dangerous precedent and the process could well become a ‘free-for-all’…

“All modeling changes should be thoroughly vetted in the stakeholder process for approval and implementation.”

‘No Process is Perfect’

Ghodsian said the new project has been subject to open and transparent vetting despite the change in modeling criteria. Other stakeholders, including DTE Energy, LS Power, Apex Clean Energy and ITC Holdings, supported MISO’s analysis behind the project alteration.

Apex said it’s clear that the load pocket needed a high-voltage project to mitigate voltage and local reliability issues.

“The transmission system needs expansion. Lack of high-voltage solutions for WOTAB has inhibited growth in an area of the country which has seen unrivaled increases in petrochemical manufacturing in addition to the production and export of LNG,” Apex said.

Some stakeholders did take issue with MISO modeling a $1,000/MWh emergency energy price in the study when it currently caps prices at $3,500/MWh. Entergy’s Matt Brown called for aligning the emergency pricing in the models for MTEP 17 with the RTO’s actual cap.

“We can’t just continue to kick this can down the road. … This issue has been with us for a while now, and at some point, we have to address it,” Brown said.

Ghodsian said MISO will address new emergency energy pricing in the models starting with MTEP 18.

“No process is perfect, and we welcome suggestions on improving [it],” Ghodsian said.

The three projects arising from the Market Congestion Planning Study will go before the board’s System Planning Committee next week and the Planning Advisory Committee later this month.