RENSSELAER, N.Y. — Members of NYISO’s Business Issues Committee last week discussed a recent Brattle Group report on pricing the social cost of carbon into the wholesale electricity market with the report’s principal author, Sam Newell.

Because most meeting participants had attended a public comment session on the topic during the previous week, Newell presented a summary of the report as well as a spreadsheet of modeling assumptions for a more detailed discussion. He explained that Brattle had used load-weighted average locational based marginal pricing (LBMP), proportional to state load patterns. (See NYISO Stakeholders Talk Details of Carbon Charge.)

Several people wondered whether the carbon charge would incentivize construction of fossil fuel generators — or whether the study assumed too much capacity being built in the form of gas-fired turbines.

“I don’t care what the demand reset curve says,” Newell said during the Sept. 12 meeting. “Look at what people are building: a lot of combined-cycle generators.”

Erin Hogan of the New York Department of State Utility Intervention Unit asked whether the study incorporated the effects of offshore wind on wholesale prices. Yes, was the answer, but not by 2025. One participant asked whether increased energy prices stemming from the charge might prompt large industrial users to leave the state. Although Newell was reluctant to speculate, he said an industrial user might see higher energy costs but a lower overall bill.

| The Brattle Group

“This is the crystal ball stuff,” Newell said. “We assume a third of New York State load is the biggest industrial users with sophisticated rate design capabilities and a greater ability to respond to price signals. … We can’t imagine all the ways the market might respond.”

Still, the study did not consider how increased wholesale prices might provoke industrial users to relocate.

“There’s a lot of freedom in how you allocate [carbon charge] revenues,” Newell said. “You could let the big users see the LBMP and just write them a check” to cover their increased costs from the charge. He added that the proposed $40/ton charge on carbon emissions was based on “nothing to do with electricity” but on the “worldwide harms from carbon.”

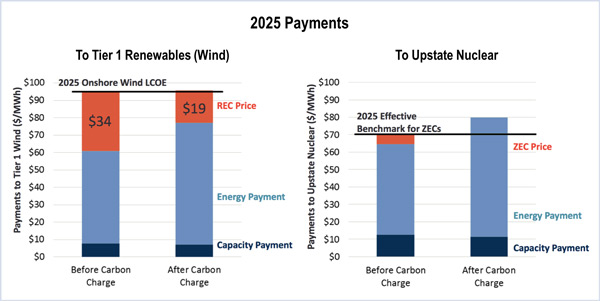

When asked why the modeled offset from renewable energy credits (RECs) was greater than that for zero-emission credits (ZECs), Newell said the ZECs can drop only by $5 and cannot go below zero, while RECs can go below zero and thus can be modeled to drop $15.

Newell thanked participants for their input and asked them also to look into the unintended consequences of a carbon charge.

LBMPs Down 29% from a Year Ago

NYISO Senior Vice President for Market Structures Rana Mukerji reported that the ISO’s August 2017 average year-to-date monthly energy cost of $35.80/MWh marked a 4% increase from a year earlier. LBMPs last month averaged $30.57/MWh, down 15% from July and 29% from August 2016.

The grid operator’s average daily sendout was 477 GWh/day in August, compared with 498 GWh/day in July and 548 GWh/day in August 2016.

August natural gas prices were lower while distillate prices were higher compared with those of the previous month. Gas prices on the Transco Z6 pipeline serving New York City averaged $2.16/MMBtu, down from $2.44/MMBtu in July but up 7.4% from a year earlier.

Distillate prices were up 17.6% year-on-year, with Jet Kerosene Gulf Coast averaging $11.53/MMBtu (up 10% from July) and Ultra Low Sulfur No. 2 Diesel NY Harbor averaging $11.65/MMBtu (up 7%).

The local reliability share was $0.12/MWh, slightly higher than $0.11/MWh in July, while the statewide share was $0.31/MWh, compared with $0.54/MWh in July. Total uplift costs, with Schedule 1 components including NYISO cost of operations, were higher than those in July.

Mukerji highlighted a section of his Broader Regional Market report, showing steps NYISO has taken to reduce the impact of potential ISO-NE policy changes on New York’s capacity market. The New England grid operator has proposed to revise the requirements for enabling “import capacity resources” to participate in ISO-NE’s Reconfiguration Auctions and bilateral transactions, a move that could increase New York capacity prices and create inefficient price signals.

NYISO last year filed proposed Tariff revisions with FERC to set the Locality Exchange Factor for capacity exports from Zone G-J generators into ISO-NE at 80% from June 2017 through May 2018, rather than use existing Tariff methodology and inputs. While FERC accepted the new methodology in January, it rejected a one-year transitional mechanism. NYISO followed up in June by filing an informational report concerning potential modifications to its rules-governing capacity exports from certain localities but does not now intend to pursue changes to the currently effective Locality Exchange Factor calculation methodology.

Updates to Tx Constraint Pricing Manuals

The BIC also approved revisions to the Transmission Constraint Pricing Manual, which will be presented to the Operations Committee for approval on Sept. 15.

| Potomac Economics

NYISO Associate Energy Market Design Specialist Jennifer Boyle proposed the changes to update the ancillary services, day-ahead scheduling and the transmission and dispatching operations manuals. Section 6.8.2 of the ancillary services manual would no longer refer to a “transmission demand curve.”

The updated day-ahead scheduling manual would include a new section (4.3.5) describing the ISO’s transmission constraint pricing logic, with sub-sections detailing the constraint reliability margin and its application to transmission facilities and the pricing logic. It also provides a table of the pricing values used.

The transmission and dispatching operations manual would see a section renamed to “ancillary service demandcurves,” with transmission demand curve references removed from the section description and table. A new Section 6.3.7 would include new sub-sections describing the same subjects being proposed for the day-ahead scheduling manual.

— Michael Kuser